- Sustainability

- DE&I

- Pandemic

- Finance

- Legal

- Technology

- Regulatory

- Global

- Pricing

- Strategy

- R&D/Clinical Trials

- Opinion

- Executive Roundtable

- Sales & Marketing

- Executive Profiles

- Leadership

- Market Access

- Patient Engagement

- Supply Chain

- Industry Trends

2021 in Focus: Pharm Exec’s Annual Industry Outlook

With a complicated and challenging global picture greeting the new year, driven by the continuing pandemic and historic political and regulatory changes in the US and Europe, we outline eight diverse trends critical to biopharma’s future health and growth.

Destined for Digitalization

Pharma is in a better position to shoot for its digital transformation goal.

In comparison with other sectors—such as retail, hospitality, banking, and media—pharma is still in its infancy as far as the journey to digital transformation goes. There are many reasons, of course, for the industry’s reticence and risk aversion, not least having to advance against a stronger tide of regulatory restrictions. No doubt pharma would have continued to tread cautiously through this digital infancy in 2020 had it not been for COVID-19. As Arda Ural, EY Americas industry markets leader, health sciences and wellness, observes, “For all the terrible things that COVID unleashed, it also offered a real-life experiment to test some of the hypotheses pharma has been thinking about with regard to digital.”

Patient engagement

Ural identifies a number of areas where digital took a stronger foothold in the industry last year. First, not surprisingly, is patient engagement. While the use of telehealth has been increasing for the last few years, the pandemic saw a surge in the rate of older patients using telehealth technology. Ural points to an EY-Parthenon Consumer Health Survey (published August 2020) that tracked 1,400 consumers throughout the patient journey that revealed both a stronger desire to self-manage their care and growing tech savviness among the over-65s. “Telehealth’s moment has arrived,” the report’s authors concluded.1 “And that behavior is going to stick,” adds Ural.

Pascal Bécache

The surge in digital engagement is propelling further advances in dealing with patient data. Pascal Bécache, co-founder of Digital Pharma Lab—which helps European biopharma companies to accelerate and integrate innovations provided by selected startups into their business models—told Pharm Exec that more than half of the projects his company saw in 2020 were concerned with patient data. “Pharma companies really want to understand what is going on with their patients, how their drugs are accepted into the patient pathway, and how the medical professional is administering them,” he explains. “They need this to add further products and services to their portfolios. Digital technology, digital products, and digital metrics will become more and more embedded in pharma companies as we go forward.”

Commercialization

Arda Ural

Concerning pharma’s commercialization activities, during the pandemic, companies began to observe that the virtual environment “is actually productive,” says Ural. He notes that not only were there companies who continued to launch products, but also companies launching their first product in this environment. While the one-to-one sales model has long been “in the pharma industry’s DNA”—the introduction of the tablet a decade ago did not fundamentally change that—Ural says that a shift is happening as we now have “a generation of physicians who grew up with video games and who are more open to consuming content through digital means.” He adds that there’s even data to suggest that physicians will be harder to engage in-person going forward. “As with Netflix and Amazon, we consume things on demand as opposed to watching TV and waiting for shows like we used to,” says Ural. “That same phenomenon is translating to pharma providers.”

Clinical trials

“We were all very humbled to see a 10-year vaccine development process crushed into 10 months,” says Ural. “That was a science and innovation victory. But it also showed that a new approach to the clinical trial process could work. We saw that patients can be enrolled and monitored remotely and site audits by pharma companies can be done remotely.” A BMJ piece by a trio of Imperial College London professors noted in July that the benefits of virtual trials extend to “patient recruitment, engagement, retention, and data collection with favorable effects on trial duration and costs.” While COVID-19 has resulted in “the greatest global disruption to clinical research since the Second World War,” they wrote, “the widespread implementation of virtual trial designs may mitigate some of the significant challenges ahead.”2 In October, Ashley George, co-founder of the Pistoia Alliance, asserted that the use of virtual trials “will surge in the future and could become the de facto standard for clinical studies,” citing a recent poll by the alliance that found more than half (55%) of life science professionals believed a quarter of all trials would go virtual within one year.3

Dealmaking

“Apparently, the IPO market is immune from the current pandemic,” wrote lawyer Laura Anthony in October 2020. Of the IPOs that have been completed since March, she observed, all priced their deals at the midpoint or higher of their ranges. She added: “The nearly absolute elimination of face-to-face presentations has not impacted deal pricing.” Not only did US tech and pharma IPOs continue unabated in 2020, their frequency increased when compared to other mid-summer years, especially election years. While there was a steep plunge in economic activity in the second quarter, tech and pharma stocks were “trading at historical premiums, pushing domestic indexes even higher,” Anthony explained.4

“Dealmakers are acknowledging that they don’t have to go on the road show. Virtual meetings have shown they can present more information to more people and do it faster,” notes Ural. “Now people who’ve never met in their lives sign off on multi-billion dollar transactions. This is another manifestation of the advance of digitalization.”

Pay it forward

Unlike some of the sectors that were badly damaged, biopharma emerged relatively unscathed, overall, from the pandemic. The industry thus retains “enough fire power and balance sheet strength to fund its ongoing digitalization,” says Ural. “If the pharma industry can afford digitalization by the ability to deploy capital against massive capital expenditures, I think this is the time to do it,” he adds. An EY survey of 500 US-based, C-suite executives, published in November, reported that 54% of respondents cited digital investment as a top investment priority going forward.

Loren Garruto, EY global and Americas corporate finance leader, strategy and transactions, commented: “Companies are innovating their capital deployment strategies—from reinvesting divestment proceeds to boosting their digital capabilities through M&A, rather than building resources internally—to stay ahead of current market and economic disruption.”5

For Ural, the answer to whether pharma companies should buy in extra digital capabilities or build them “is probably somewhere in between.” He explains, “You don’t want to be competing with people whose day job is technology. You want to own your own business strategy and prioritization, but you need to find the right partners to help you with the digitalization journey.”

