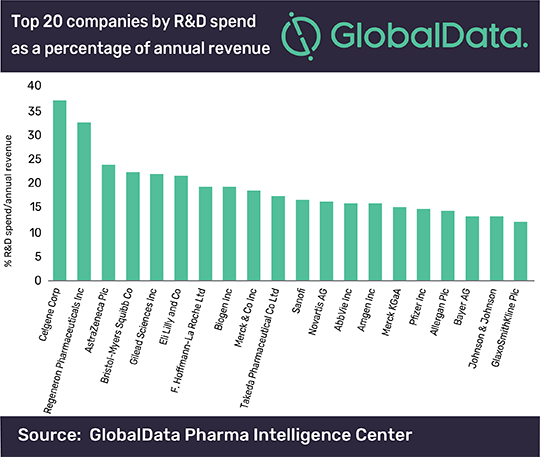

Celgene "Had the Highest RD Spend in 2018"

Celgene had the highest proportional R&D spend, according to a GlobalData analysis of the top 20 global companies by R&D spend for 2018, which shows that companies with expensive late-stage pipeline drugs are spending significant proportions of their annual revenue on R&D. Madeleine Roche, associate pharmaceutical analyst at GlobalData, said: “Within the top 20 global companies that spent the most on R&D in 2018, the top spender-despite having the second smallest annual revenue of the group at $15.28bn-is Celgene, whose R&D spend was equal to 37% of its annual revenue. GlaxoSmithKline (GSK) is at the bottom of the top 20 list with the lowest percentage R&D spend/annual revenue at 12%.” Roche addd: “R&D spend is increasing, but its return is decreasing, mostly due to the high cost of late-stage drug development. Despite having an annual revenue more than three and a half times greater than Celgene’s, GSK has seven drugs in the pre-registration phase compared to Celgene’s eight at the same stage of development.” Regeneron, in second place for percentage R&D spend/annual revenue (32.6%), and Gilead in fifth place (21.9%), are notable for their traditional core pharma business structure, while other companies in the top 20 are multinational conglomerates. Roche concluded: “The acquisition of Celgene by Bristol-Myers Squibb (BMS) closed on November 20, 2019, valued at $74bn. Notably, the acquisition itself takes a gamble on R&D, and contingent value rights (CVRs) issued with Celgene’s shares mean that profitability is hinged on the success of pipeline drugs ozanimod, liso-cel and bb2121. Already placing third for percentage R&D spend/annual revenue pre-acquisition, it seems BMS decided to bolster spending with more spending. Spare cash, decreasing valuations and key patent losses in the last few years may well have spurred this acquisition from BMS’s side.”

Addressing Disparities in Psoriasis Trials: Takeda's Strategies for Inclusivity in Clinical Research

April 14th 2025LaShell Robinson, Head of Global Feasibility and Trial Equity at Takeda, speaks about the company's strategies to engage patients in underrepresented populations in its phase III psoriasis trials.

Beyond the Prescription: Pharma's Role in Digital Health Conversations

April 1st 2025Join us for an insightful conversation with Jennifer Harakal, Head of Regulatory Affairs at Canopy Life Sciences, as we unpack the evolving intersection of social media and healthcare decisions. Discover how pharmaceutical companies can navigate regulatory challenges while meaningfully engaging with consumers in digital spaces. Jennifer shares expert strategies for responsible marketing, working with influencers, and creating educational content that bridges the gap between patients and healthcare providers. A must-listen for pharma marketers looking to build trust and compliance in today's social media landscape.