A Broken System – Making Drug Decisions without Real-World Data

The price of a drug need not be, and in fact must not be, the only factor considered when determining its value, writes William Kirsh.

The spiraling cost of prescription drugs is creating unprecedented access and affordability challenges across our healthcare system. From hospital leaders to providers to patients to government, drug prices are on everyone’s radar. And with good cause: According to a January 2019 report from the American Hospital Association, total hospital and health system drug spend increased by 18.5 percent between 2015 and 2017. “Growth in inpatient and outpatient drug spending exceeded the growth in the Medicare hospital payment rates for each setting during this period as well as the growth in general health care expenditures,” the report notes.

Further, as personalized medicine becomes ever-more prevalent, drug prices are likely to continue along the same trajectory. “Twenty-three of the nearly 100 prescription drugs that were approved in 2018 currently have a list price of over $30,000 per year for a course of treatment,” according to GoodRx, and “many of the drugs on this list treat specific cancers and other relatively uncommon conditions.” Additionally, total US expenditures for specialty drugs doubled from $83 billion in 2013 to $157 billion in 2017, according to a report from IQVIA Institute.

Controlling ever-growing drug prices has been a focus for the current White House administration. In May 2018, the White House issued a “Blueprint to Lower Drug Prices,” and HHS has rolled out several initiatives and proposals around this goal, including controversial 340B reimbursement cuts and suggested new payment models. And on May 8 of this year, the administration finalized a ruling requiring that pharmaceutical companies include prescription drug list prices on direct-to-consumer television advertisements in cases in which the list price is equal to or greater than $35 for a month’s supply.

While any effort to keep life-saving medications affordable is laudable, I believe that hospital leaders, lawmakers, and other stakeholders may be missing an important nuance – that the price of a drug need not be, and in fact must not be, the only factor considered when determining its value.

An antiquated system

When it comes to hospitals deciding which medications to purchase, as well as determining which ones remain on the formularies, and which have the most value, the method is largely static and antiquated, having changed very little since the 1980s. Generally speaking, Pharmacy and Therapeutics committees, consisting of internal hospital leadership, vote to collectively decide which medications should be added or removed.

The problem with this method is that the decisions are largely subjective – influenced by anecdotal evidence about which drugs are most effective, which ones patients “prefer,” group consensus, relationships with sales reps, brand loyalty, and other unscientific factors. Having been a practicing physician for 33 years and having sat on many such committees, I can attest first-hand to the fact that many physicians prescribe drugs purely based on their own experience and comfort levels, often sticking to the medications they’ve always used.

“The pharmacy and therapeutics (P&T) committee was introduced almost a century ago as a forum for discussing drug use in hospitals,” wrote David Shulkin, MD, in his report for the journal Pharmacy and Therapeutics, back in 2012. “Those who led pharmaceutical-management programs in the past could not have anticipated the magnitude of change occurring in health care today … the P&T committee must evolve-in fact, reinvent-itself.”

Shulkin has it exactly right. The formulary decision process has simply not caught up with the rest of the healthcare industry – or indeed, with many industries – in understanding the need to make decisions based on real-time, real-world data (RWD). We already use RWD to monitor our heart rates on smart watches while we exercise, decide the best route to drive using our GPS systems, and determine which ads show up on our social media accounts.

In healthcare, we use RWD such as glucose and blood pressure readings to monitor patients with chronic conditions and rely on data from lab testing to make treatment decisions. The FDA has even recognized the value of RWD as part of post-market research for understanding how medications are truly impacting patient populations. In December 2018, then-FDA Commissioner Scott Gottlieb, MD, issued a statement about how real-world data (RWD) and real-world evidence (RWE) offer opportunities to understand clinical outcomes of pharmaceutical products. “Because they include data covering the experience of physicians and patients with the actual use of new treatments in practice, and not just in research studies, the collective evaluation of these data sources has the potential to inform clinical decision making by patients and providers, develop new hypotheses for further testing of new products to drive continued innovation, and inform us about the performance of medical products,” he said.

It seems logical that if the FDA recognizes the value of using RWD to assess drugs, we’d use the same method when making formulary decisions. So why the resistance? Why the insistence on following age- old practices? We can do better. In order to capitalize on these new capabilities and the availability of actionable data, the formulary decision process needs to evolve.

Show me the data

“Real-world evidence demands real-world data. Period. This data provides the only path for a clinician to practice evidentiary medicine that is truly incontrovertible. The proliferation of exorbitantly expensive drugs necessitates a new way of selecting the right medications for the right conditions based on actual patient outcomes,” says Travis Leonardi, CEO and Founder of healthcare analytics and technology company Sentry Data Systems. “Hospital leaders must rely on a drug selection process rooted in evidence and based on real-world data in order to thrive.”