Whatever path companies take to achieve full digital transformation, Ural says he is optimistic that the industry is finally reaching the inflection point: “The era of the digitalization of pharma has arrived.”

References

- “COVID-19: What patients are saying and how providers should respond,” www.ey.com, Aug. 10, 2020.

- Simon Erridge, Azeem Majeed, and Mikael Sodergren, “Virtual trials: looking beyond COVID-19,” blogs.bmj.com, July 6, 2020.

- Prof. Ashley George, “Virtual Clinical Trials Post-COVID-19: Collaboration Will Be Key to Success,” appliedclinicaltrialsonline.com, Oct. 6, 2020.

- “A COVID IPO: The Virtual Road Show,” prnewswire.com, Oct. 5, 2020.

- US executives rethink corporate strategies in anticipation of post-election legislation, regulation and policy changes, ey.com, Nov. 11, 2020.

— Julian Upton, European and Online Editor

A New Care-Team Playbook

PAs and NPs have emerged as key stakeholders in patient support.

There’s a reason the term Healthcare Heroes arose during the COVID-19 pandemic. People noticed it wasn’t just physicians rolling up their sleeves to treat those affected by the virus. COVID required all hands on deck, and many healthcare workers’ roles shifted, especially those of advanced practice providers (APPs), which include physician assistants (PAs) and nurse practitioners (NPs). As a result, these dedicated caregivers continue to gain ground as stakeholders in patient support. Now it’s pharma’s turn to recognize their potential.

Redefining roles

Currently, APPs can prescribe in all 50 states. In most states, they work under the supervision of a physician though some allow them to practice independently. Due to growing demands on the healthcare system, particularly during COVID, many states granted APPs greater treatment autonomy. The Center for Medicare and Medicaid Services (CMS) also issued a number of waivers last year allowing APPs to handle greater patient management responsibilities.

According to the US Bureau of Labor Statistics, employment of PAs is projected to grow 31% from 2019 to 2029. NPs are in a group that is expected to increase 45% in that same period. The organization ties these numbers in part to states expanding APPs’ practice authority, expanded insurance coverage of PA services, and wider public recognition of NPs as primary care sources.

Part of the push to give APPs more treatment and prescribing authority is due to an anticipated shortage of physicians in the US. The Association of American Medical Colleges estimates a shortfall of between 46,100 and 90,400 physicians by 2025. Meanwhile, the demand for healthcare services continues to increase due to an aging baby-boomer population.

APPs have gained responsibility and are being asked to do more by means of patient care and treatment initiation, yet they are still not targeted for sampling or treatment information. This comeuppance is something the pharma industry should begin to seriously focus on.

“It can be frustrating,” says Richard Zwickel, CEO of POCN, the largest network of NPs and PAs. “We still talk with pharma clients who believe NPs and PAs are a separate audience or who’ve told me that NPs and PAs are not part of their marketing plan for 2021. However, this group is no longer an ancillary group. A target is any APP writing a prescription. We are seeing APPs initiating a significant number of prescriptions.”

Sean DeGarmo

Not all prescription data accurately attributes a script to the healthcare professional who wrote it. Sometimes, prescription information can be misleading, as it is attributed to the APPs’ affiliated doctors. But as pharma closely looks at the data, they’ll see that NPs and PAs write more than one billion prescriptions annually, according to POCN in a recent Pharm Exec podcast.

“NPs and PAs are the ones who are writing a lot of prescriptions, so making sure that they understand the risks, benefits, and alternatives of those medications is important,” says Sean DeGarmo, director of APRN initiatives at the American Nurses Association (ANA).

Now that APPs have proven they can handle the care load and responsibilities and have instilled confidence in the public, the hope and belief is that the emergency authority they received during COVID will continue.

Carolyn Morgan

“We’ve seen a lot of pharmaceutical companies recognize the importance nurses play,” says Carolyn Morgan, president of PRECISIONeffect. “But as we see downward pressure in hospitals and a decline in local community physicians, we’re going to start to see the NPs really step forward. That’s an incredible opportunity and something that has been a long time in the making.”

Though APPs can perform many of the same duties as physicians, their ability to connect with patients is a strong advantage. APPs tend to spend more time with patients, because physicians are simply just too busy. They’re also better trained to engage in patient dialogue and have a more contemporary approach—they are more likely to reach out to patients or caregivers with a text or email.

“We’ve developed an adherence metric, where we feel that the NP or PA is communicating better, which is translating to better adherence as well as better outcomes,” says Zwickel.

As a result of the CMS waivers, many APPs have stepped into telemedicine roles, improving their access to patients and allowing them to interact with more patients in a day than they could normally see. This treatment option may also lead some practitioners to reimagine their work situations, opting for more flexibility and safety through video or phone consults.

“It’s a great opportunity for pharma to come in and be their partner and think through what the next iteration of their career can be,” says Morgan. “There’s so much opportunity when you think about developing that relationship and what that can look like.”

Connecting with APPs

As pharma looks to build long-term relationships with APPs, it needs to invest in the space. PRECISIONeffect suggests using residence programs to communicate with APPs early on and encourages the creation of nurse advisory boards. The American Nurses Credentialing Center, a subsidiary of ANA, has worked collaboratively with medicine and pharmacy on a joint accreditation program, setting standards for organizations that provide team-based education. POCN has built a leadership series to reach its audience at a highly effective local and regional level.

Kathy Chappell

The recent uptick in the consumption of digital information by APPs is not expected to recede any time soon. “We’re going to have to continue online delivery of education,” says Kathy Chappell, senior vice president of accreditation, certification, measurement, and the Institute for Credentialing Research and Quality Management at ANA. “In-person education will come back, but I think we’ll have more hybrid models in the future.”

Social media is one area to watch. It seems APPs are drawn to the organic connections derived from this medium.

Lauren Westberg

“We’ve seen really great results with some of our social campaigns, because they’re not just hearing from our clients,” says Lauren Westberg, EVP and managing director at PRECISIONeffect. “We may be kicking off the conversation, but it’s a conversation between nurses and nurse practitioners and others who are facing similar situations.”

