- Sustainability

- DE&I

- Pandemic

- Finance

- Legal

- Technology

- Regulatory

- Global

- Pricing

- Strategy

- R&D/Clinical Trials

- Opinion

- Executive Roundtable

- Sales & Marketing

- Executive Profiles

- Leadership

- Market Access

- Patient Engagement

- Supply Chain

- Industry Trends

Access-Based Commercial (ABC) Strategy for Drug Commercialization

Wolfram Lux and Simon Seiter discuss the implications of Strategic Market Access on work and processes, and its role in product planning and drug development success.

Medical and commercial perspectives in drug commercialization have been aligned for well over a decade now. The importance of market access has grown exponentially during the 2010s, becoming a crucial part of pharmaceutical product planning and development today. Long overdue, though, is for pharmaceutical companies to have market access join forces under a strategic angle, taking its seat among equals and satisfying the needs of all market stakeholders, to optimize market success of pharmaceutical products.

Despite today being one of the main pillars of drug commercialization, the industry will still have to master key challenges to fully unleash the strategic potential of market access and make Access-Based Commercial (ABC) Strategy a reality, to allow for sustainable market success of their products.

In a recent pulse survey among senior industry executives, our team at Simon-Kucher and Partners interviewed senior executives from the biotech and pharmaceutical industry to learn more about how companies approach Strategic Market Access, its implications on work and processes, and its role in product planning and drug development success.

Current market access and its strategic implications

Wolfram Lux

The strategic perspective remains key for today’s pharmaceutical business, as payers continue to gain influence as a dominating player (even if still not entirely in line with medical or therapeutic needs).

Surprisingly however, when we asked senior industry executives what the term Strategic Market Access (SMA) means for their business today, definitions also encompassed prediction, strategy, safety, and an array of other factors that target a single goal: commercial product success.

• “SMA defines and grasps value by strategically finding and demonstrating evidence that leads to high value.”

• “SMA is pretty much everything, i.e. defining key customers and target populations.”

• “SMA predicts and shapes the future of a medical solution for long-term value and answers the key question ‘How much are you going to sell?’”

Senior executives agree on the strategic importance of incorporating a market-access-oriented perspective early on in the drug development process and its direct link to later product success. All see SMA as an effort-intensive journey toward excellence and attaining the best evidence just before launching a product.

SMA implementation hurdles

Simone Seiter

Despite the overwhelming agreement on SMA’s significance for today’s drug commercialization, implementation remains a challenge. For many companies, this lengthy process can require up to three years and surprisingly is often initiated by the functional team members, who realize the importance directly through their daily work, e.g. market access, or medical/commercial activities. SMA is rarely driven deliberately by executive management. Even within companies that achieve the ideal SMA implementation and setup, its beneficial effects are not immediately apparent, up to a point that some senior executives are still questioning its value and impact. This is also due to the fact that no one has experienced their own alternative situation without SMA in order to draw a direction comparison. However, there are still many companies out there which seem to do fairly well without SMA.

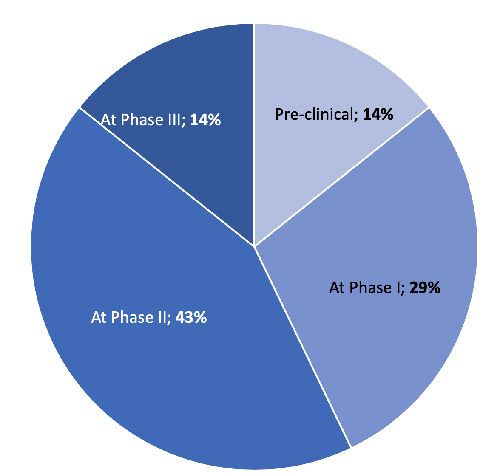

Contrary to its acknowledged strategic importance, SMA is still done quite late in the drug development process, raising the question of whether companies have set up SMA in the most optimal way. Not even half apply SMA before their phase 2 (proof-of-concept) trials. However, we would expect an earlier utilization of SMA to properly address the main strategic questions surrounding market access:

• Which therapeutic areas provide the optimal prospects for a new molecule from a holistic point of view? This includes medical needs, payer expectations, pricing potential, pricing models, and commercial competition.