What does such a process, steeped in RWD, consist of? The process involves comparing and contrasting the efficacy of specific drugs based on longitudinal census population data that spans the entire healthcare continuum and includes clinical, claims and pharmacy data records. Hospital leaders are able to compare de-identified patient data such as length of stay, readmissions, and co-morbidities against indexes of similar hospitals (rural, academic, critical access hospitals, and so on), to see what the drugs are really doing and how they’re really performing.

Too often, the only “data” available when making formulary decisions about the value of certain drugs is clinical trial information from the pharmaceutical companies. Yet there are many factors in clinical trials that could result in the medications behaving differently in real-world patient populations. Several studies have shown that clinical trial enrollees often do not have the same diversity of age, gender, and ethnicity as the general population, for example. Additionally, enrollees who are paid for their time in clinical trials may therefore be more incentivized to adhere to medication schedules, instructions and regimens than typical patients. Real-world medication effects and patient outcomes simply cannot be assessed without RWD.

In the absence of that RWD, formulary decisions are often based primarily on drug price; yet the simple fact is that price is not equal to value. In many cases, the more expensive drug may be the better choice, if only physicians had at their fingertips the data to show that the more expensive drug actually reduces length of stay or prevents ER visits in patients with a certain chronic condition.

For example, I recently worked with a major academic teaching hospital in the Northeast to show them how RWD might change the impressions they had about the value of IV acetaminophen for post-op orthopedic pain management. Hospital leadership and physicians alike believed that IV acetaminophen was the most effective choice for managing pain, and that its use contributed to reduced length of stay. However, after taking a deep dive into a longitudinal database of patient records at their hospital (data collected from many patients over the course of many years), comparing that data against an index of similar hospitals, and applying analytics to that information, what we found was something very different.

We learned that there was in fact no difference in length of stay for the IV acetaminophen patients compared to those on other pain management drugs, and that there was actually a correlation between the use of IV acetaminophen and increased opioid prescribing, indicating that the IV acetaminophen wasn’t nearly as effective as leadership thought it was on any of the measures considered.

The hospital had been so sure of the value of IV acetaminophen for this use case that their IV acetaminophen costs had tripled in about three years. Without access to the RWD and analytics to help drive better business decisions, the hospital’s Pharmacy and Therapeutics committee would have never considered looking into other options that might offer more value for the cost.

Reason for hope

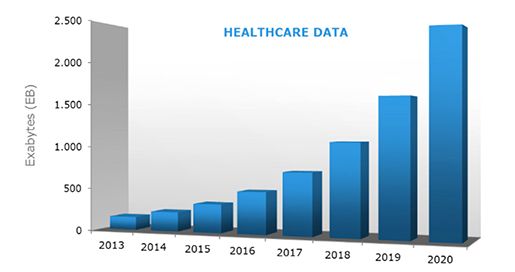

The good news is, RWD is plentiful in healthcare and growing exponentially every day, so we have more than enough information on-hand to start making strategic, informed decisions about which drugs we use.

According to the EMC Digital Universe with Research & Analysis by IDC Healthcare, data growth in healthcare is one of the fastest across many industries.

* Source: EMC Digital Universe with Research & Analysis by IDC

Let’s compare the process of assessing the drugs on our formularies to driving a car – how do you know where you’re going? The worst possible case to make any decision, of course, would be having no data – no map, no instructions, and no sense of how to get from A to B. The current Pharmacy and Therapeutics committee process is not quite flying blind, but the data available is static, old, and doesn’t take into account real-world, real-time circumstances. That’s a lot like driving to a place you’ve never been before with a paper map – you have enough information to see the route, but no idea about construction delays, whether streets have changed names, or how much traffic is on the road at any given moment. You’re making your decision based on information that’s frozen in a moment in the past – a lot like voting on drug formularies based only on a snapshot of a clinical trial from the pharmaceutical company.

Using real-world data from a longitudinal patient database and indexes of data from other similar hospitals, however, puts you on the road with a top-of-the-line GPS. Now, you can look at what is really happening with admissions, length of stay, comorbidities, and more, and course-correct based on what the information is telling you.

"The ability to formulate treatment decisions, particularly around pharmaceutical interventions, that are based on years of actual patient data is game-changing for the healthcare industry. This is the future of medicine. We believe that within the next two to four years, every hospital in America will make formulary decisions that are grounded in real-world science,” says Leonardi. “The answers are in the data.”

William Kirsh, DO, MPH, is Co-founder and Chief Medical Officer of Sentry Data Systems.

Trump: 'Major Tariff' on Pharmaceuticals Coming Soon

Published: April 9th 2025 | Updated: April 9th 2025“We’re going to tariff our pharmaceuticals, and once we do that, they are going to come rushing back into our country," President Donald J. Trump said during a Tuesday night dinner in Washington.