The in-office message is also important. Since NPs and PAs don’t receive much access to pharma during their schooling, companies should take time to explain why their branded product might be better than a more cost-effective option.

“They graduate with a pen and a script, and they go right to work,” says Zwickel. “NPs and PAs used to have to earn their stripes in a clinic, urgent care, or primary care. But now it is not uncommon for APPs to come right out of school and go work in specialties. That’s only going to increase. NPs and PAs need to be better identified based on their patient panel. They need to be understood based on their inferred specialty.”

— Elaine Quilici, Senior Editor

Lines Crossed Due to COVID

Quick action on innovation, rethinking trial access and disclosure highlight movement.

According to The Harris Poll, the pharmaceutical industry is at a “once-in-a-generation” inflection point. Currently, the industry sits at a positivity rate of 60% in the eyes of the public, compared to just 32% in January 2020.1 How did this massive jump occur over the course of a global pandemic?

Collaboration, speed, and agility

In mid-May, Michael J. Hennessey Jr., President and CEO of MJH Life Sciences, parent company of Pharm Exec, convened a closed roundtable of pharma CEOs to discuss the industry’s pandemic response. Michael G. Kauffman, MD, PhD, CEO of Karyopharm Therapeutics, highlighted his organization’s testing of its own anti-myeloma drug as a potential COVID-19 therapy. The company’s clinical trial protocol was turned around by 10 different global regulatory bodies in two weeks and was open for patients shortly after. “It really tells you what is possible when most obstacles are eliminated,” said Kauffman. “And this is tenfold faster than we’ve ever done in the past.”

Like Kauffman, Hervé Hoppenot, president and CEO, Incyte, witnessed the industry’s fast-acting ability. Incyte’s RUXCOVID study protocol was prepared, over a weekend with its partner, Novartis, and submitted to FDA the following Monday morning. “The level of urgency was very clear,” said Hoppenot.

A few of the CEOs credited FDA with how the industry has been able to move at such a great pace despite being in the midst of a global health crisis. Clay B. Siegall, PhD, president and CEO of Seattle Genetics Inc., said, “The FDA has been incredibly collaborative,” in reference to his organization’s approvals during the early part of the pandemic in breast cancer and bladder cancer.

At the forefront of the battle against COVID-19, Pfizer and BioNTech’s mRNA-based vaccine candidate, BNT162b2, began development in January 2020. Just 10 months later, the companies became the first to submit a COVID vaccine application to FDA for emergency use in the US. The pair had expected to manufacture 50 million doses of the vaccine before the calendar turned to 2021.

This timeline, along with the others mentioned, are just a few pieces of evidence that encapsulate the pharma industry’s fast-acting approach to innovation when public health is on the line.

Trial transparency

While internal collaboration in pharma has made significant strides in the past year, the public’s eye is still focused on the industry more than ever before.

An increased interest in clinical trials has created a greater demand for accurate information, bringing to light the transparency of trial results. Sometimes viewed as a sore spot for the trial industry, the publication of results has never been more important.

In January 2020, Science published results from a study on trial results that found there was a lack of disclosure; of 184 sponsor organizations with at least five clinical trials due as of Sept. 25, 2019, 30 companies, universities, or medical centers never met a single deadline.2

Under the most up-to-date World Health Organization (WHO) best practices, results from every clinical trial should be uploaded to their respective local registries no later than 12 months after primary or study completion date.

With the public’s need for accurate health information greater than ever in the middle of a pandemic, now could be the time for increased disclosure of clinical study results. Leading vaccine candidate developers, such as Pfizer-BioNTech and Moderna, have been compliant in regard to the publication of trial results. Led by these actions, increased disclosure of trial results across the board would benefit numerous stakeholders, including regulatory authorities, sponsors, healthcare providers, and the public. This could prevent the duplication of research, promote accurate decision-making, and ensure the public has the most up-to-date information on efforts to combat the global health crisis. All are important factors that could save invaluable time in the race against COVID-19.

Decentralized trials

In addition the publication of trial results, the COVID-19 pandemic has identified another pain point for the industry: low participation in clinical trials. Pre-COVID, studies often required patients to make face-to-face visits at investigative sites and clinics to participate. This created many barriers for patients such as forcing them to miss time at work, creating greater out-of-pocket expenses, and increasing travel.3

The industry responded to the pandemic with the accelerated adoption of decentralized trials—only requiring patients to make in-person visits when absolutely necessary, if at all. In a survey conducted by Informa Pharma Intelligence on behalf of Oracle Health Sciences, released in November, 76% of respondents reported that the pandemic sped their adoption of decentralized trials.4 In a trend that appears almost guaranteed to continue post-COVID, the industry could see an uptick in participation in trials with greater ease-of-access for patients.

When 2020 brought a global health crisis to the table, it is difficult to argue that another industry responded as well as pharma. As the calendar now flips to 2021, it will be interesting to see if the industry can continue to “cross the line” with perhaps more innovation—even with a potential end to the pandemic in sight.

References

- https://theharrispoll.com/pharma-industry-at-a-once-in-a-generation-inflection-point/

- https://www.sciencemag.org/news/2020/01/fda-and-nih-let-clinical-trial-sponsors-keep-results-secret-and-break-law

- https://jamanetwork.com/journals/jamaoncology/fullarticle/2769129

- https://go.oracle.com/researchacceleratedtrials?elqCampaignId=257896

— Andy Studna, Assistant Editor

Stepping Up Trial Diversity

Real progress sought in efforts to address study underrepresentation.

Running clinical trials that include a diverse population reflective of the people who will eventually take the medicine seems like a no-brainer. But for years, stakeholders haven’t prioritized enrolling a heterogeneous group of participants in studies. Though the issue has been bubbling for years, the combination of COVID and racial concerns in 2020 brought the matter to a boiling point, and 2021 will be an important year for change.