• Which clinical evidence is required for various stakeholder groups and which clinical endpoints are required for strongest evidence at a later stage? Which HEOR endpoints in particular should be tested early on?

• Which geographic markets should be prioritized and which clinical and HEOR evidence is required?

To fully benefit from its strategic value, SMA should kick-in at a much earlier stage, before the main path for product development has been laid out and significant investment in clinical trials committed.

Limited decision-making power assigned to the role of SMA

When we asked senior executives how they had implemented SMA in the product planning and development process, answers did not reflect the previous acknowledgement of the role of SMA in the senior executives’ businesses.

Figure 2: Formalized ways to facilitate SMA

Rather than SMA and the conclusions drawn from it being granted formal decision-making power, or at least a high degree of formal fulfillment requirements, the majority of companies grant SMA a similar weighting to the other key functions in product development (i.e. Medical and Commercial) in the product development team. This way, SMA takes rather a supportive role, providing insights and perspectives but not making the calls on passing formal decision gates in the process, as medical and commercial requirements traditionally do. In addition, product development teams are still widely led and managed by experts with a commercial or medical background.

In summary, SMA is widely regarded as an important strategic perspective for the future commercial success of a drug, but it hardly possesses decision-making power during the drug development process.

Despite these findings, senior executives agreed that substantial benefits from using SMA have been achieved, such as:

Benefits for a product’s value proposition:

- Better differentiation vs. competition

- Reduced price concerns from HCPs, focus on true medical benefit drives Rx-decision-making

- Highest likelihood of success for drug

- Better fit to customer

- Optimal alignment of commercial goals

Benefits for overall clinical development:

- Increased probability of fast reimbursement and higher price thanks to value-maximizing outcomes

- “Real-world approach” applied to trial design for more meaningful outcomes

- Minimized inconsistency between regulatory-oriented vs. payer-oriented perspectives

Benefits for overall commercial strategy:

- Improved identification of opportunities and avoidance of mistakes

- Stronger ability to meet expectations around drug performance in the market

- Improved customer centricity during product development

- Genuine medical benefit provided to a country by effectively eliminating MA as a roadblock

Among these clear benefits, utilizing SMA has other positive outcomes. Better risk assessments with more accurate forecasting are now possible, and companies that properly use SMA experience more accurate decision-making and increased operational efficiency in product development. In fact, SMA executives say their organizations understand target markets better (both geographically and therapeutically) and believe that this has increased the availability of drugs and market access success rates, but also the ease for patients to get access to their products.

SMA is yet to reach its full potential

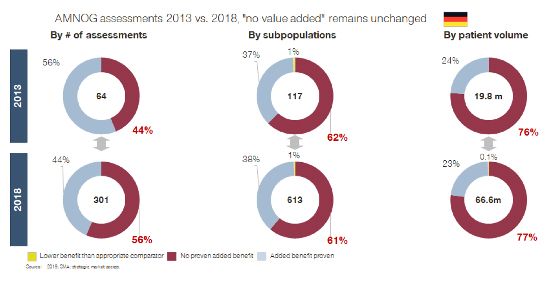

If we look at reported HTA outcomes, many of these postulated benefits are not visible (yet). Here is an example specifically of AMNOG assessments in Germany, but numbers from France, Italy, and Spain send the same message:

We expected SMA utilization to have improved HTA outcomes in the last three to five years – the timeline in which two out of three companies say they have implemented SMA. However, we must acknowledge that SMA has not (yet) delivered against this promise either. Market access and launch success rates remain more or less unchanged since the beginning of the 2010s, as data from HTA bodies and the latest IMS launch excellence study from 2018 shows (IMS Launch Excellence V, 2018).

Looking at today’s situation, we have to acknowledge that SMA has not unleashed its full potential to secure future success of drug commercialization.

Overcoming the challenges in Strategic Market Access

Without doubt, SMA should be one of the three key strategic pillars to successfully commercialize a drug along an Access-Based Commercial (ABC) Strategy, in addition to the scientific-medical and commercial perspectives. So far, its potential has not been fully exploited though, preventing companies from sub-sequentially harvesting well-earned fruits in the form of higher market access and commercial success rates for their products.

