The D-Mab Men

Pharmaceutical Executive

Amgen's salvation just may be denosumab. We sit down to talk with the head scientists driving the drug.

All of a sudden, Amgen's future seems a whole lot brighter. The source of salvation? Denosumab, a Phase III monoclonal antibody that targets the RANK ligand pathway, which is responsible for regulating cells that destroy bones. Some analysts have called denosumab the most valuable late-stage compound in the industry's pipeline. And certainly, with Amgen testing the drug for the multi-billion dollar osteoporosis market as well as several oncology conditions, including breast and prostate cancer, excitement behind the biologic is mounting.

How D-Mab Works

With sales of Amgen's EPO drugs expected to slow, there's no time to waste, and the company is moving full-steam ahead. If successful—and the recent news that denosumab outperformed the osteo gold-standard Fosamax provides solid evidence—it could be the first personalized therapy for a primary care condition, and the first drug to target the RANK ligand pathway, discovered at Amgen.

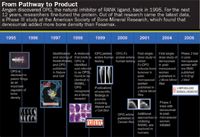

From Pathway to Product

Multiple indications for biopharmaceuticals is nothing new for the industry. But Amgen has bet big on denosumab by undertaking two enormous, nearly concurrent clinical trials for the drug. Its 8,000-patient oncology program is larger than the trials conducted for Avastin, Rituxan, Zometa, and Gleevec, and its osteoporosis study, with 10,000 patients, is Amgen's largest ever.

Steering the future for "d-mab"—and in essence, the company as a whole—are the program's two development heads, Dr. Javier San Martin, an Argentine native who cut his teeth designing osteoporosis and parathyroid hormone clinical trials for Lilly; and Dr. Roger Dansey, a physician from South Africa who brings a detail-oriented approach gleaned from his years as an associate professor and attending physician in a bone marrow transplant unit. Here, the men discuss the promise of denosumab, and their experience running these global clinical trials in tandem.

Osteoporosis and cancer seem like completely different conditions. What allows these two diseases to be treated with the same drug?

SAN MARTIN: The interesting feature for these two different indications is that the "bad guy" is the same: the osteoclast. The overfunction of osteoclasts is the key feature for both osteoporosis and cancer. Denosumab inhibits osteoclast formation, which has an effect on their function and survival.

With both conditions, the aim is to prevent clinical events related to bone failures. In osteoporosis, it's spine fractures and hip fractures. Osteoporosis is a chronic, progressive condition, and the goal is to increase overall bone strength to prevent those fractures from happening in the first place. We measure that improvement in bone strength by looking at bone density gains—and we have strong data there. On the oncology side, the failure happens where the bone metastasis makes the bone weaker in a particular place.

DANSEY: It's not without precedent. If you look at bisphosphonates, they play in both areas. There's the very potent intravenous bisphosphonate Zometa that dominates the cancer market versus the oral bisphosphonate market.

But we're fortunate. We have confidence in the specificity of the molecule and its ability to just do what it's supposed to do. The molecule for the RANK ligand pathway is well defined; the biological effects of blocking that pathway are well defined; we've got the molecule to block the pathway; and the molecule seems to only block this particular pathway.

As you go through these trials, is there a chance to learn from one another?

DANSEY: There is an umbrella group that steers both these areas and gives us guidance and input across the two. On a weekly basis, we share plans, results, all sorts of things. So we do learn from each other. The trials that are going on now in Javier's area, osteoporosis, absolutely inform what the potential is in the cancer area. So every data point we get that indicates denosumab will bring clinical benefit means the other trials can expect to see that benefit as well.

SAN MARTIN: We can share learnings about the safety profile. We can also compare information about the pharmacodynamics of the drug or the level of suppression of bone resorption, which is what you want this drug to do— and we're seeing amazingly consistent efficacy and safety results from both programs.

Where do the programs differ?

DANSEY: We not only have two programs—in two different disease settings—but we have two different doses and two different schedules. It's a fascinating situation to be in, with this pathway representing a platform for preventing bone disease in many circumstances, depending on the right dose and schedule using this molecule.

The osteoporosis program has a very convenient schedule—only twice a year—and is given by subcutaneous injection, whereas in the cancer program, denosumab is given every month. We're testing different ranges of osteoclast blockage based on the need in cancer, where the driver is excessive versus the level of RANK ligand stimulation that goes on in osteoporosis.

Exploring multiple indications has become a standard practice for the industry. But Amgen has taken a risky approach by deploying trials for denosumab for different indications at the same time. With all the risk that comes with large, late-stage

DANSEY: We followed the science. The biology in the two—and potentially three—areas is so compelling that it would be a disservice if you didn't go down these roads.