One of the most public moves made by pharma in this area was when Moderna slowed down trials of its COVID vaccine in September specifically to enroll more minorities. According to news reports, CEO Stephane Bancel explained it was an effort by the company to be more representative of the nation’s demographic breakdown. According to the company, 37% of the study’s population is now from minority communities, including more than 6,000 Latinos and 3,000 Blacks.

Richardae Araojo

“The US population is growing increasingly diverse, and ensuring meaningful representation of racial and ethnic minorities in clinical trials for regulated medical products is fundamental not only to the FDA’s regulatory mission but also public health,” says RADM Richardae Araojo, PharmD, MS, associate commissioner for Minority Health and director of the Office of Minority Health and Health Equity at FDA. “The FDA continues to work to increase the participation of racial and ethnic minorities and other diverse populations in clinical trials that test new medical products through hosting public meetings, developing tools, and issuing guidance documents.”

There are many factors contributing to why minority groups have been underrepresented in clinical trials. A lack of trust borne out of past historical abuses is one. The unethical Tuskegee Study, in which Blacks were misled into thinking they were receiving free healthcare to treat their syphilis, created long-term skepticism in healthcare and the government. A number of other experiments also led to systemic distrust. (See our Executive Profile here.)

Alekhya Pochiraju

Other barriers can vary based on the population companies are seeking to enroll. This might include differences in language, culture, religion, or age. A lack of awareness and knowledge about what a clinical trial is and what it means to participate is also a concern. When potential subjects are handed a consent detailing the purpose of the research, associated risks, and potential benefits, they might not be able to comprehend the complex medical jargon.

“Low health literacy predicts poor health,” says Alekhya Pochiraju, an industry expert in clinical trial execution and a proponent of clinical trial diversity. “A lack of awareness and education about clinical trials as a safe option could lead to not knowing available treatment options or the possibility for clinical trial enrollment.”

Trial design also plays an important role in reaching a target group. Inadequate recruitment and retention efforts, accessibility to the site location, frequency of study visits, time and resource constraints for patients, transportation, and participation may conflict with caregiver or family responsibilities, and may cause time away from jobs and other commitments.

“Designing trials will require keeping disease burden in mind, as certain diseases have high disease burden among specific racial-ethnic cohorts,” says Pochiraju. “This calls for examining clinical trial design through a patient-centric approach.”

The pharma industry, federal partners, medical professionals, health advocates, and other stakeholders all have a shared interest in advancing diverse participation in clinical trials as it helps researchers find improved treatments and methods to fight illness. It also helps to uncover sex, race, and ethnicity differences that may be important for the safe and effective use of a product.

In support of FDA’s efforts to advance diverse participation, the FDA Office of Minority Health and Health Equity developed the Diversity in Clinical Trials Initiative. This includes an ongoing multimedia public education and outreach campaign to help address some of the barriers preventing diverse groups from participating in clinical trials.

“[We employ] a variety of culturally and linguistically competent strategies, tools, and resources, such as educational materials in multiple languages; a dedicated webpage with public service announcements and videos; social media outreach; and ongoing stakeholder engagement, collaborations, and partnerships,” says Araojo.

While there is not a one-size-fits-all approach to recruiting diverse populations, there are several strategies that support clinical trial diversity, she says. Among her suggestions are:

- Early planning to address inclusion.

- Consistent and continued community engagement through working with cultural ambassadors, faith-based organizations, and trusted local leaders.

- Engaging patients and providers in trial design, logistics, recruitment, and retention practices.

- Choosing investigative site locations where there are more racial and ethnic minorities, a diverse study team staff, and cultural sensitivity.

- Making enrollment less burdensome by eliminating language barriers and re-evaluating trial criteria.

“Often it is assumed people of color are not willing or able to participate in the clinical trials which pose an opportunity barrier,” says Pochiraju. “Setting expectations that all potentially eligible participants are asked helps to reduce the participation gap. There’s a strong correlation between physician and clinical trial participant diversity. Striving for diversity throughout the healthcare system will help reflect diverse trial enrollment.”

In November, FDA issued the final guidance on “Enhancing the Diversity of Clinical Trial Populations—Eligibility Criteria, Enrollment Practices, and Trial Designs,” which was first issued as a draft in 2019. The guidance provides the agency’s current thinking on steps sponsors can take to broaden eligibility criteria in clinical trials through inclusive trial practices, trial designs, and methodological approaches. The guidance also provides recommendations for how sponsors can increase enrollment of underrepresented populations in their clinical trials and improve recruitment so that enrolled participants will better reflect the population most likely to use the drug, while maintaining safety and efficacy.

“Clinical trials and the people who volunteer to participate in them are essential to help develop safe and effective medical products to fight diseases and illnesses,” says Araojo. “The FDA remains committed to increasing enrollment of diverse populations in medical product development and will continue to broadly engage with stakeholders to advance this important goal.”

— Elaine Quilici, Senior Editor

Time of Transition

Keeping pace with the shifting landscape for regulatory affairs in the US and UK.

When looking ahead at the priorities of new leadership in the US, “we’re expecting a lively first 100 days with the Biden administration,” says Paul D. Rubin, partner at Debevoise & Plimpton and co-chair of the firm’s Healthcare & Life Sciences Group. As COVID-19 remains top of the agenda, the primary focus, Rubin told Pharm Exec, will be on making sure vaccines are distributed and administered appropriately, while a more immediate action is likely to be the introduction of a “mask mandate” in one form or another. Rubin also anticipates more coordination at the federal level in the fight against COVID, rather than relying on the states, for example, to purchase equipment directly from potential foreign and domestic sources.