SMA was, and to some companies still is, a new type of "expertise", for which not every organization is prepared. Some companies have had to change their organizational scheme to accommodate this new way of strategic thinking, some have struggled with resources and timely synchronization, and others have faced general conflicts of interest or were just trying to mimic competitor behavior.

To increase the chances of optimal drug commercialization, SMA and its successful implementation is a must. However, to achieve full implementation of SMA on the path toward an ABC Strategy, a number of challenges have to be overcome. Foremost, this relatively new perspective on long-range outcome projections needs to not only be accepted, but also play a relevant role in strategic product planning.

Beyond this, as stated in our pulse survey, SMA also involves higher development costs due to more complex trials and longer development timelines. In search of quality and success, money, time, and resources must be sacrificed.

In addition, the SMA perspective within an ABC Strategy perfectly serves the focus on specific markets with higher success expectations. But what about those that don’t make it into strategic focus? Are they totally disregarded? And looking at the average value generation gap between Europe and the USA, Europe as a whole could potentially fall outside the strategic focus, which in some circumstances would be recommended by a strict SMA execution.

Does that mean the industry should abbandon certain markets or entire regions? What does that mean for the industry’s responsibility toward society? Should patient populations outside of SMA’s perpsective be neglected? What does that mean for orphan or ultra-orphan diseases, such as genetic disorders – can they withstand being scrutinized from an SMA perspective?

ABC Strategy requires the integration of three major perspectives on product planning and development:

• The scientific-medical view

• The classical commercial competitive view

• The long-range strategic market access (SMA).

SMA can bring great potential for commercialization success into that equation but – while still struggling with organizational excellence challenges – leaves us with a bundle of ethical questions too.

Reaching the next level of product commercialization

Not only each individual player but also the industry as a whole needs to make Access-Based Commercial (ABC) Strategy a reality – for the benefit of patients as well as commercial business prospects. But what will it take to achieve this reality?

Simon-Kucher calls on the industry to take advantage of the ABC Strategy at its highest level by critically reviewing their overall SMA setup, its level of organizational integration, and its overall execution. Companies need to rethink their approach to the market and consumers from a holistic point of view. This includes every aspect of customer needs and agendas, and starts with improvements to the foundations of SMA. Only if SMA is fully integrated in an organization can players develop and execute a true Access-Based Commercial (ABC) Strategy and secure patient benefits and commercial success for their products.

Our pulse survey revealed that companies are at different levels of implementation and maturity. This means companies need to understand their status, review the SMA process and approach, and then define how to optimize it – all supported by change management in parallel.

The ABC Strategy index

Built from five key business questions, Simon-Kucher’s ABC Strategy Index reflects how close a company is to ABC Strategy in its product development. It helps to reflect which levels of organizational integration are still to be reached and which tasks need to be accomplished to fully unleash the potential of ABC Strategy for product commercialization.

The ABC Strategy index comprises five steps and levels of achievements, listed here in order of priority:

- Has the organization built a common, cross-functional understanding of customer needs and business objectives and has it led to a coherent product strategy by excellent operational execution?

- Is the relevance of SMA and its long-range recommendations accepted and have SMA considerations been implemented in the early phases of the clinical development process as formal stage gate decision criteria?

- Does SMA have senior management endorsement and has its implementation been driven through active change management?

- Has the lack of strategic market access expertise and resources been resolved sufficiently?

- Have we revisited our relationship with science and do we allow for a balance in managing product development that satisfies the economic needs of payers, but at the same time drives new and innovative science (to secure continuous drug innovation)?

We continue to investigate the dynamic evolution of the industry’s commercialization process and success stories, helping pharmaceutical players to get to the highest level in the ABC Strategy index, and in doing so, get ahead of their competition.

Dr. Wolfram Lux is a Senior Director and Dr. Simone Seiter is a Partner, both in the global Pharma & Biotech practice within Simon-Kucher & Partners Life Sciences Division (Frankfurt, Germany).

To Tackle the Plastic Waste Crisis in Pharma, Here’s Where to Start

October 30th 2024By demonstrating big advancements in recycling, pharma companies will be much more likely to attract shareholders and other investors, giving themselves a leg up in the competition to lead the biopharmaceutical industry well into the future.