Chemotherapy vs Immunotherapy: China's Liver Cancer Market Outlook

Jianan Huang outlines the market prospects for first-line treatments for liver cancer treatment in China.

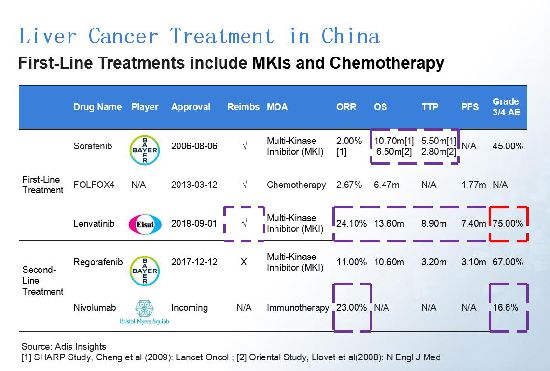

First-line treatments for liver cancer treatment in China currently include multi-kinase inhibitors and chemotherapy. Sorafenib (co-marketed by Bayer and Onyx Pharmaceuticals as Nexavar) is the most popular targeted therapy, but it may not be the best choice for patients in China. In the two clinical trials conducted on Oriental and western patients respectively, sorafenib mainly showed great overall survival (OS) and time-to-progression (TTP) data on western patients. Developed by Japan pharma Eisai, lenvatinib has an excellent efficacy data for Oriental patients and also successfully received reimbursement in China, but without good safety data. Bristol Myers-Squibb's (BMS) nivolumab (Opdivo), however, is showing strong potential on both efficacy and safety. (Click images to enlarge.)

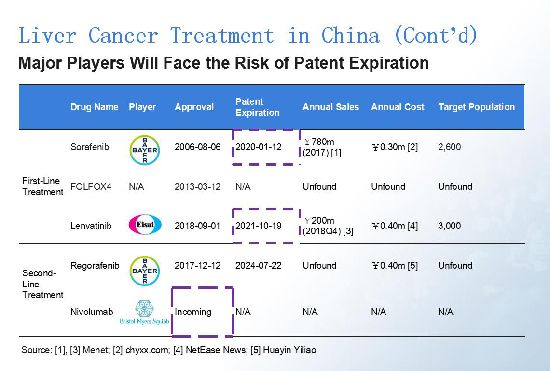

Bayer and Eisai are currently the lead players, but their products hit patent expiration in the next few years. After the approval of its liver cancer products, we believe BMS will play an increasing significant role in China.

Click on image to enlarge

Based on Cancer Statistics in China (2015), the incidence of liver cancer in china is 545,000. As average OS is less than 1 year and mortality is near to incidence, we can assume that the prevalent population is equal to incidence. The incidence rate of liver cancer is about 0.04 percent in China, which is significantly greater than other countries.

Based on the research of F. Wang et. al. (2019) in the International Journal of Environmental Research and Public Health, the estimated annual change of incidence rate is -0.200%. Diagnosed percentage is estimated to be ~50%, and treatable percentage is estimated to be ~67%. An Excel model shows the treatable population is estimated to be ~180 thousand.

Although prevalent population is slowly decreasing, we forecast that the diagnosed percentage and treatment percentage will increase because of developments in science and technology. As a result, the treatable population will slowly increase.

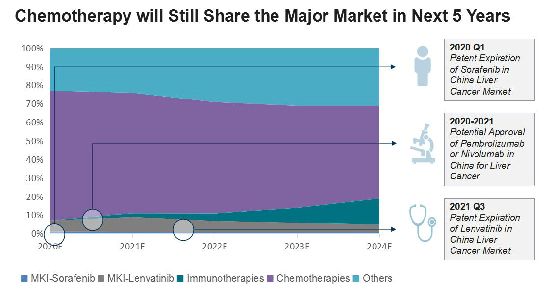

Chemotherapy is currently the major treatment for all cancers, but it faces a decrease after potential approval of other immunotherapies in China for liver cancer. However, in last five years, immunotherapy has had only a limited market share. Chemotherapy will still account for half of China's liver cancer market going forward, due to its pricing. Sorafenib and lenvatinib, however, will lose their major market share following patent expiration.

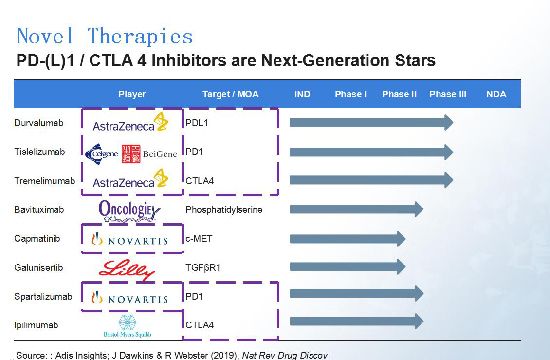

An article by Dawkins and Webster in Nature Review Drug Discovery (2019) pointed to eight notable drug candidates for liver cancer. PD-1/L1 and CTLA4 inhibitors are the most popular drug candidates, with major players including AstraZeneca and Novartis. Beigene, a Chinese biotech, also has a PD-1 asset for liver cancer in partnership with Celgene (now BMS); the asset is currently in Phase III study.

Click to enlarge

As mentioned, marketed drugs usually have serious Grade 3/4 adverse events. AstraZeneca's durvalumab and Novartis' capmatinib, however, show great improvements on safety. Oncologie's bavituximab has a relatively good TTP, but we need further data before delivering a conclusion about its efficacy.

Jianan Huang, College of Pharmaceutical Sciences, Zhejiang University, China.