Under the Trump administration, FDA issued fewer warning letters than in previous years. (Source: JHVEPhoto - stock.adobe.com)

There will continue to be a real focus on the pharma supply chain, adds Rubin. He expects the list of 223 essential drugs and biologics and 96 medical device counter measures published by FDA on Oct. 30, 2020, to be heavily scrutinized, with a focus on efforts to ensure that those products are produced domestically. In addition, there is likely to be an increase in enforcement within FDA, which under the Trump administration dispatched fewer warning letters and generally classified fewer inspections as “Official Action Indicated” than in previous years. In the longer term, there may also be a push to make FDA an independent federal agency, says Rubin. He adds that we will also see implementation of the new over-the-counter (OTC) drug law under the CARES Act, the development of policies addressing products such as CBD, and a probable re-engagement with the World Health Organization.

While Biden is a supporter of drug pricing reform—and the Senate did shift to a slight Democratic majority following the party’s pair of Georgia runoff wins in early January—there could still be continued constraints on what can be achieved in this area (see Price and Priority further below). More urgent for Biden could be the fate of the Affordable Care Act, observes Andrew Bab, Debevoise & Plimpton partner, who co-chairs the Healthcare & Life Sciences Group with Rubin.

If the constitutionality of the act is upheld by the Supreme Court, as is likely, “Biden has already emphasized that one of his priorities is shoring up the ACA,” says Bab. “If not, Biden will need to work with both parties to design a new approach.”

Another area to consider as we go into 2021, says Bab, is the appointment, if confirmed, of Xavier Becerra as the next secretary of health and human services (HHS). The former California attorney general has been aggressive in dealing with mergers and acquisitions in the healthcare space, where the Trump administration has been less active in challenging M&As from an antitrust perspective. “I would expect that to be reversed to some extent under Biden, particularly in the healthcare sphere, given Becerra’s history and the general policy approach of the administration,” adds Bab.

Britain Prime Minister Boris Johnson signs the Brexit trade deal with the EU on Dec. 30. (Source: REUTERS / POOL - stock.adobe.com)

For John Oroho, executive vice president and chief strategy officer of Porzio Life Sciences, however, Biden’s may be a “more hands-off administration in connection with the FDA and HHS than the Trump administration.” While the times dictated some of it, Oroho notes that “Trump was more hands-on with FDA and HHS than any other administration back to Reagan.” On the compliance front, however, Oroho expects an increased focus on transparency, with strong enforcement of anti-kickback and False Claims litigation. He points also to continued growth in price transparency, but if the Biden administration chooses not to federalize pricing transparency requirements, “we could end up with 45 reporting requirements around the country, which would be a compliance nightmare.”

As for any last-minute policy changes that the Trump administration was to instigate before Jan. 20, other than perhaps a “slimmed down coronavirus relief bill,” Oroho doesn’t see anything pushed by the Trump administration getting through the Congress, or even making it to the floor. In certain cases, any major policy changes issued between now and inauguration day “will have to be by executive order.” These executive orders could be quickly reversed by the new administration.

Brexit: Faster approvals, tenser trade talks

In the UK, as in the US, transition was also top of mind at the end of 2020. By the start of the holidays, with just days to go until the end of the Jan. 31–Dec. 31 Brexit transition period, the UK and EU still had not reached an agreement on formalizing arrangements for their future relationship. UK companies had taken various steps to ensure they would still be operational on Jan. 1, 2021, but the trade-deal uncertainty became an increasingly urgent problem as the clock ticked toward the end of the year. On Christmas Eve, however, the UK saw Prime Minister Boris Johnson announce, with a touch of seasonal showmanship, that a deal had finally been secured.

The pharma and healthcare sectors, among many other industries, could breathe a sigh of relief. With half of all the medicines that come into the UK coming from the EU, a no-deal situation would have seen about 40% to 60% of these products delayed for several months. In a joint press release, Richard Torbett, chief executive of the Association of the British Pharmaceutical Industry (ABPI) and Nathalie Moll, director general of the European Federation of Pharmaceutical Industries and Associations (EFPIA), welcomed the news in measured tones, indicating that it was now time to look at the detail of the deal “to understand what it means for our members and the future of the pharmaceutical industry.” Underlining that “the end of the transition means there will be a significant change in how border and customs arrangements work come Jan. 1, ABPI and EFPIA concluded: “We will continue to do everything in our power to maintain the flow of medicines to all parts of the UK and the EU.”

The COVID factor

The novel coronavirus pandemic has, of course, been another tense factor in the progression of UK and EU regulatory affairs during 2020. However, it has had its upside in terms of helping to secure the UK’s regulatory foundations. “For example, the UK Medicines and Healthcare products Regulatory Agency (MHRA) has been able to strengthen those EU processes that work and rectify those processes that didn’t work,” says Marie Manley, partner and head of life sciences at the UK law firm Sidley. “It has been able to build up a system that is more flexible, and which allows for the emergency situation we find ourselves in.” It was no accident that the UK was the first country to approve the Pfizer-BioNTech vaccine, says Manley; the UK had already been listening to criticisms about the lengthy approval process and was looking at how to speed it up. To expedite the vaccine approval, for example, MHRA employed a rolling review, in which the development of the product is monitored before its application is submitted, enabling regulators to see clinical data in real time and discuss trials and manufacturing processes with the drugmakers as they proceed. “In this respect the regulator is more a partner of the industry, helping a product on the route to approval without compromising safety,” says Manley. “This is one positive outcome of the COVID crisis.”

NICE to get nicer?

The UK is small compared with the EU, US, and Asian markets. Therefore, the effort of getting a product assessed and approved by MHRA “has to be worth it,” says Manley. “The procedure cannot be over-burdensome, and once a product receives authorization, it should not be hit with an additional hurdle.” This has often happened, however, following a health technology assessment (HTA) by the National Institute for Health and Care Excellence (NICE). “HTA in the UK has been perceived by companies as a blockage,” says Manley. “Because NICE’s determinations have been very tough on cost-effectiveness, they have been a deterrent.”

NICE needs to become attractive, more pharma friendly, and understand that some new technologies can’t provide the kind of data that the organization has been typically requesting, Manley believes. But she notes that NICE is starting to take steps in this new direction, launching new consultation processes, looking more at real-world evidence, and listening more to patients.