SAN MARTIN: The main reason is the beauty of this discovery. It's so unique to have a target therapeutic for two conditions that are driven by the same cell and the same mechanism and the same pathway—and we had the perfect therapeutic for that target. Obviously, it was a big decision, but a good one.

So why such big trials? At least in oncology, aren't smaller trials the norm?

DANSEY: The reason these trials are big is because we need to be sure that the results are correct—and the bigger the trial, the more sure you are that you've got something real. Also, the bigger the trial, the more safety information you have. To convince the world and regulatory authorities, you need this type of trial size.

For the oncology program, we decided to conduct head-to-head clinical trials. Our studies are direct comparisons to Zometa, and examined fracture rates and other information in advanced cancer. We already have Phase II data that shows good outcomes, and we consistently see similar effects and superiority in terms of preventing the breakdown of bone.

The upside to that, of course, is that when you finish big trials, you end up with very robust and rich data. In advanced cancer, that's not a common thing to do. In osteoporosis, it's a little more common.

SAN MARTIN: We did what we needed to do. This is one of the last studies you can do placebo control with people with osteoporosis because you already have a number of drugs approved and it will become very difficult to continue doing three years of placebo-controlled studies when you have a good number of therapies already approved for this condition. So we ended up doing three years because the regulatory requirement for efficacy is to prove that the drug prevents fractures over a period of at least three years. And we want to demonstrate not only prevention of the spine fracture, which is the more common fracture, but also the hip fracture, which is a more dramatic clinical event in osteoporosis.

In the case of oncology, you also aim to prevent clinical events related to the bone metastasis, not just improve a surrogate marker. So you want, say, less people that have been treated with denosumab to experience a given skeletal event compared with the controlled group. And it takes a lot of people to be able to demonstrate that.

In the future, the approach to drug development through researching targeted pathways, and then developing a medicine for that target, will help to minimize the number of patients needed for clinical trials. But for right now, this is what it is. You need to expose a large number of patients for a long period of time so you can understand how the drug will act in real life when it is approved. Hopefully, the overall story of denosumab will make the scientific community and the biotech and pharma companies more able to efficiently develop drugs.

Given the environment at FDA, have you changed the way you have thought about safety?

DANSEY: You're quite right, things do change. But we are a data-driven, science-based company, and we design and execute clinical trials to the highest standard we can with the right assumptions on the front end, such that we have data to bring to the regulatory authorities. So I think the trials we are doing are the right trials to have done. And when all is said and done, the data we present will define the safety profile of the molecule.

SAN MARTIN: From the therapeutic standpoint, this is a great question. The safety concern for the osteoporosis patient population is very small, and I think the FDA will be very sharp when looking at the safety profile of denosumab. But that is the beauty of this targeted therapeutic—you don't see any off-target effects and you can easily predict the safety profile.

Many analysts hinge their sales predictions on the expected high cost of the biologic. How will you deal with pricing concerns?

DANSEY: We're completely aware that those sorts of issues need to be addressed, and we've got plans in place.

SAN MARTIN: We're aiming to have a better drug. So cost effectiveness and health economics play a role. We're aiming to make denosumab the gold standard for osteoporosis treatment. That's the vision we have, and Roger has the same for oncology. When you do drug development, you just aim to develop the best possible medicine for people; that's the way we want to go.

When you have a drug that is definitely better, the cost/benefit ratio changes. But it's a very complicated issue. Ten years ago, no one would have any question that if you had a better drug they'd pay for it—and 10 years from now we may be in a different place.

People are looking at this drug as the next "it" drug for Amgen. How does that pressure manifest itself?

SAN MARTIN: I do yoga (laughs). No seriously, we're not feeling the pressures of making sure this is going to be a blockbuster today. I'm just excited about completing the clinical program and writing a chapter in the story of drug development that will be unique. If we do this right, Amgen's future and the patients' future will come together.

DANSEY: It's not too often that you get this kind of opportunity. I mean, this quality of molecule just doesn't come around all too frequently. We feel very privileged. As far as pressure? We don't feel it, we are in the best possible place to be.

The Misinformation Maze: Navigating Public Health in the Digital Age

March 11th 2025Jennifer Butler, chief commercial officer of Pleio, discusses misinformation's threat to public health, where patients are turning for trustworthy health information, the industry's pivot to peer-to-patient strategies to educate patients, and more.

Navigating Distrust: Pharma in the Age of Social Media

February 18th 2025Ian Baer, Founder and CEO of Sooth, discusses how the growing distrust in social media will impact industry marketing strategies and the relationships between pharmaceutical companies and the patients they aim to serve. He also explains dark social, how to combat misinformation, closing the trust gap, and more.