Not least in its response to COVID, the UK’s move to regulatory independence, then, has ushered in some positive developments, both for the UK and for the EU. (As Manley notes, Europe will also be driven by the UK’s competitiveness.) As 2021 came into view, there looked to be some light at the end of the Brexit tunnel.

— Julian Upton, European and Online Editor

Production Pivots for Pharma

The likely manufacturing implications from COVID and gene therapy in 2021.

We have written before about manufacturing capabilities for cell and gene therapies, in the halo of oncoming trends. In our November 2019 issue, Salim Syed, head of biotechnology research, senior biotechnology analyst, and managing director at Mizuho, was quoted: “As these therapies get more complex, [manufacturing] matters even more.” This was followed closely with our inclusion of cell and gene therapy manufacturing as one part of an overall cascade effect for our 2020 Industry Outlook. Murray Aitken, executive director of IQVIA Institute and member of the Pharm Exec Editorial Advisory Board (EAB), said at that time, “The whole infrastructure for handling these novel therapies is still a big barrier, and it’s going to take a few years before the infrastructure and platforms are established for these therapies to become commonplace.”

Granted this was involving 2019 trends, pre-COVID, when the mid-year approval of Novartis’ Zolgensma indicated for treatment of pediatric patients less than 2 years of age with spinal muscular atrophy (SMA) with bi-allelic mutations in the survival motor neuron 1 (SMN1) gene made news.

But in another all-too-familiar COVID outcome, the general population is more apprised of challenges around manufacturing vaccines and therapies, specifically around scaling up and sourcing material for the pre-distribution supply chain. Forget that the vaccines have been made available in record time, it’s the glitches in manufacturing that make the news—for example, when it was discovered that some of the vials used in Oxford University and AstraZeneca’s vaccine candidate trial were not filled properly and didn’t have the right concentration, resulting in cohorts receiving a half dose. It was later decided with regulators that the clinical trial would continue, and the manufacturing problem corrected.

If we move out from the COVID spotlight, manufacturing issues surfaced in the advanced therapies space later last year. Sio Gene Therapies (formerly Axovant), a clinical-stage company developing gene therapies for neurodegenerative diseases, hit a major snag in advancing its promising AXO-Lenti-PD for Parkinson’s disease. It announced delays in CMC data and third-party fill/finish issues in the development of a suspension-based manufacturing process that will delay trial enrollment to the end of 2021.

Bluebird bio, in its third-quarter results, announced that FDA requested amendments to the CMC portion of its biologics license application (BLA) submission for bb1111, a gene therapy for sickle cell disease (SCD) that uses suspension-based lentiviral vector technology. FDA asked for the use of drug product manufactured from SCD patient cells in addition to healthy donors, as well as commercial lentiviral vector to demonstrate drug product comparability for its bb1111 program. Bluebird anticipates this delaying the submission timing until the end of 2022.

(Source: andrey_orlov - stock.adobe.com)

To emphasize the importance of manufacturing in the world of gene therapy, John Crowley, CEO of Amicus Therapeutics, said in its Q3 earnings call that the company had spent “an enormous amount of time and effort focused on the CMC and the technical operations parts” of its programs in Fabry and Batten’s diseases. Early in 2020, Amicus opened its Global Research and Gene Therapy Center of Excellence in Philadelphia, which followed the 2019 announcement of a major expansion of its gene therapy collaboration with the University of Pennsylvania.

Also a part of the manufacturing-build movement is Bayer, which launched its cell and gene Therapy (C>) platform within its pharmaceuticals division in early December. Spurred by Bayer’s acquisition of BlueRock Therapeutics in 2019 and its December 2020 purchase of Asklepios Biopharmaceutical (AskBio), along with its existing expertise and recent investments in product supply capabilities, is the goal “to fill an important global demand gap for development and manufacturing of gene therapies.”

In November 2019, we noted that many pre-commercial and commercial companies were opting to invest in their own manufacturing capabilities—BioMarin, Wave Life Sciences, Novartis, and Astellas. Soon after, CDMO Thermo Fisher Scientific, not to be outdone by its potential clientele’s own growth, opened a $90 million, 50,000-square-foot viral vector manufacturing facility in suburban Boston.

This set the stage for the 2020 cell and gene field playout, that despite COVID-19, did come to fruition. By July 2020, over 134 investigational new drug (IND) applications for gene therapies were approved, which was on track to meet or beat 2019. That brings us full circle to the pandemic. What COVID-targeted therapies and vaccines are experiencing on a number of fronts, dovetails with existing challenges in the gene therapy space. Do you retain a significant portion of your manufacturing capabilities à la Pfizer-BioNTech? Or do you go the Moderna route, and contract with a large firm, as it did with Lonza? Do you build an integrated European manufacturing network consisting of several contract development and manufacturing organizations (CDMOs), such as CureVac? Suffice to say, in the pages of Pharmaceutical Executive, you will hear the benefits of all of these models from stakeholders on all sides…not just in COVID.

As we head into the small population sizes of gene therapy with potentially shorter regulatory approval pathways because of their inherent life-saving (or life-changing) potential, you also run into the need to collect extended patient data for longer periods to determine those long-term safety or efficacy questions, or collect more real-world patient data for submissions. Enter our next 2021 Industry Outlook choice, real-world evidence.

— Lisa Henderson, Editor-in-Chief

Grabbing the Reins in RWE

Achieving and acting on the potential of complex analytics not lost on industry.

Falling under the COVID-19 category of “if it was already in motion, the pandemic is speeding its implementation and/or adoption” is real-world data/real-world evidence (RWD/RWE) for the three primary uses of said data related to biopharma. The three uses are:

- FDA applies RWD and RWE to monitor postmarket safety and adverse events and to make regulatory decisions.

- The healthcare community uses these data to support coverage decisions and to develop guidelines and decision support tools for use in clinical practice.

- Medical product developers are using RWD and RWE to support clinical trial designs (e.g., large simple trials, pragmatic clinical trials) and observational studies to generate innovative, new treatment approaches.

As explained in the previous Outlook Trend, postmarket safety surveillance and adverse events monitoring by FDA and manufacturers is reaching new heights based on the abbreviated regulatory pathways associated with breakthrough therapies, as well as general unknowns in the larger field of advanced therapies, including cell and gene medicines. Early approvals of therapies that haven’t been studied in extended large populations for longer periods of time require postmarket surveillance, of which COVID-19 vaccines and therapies such as spinal muscular atrophy treatment Zolgensma require.

How long will COVID-19 vaccines prove effective once in the global population? Same with Zolgensma—will its seemingly miraculous effects last a lifetime?

The pandemic is not only a US-based factor in pushing adoption of RWD/RWE. In October, participants from 28 global medicines regulatory authorities, as well as experts from the World Health Organization (WHO), met to discuss their experiences with supporting and assessing RWE to facilitate regulatory decision-making on COVID-19 treatments and vaccines. Convened under the umbrella of the International Coalition of Medicines Regulatory Authorities, and co-chaired by Health Canada and the European Medicines Agency (EMA), participants shared their lessons learned from ongoing COVID-19 observational studies based on RWD in various countries and regions around the world. The meeting built upon three previous meetings on COVID observational studies held in April, May, and July 2020, and underlined the need and commitment by regulators to cooperate and improve information-sharing globally.

While FDA can flag therapeutic issues coming from its Sentinel system, as well as a database of de-identified clinical data from electronic medical records (EMRs)—and the healthcare community relies on its own EMRs and analytics—pharma has to rely on building registries or accessing external data sources to determine RWD/RWE to support clinical trial designs and regulatory submissions. Companies have to do that as well to build cases for payers in the event of drug approval and for ongoing reimbursement support.

Scott Gottlieb

In a roundtable sponsored by Parexel, Scott Gottlieb, MD, former FDA commissioner, spoke to the current pandemic and other trends that were accelerating the use of RWE.

He also touched on an additional area where the pandemic spurred greater collection and use of RWE.

“You’ve seen a lot of amendments to [clinical trial] protocols where there have been missing data—such as from patients lost to follow-up—and sponsors have been able to use RWE to augment the datasets that were already being accrued, to compensate for some of the complexities that were created by COVID, such as not being able to bring patients back onsite for follow-up,” noted Gottlieb.

The discussion that follows in the roundtable of global biopharma regulatory leads is robust and highlights concerns around validating data for regulatory and payer use; current uses of RWE; its use in rare diseases and oncology; as well as the positive effects of RWD/RWE on patients.

Markus Gores

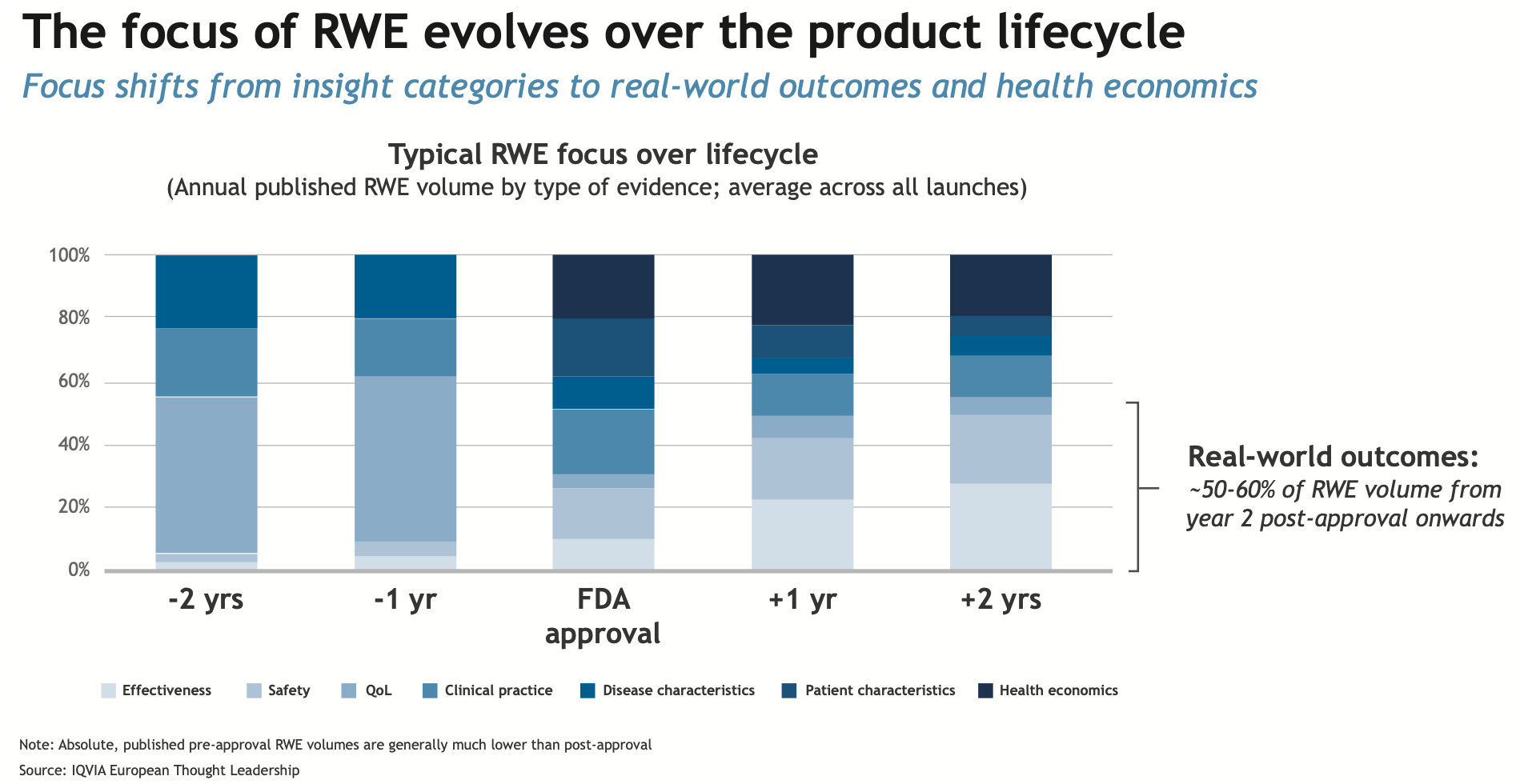

The chart below from an article we published in September outlines the evidence/data sources at various points of a drug’s lifecycle. The article, authored by Markus Gores, vice president, thought leadership, EMEA, IQVIA, further pinpoints how the biopharma enterprise can best leverage all sources and methods to get started on RWE.

There is a robust debate around the future of randomized-controlled trials (RCTs) in an RWE world; however, by and large for pharma and regulators, RWD/RWE is not seen as a replacement for RCTs but as a realistic solution for many therapeutic situations.

Click to enlarge

Because RWD/RWE data sources are exactly that, data, the underlying technology and integration needed to achieve more complex analytics is not lost on regulators or manufacturers. In early December, Verantos, which runs RWE studies for regulatory and reimbursement purposes, was awarded a grant from FDA to implement a multi-year advanced RWE study called “Transforming Real-World Evidence with Unstructured and Structured Data to Advance Tailored Therapy” (TRUST). According to the press release, the three-year study “will apply advanced RWE to a clinical scenario, and data quality will be studied by comparing traditional approaches (claims and health record structured data) to advanced approaches (deep phenotyping and data linkage). Differences in results will be measured to understand the extent to which data quality influences the resulting clinical assertions. Findings may inform future study design and definitions of fit-for-purpose data.”

— Lisa Henderson, Editor-in-Chief

Price and Priority

With drug pricing debate quieter but still simmering these days, new legislation uncertain.

As inauguration day grew near, President-elect Joe Biden was beginning to construct his cabinet, tapping Xavier Becerra for Secretary of Health and Human Services and Vivek Murthy, MD, for Surgeon General. Throughout his campaign, Biden proposed the ideas of allowing Medicare to negotiate prescription drug prices, regulating the launch prices of drugs without competition, and limiting price increases to the rate of inflation. While reducing the price of Rx remains urgent for the American public, its position on Biden’s priority list is currently unknown.

Ed Schoonveld

“The priority is seemingly high and inappropriately so,” contends Ed Schoonveld, managing principal of value and access for ZS Associates. “Prescription drug costs have been a stable 12% to 13% of total cost of healthcare for the last 20 years, yet it gets all the public attention. A broader focus on the reasons for rising healthcare cost, and means to address that more holistically, would make more sense. Particularly in light of the COVID crisis (and any future similar threats), maintaining a healthy biopharmaceutical industry is economically crucial.” (Schoonveld points to his comments on venture capital funding needs in his recent Pharm Exec article)

With issues like the COVID-19 crisis and the need to expand health coverage at the forefront, experts are doubtful of any substantial progress toward reining in drug prices. “My general feeling is that we have come closer to government legislation of some kind,” Schoonveld told Pharm Exec. “While the Most Favored Nation (MFN) Interim Final Rule (IFR) seems likely to be challenged on procedural grounds, it has been supported by many Democrats as perhaps a quick solution that Democrats should support. If Biden is successful in building some bridges between Democrats and Republicans, agreement on action on drug pricing may be high on the list of compromise.”

A question will remain that, if such a compromise is reached, will it be an MFN-style indirect price control, Centers for Medicare & Medicaid Services’ (CMS) ability to negotiate, or a mix of these where negotiations are empowered with MFN- and perhaps Institute for Clinical and Economic Review (ICER)-style benefits assessments. The MFN model, announced in late November by HHS Secretary Alex Azar, was implemented this month through the CMS Innovation Center. The model will protect current beneficiaries’ access to Medicare Part B drugs, make them more affordable, and address the gap in drug prices between the US and comparable countries.

If such an agreement were to be reached, what would restricting drug prices look like for the biopharma companies and individuals responsible for researching and supplying them? “With deep controls into drug pricing, such as is done with the MFN ruling, each company will be forced to 1) consider whether investment in each drug candidate makes financial sense (with many new treatment options potentially dropping out), and 2) evaluate whether they should launch in international markets or just launch in the US at a higher price,”says Schoonveld. “Simply put, some drugs will not be developed. The impact will particularly be felt by seniors, as the focus is on Medicare drugs. It is a dangerous seven-year ‘experiment’ with our futures, as the impact may be felt suddenly and painfully after five years or so, when the damage will become clear.”

Another key component in the crusade to cut drug prices lies with the control of the Senate, which shifted over to the Democrats after the party won both runoff elections in Georgia early this month. But its now slight majority, nevertheless, will most likelystill equate to four years of congressional congestion on this issue, experts point out. Democrats will have control of HHS and the federal government’s healthcare regulatory system.

With both Pfizer-BioNTech and Moderna’s COVID-19 vaccines approved for emergency use, and Oxford/AstraZeneca and Janssen (J&J) currently on their own respective paths in large-scale Phase III trials of vaccine candidates, pharma is basking in the light at the end of the COVID tunnel, wearing a hero’s cape. Though they’re thankful to see an end in sight, that won’t necessarily make the American public forget about the hefty price tags attached to everyday therapies that will remain once the pandemic is contained.

“The distrust and anger is very deep,” says Schoonveld. “No good deed goes unpunished, and it will take sustained efforts from the industry to collaborate on solutions to overcome their current reputation.”

— Miranda Schmalfuhs, Assistant Editor

Cell and Gene Therapy Check-in 2024

January 18th 2024Fran Gregory, VP of Emerging Therapies, Cardinal Health discusses her career, how both CAR-T therapies and personalization have been gaining momentum and what kind of progress we expect to see from them, some of the biggest hurdles facing their section of the industry, the importance of patient advocacy and so much more.