ACP’s Drug Cost Paper Ignores Economic Reality

The American College of Physicians chimed in on the debate surrounding prescription drug costs, offering its views for stemming the escalation. Ed Schoonveld offers a deep dive into the positions taken.

Biotechnology and gene therapies offer advances in medical science with lifesaving solutions, but also force trade-offs with affordability. It is important that the physician community gets more engaged in helping evaluate what constitutes value to patients, as health insurance companies impose sometimes very strict coverage limitations for new treatments.

Providing a view of the issue of rising drug costs, plus specific positions and recommendations for government action, the American College of Physicians (ACP) published a position paper on March 29 titled “Stemming the Escalating Cost of Prescription Drugs: A Position Paper of the College of the American College of Physicians.”

A number of reactions have already been posted, but let’s try to dive a bit deeper into the rationale and relevance of the arguments in the context of getting to some solutions. Some of the recommendations make a lot of sense, others less so.

U.S. spending in a global context

The paper states that the United States has the highest per capita spending on drugs in comparison with other OECD (Organization for Economic Co-operation and Development) countries. This is true, but the same is true for many other categories of products, as U.S. per capita income is also much higher than in other OECD markets.

The pharmaceutical share of healthcare expenses for drugs is essentially similar between the United States, Canada and the three largest EU markets. Higher U.S. per capita spending on healthcare and drugs is primarily linked to higher average salaries, rather than indicating that drugs or medical services are overpriced. Actually, physician incomes are much higher in the United States than anywhere else, which is probably one of the direct reasons why it is more expensive to bring drugs to market in this country, given the large number of medical/clinical activities that are needed to gain approval from FDA and managed care organizations (MCOs).

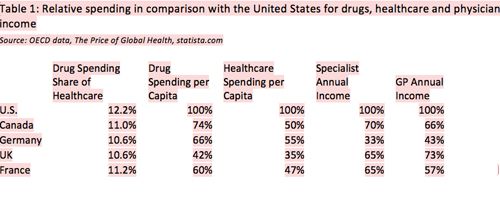

Table 1 provides more detail on spending in Canada and the three largest EU markets in comparison with the United States. Main observations from this analysis:

- Drug spending per capita is ranging from 40% to 74% of that in the United States, but overall healthcare spending is ranging from 35% to 55% of the U.S. level, a clearly larger difference. U.S. healthcare cost per capita is double of that of Canada, while drug spending is only about 35% higher.

- Specialist and GP incomes are drastically lower in Canada and Europe in comparison with the United States; specialist incomes range from 33% to 65%, and GP incomes range from 43% to 73% of their U.S. colleagues.

Conclusion: Drug prices are not inconsistent with cost differences for general healthcare and, as a large part of that, physician fees. Since drug spending is only 12% of healthcare spending and the cost differences are similar, we need to take a broader perspective on cost containment than just focusing on drugs.

Impact of drug cost on patients

The paper states that in 2012 approximately 18% of retail drugs were paid out of pocket by patients. The actual number is likely to be lower in 2016 because of the introduction of the Affordable Care Act. However, we also know that the co-pay and co-insurance rates that health insurance companies pass on to patients have gone up substantially during recent years.

Medicare patients pay 20% of their healthcare bill, whether physician fees, hospital charges or pharmaceutical cost. That is a heavy burden and we need a stronger safety net for patients, so that they don’t have to go into bankruptcy over healthcare. Many of us will get emotional thinking about a loved one having a devastating disease, let alone the financial devastation of funding the treatment that comes on top of that. This is where insurance needs to offer a solution.

Pharmaceutical companies have introduced affordability-based compassionate programs to help pay for drug cost. In addition, many companies have introduced co-pay offset programs or coupons to help contain patient cost for innovative drugs. For Medicare patients, these programs are unfortunately forbidden by law, just as physicians are not allowed to lower their fees for Medicare patients to ease the 20% co-payment requirement. Pharmacy benefit managers (PBMs) and MCOs are also resisting the use of coupons, which conflict with their cost management practices (i.e., driving prescriptions to drugs that produce the highest rebates).

Conclusion: Healthcare costs, whether through lack of insurance or high co-pays, are a large problem for patients. It is important to jointly look for solutions, but simply blaming the pharmaceutical industry for the cost of scientific advancement may not be all that helpful.

ACP recommendations

The paper states, “The American College of Physicians (ACP) supports policies and proposals that give patients the best available information and access to prescription medications at the lowest cost possible, while acknowledging the need for a strong pharmaceutical market that fosters investment in and development of new treatments.” This statement is very reasonable with respect to the focus on patient need and a strong market for new treatments. Cost is, of course, a constraint, but singling out pharmaceuticals, which represent only 12% of healthcare cost, is simply irrational and not in the interest of patients.

The paper includes seven recommendations in areas of transparency, government controls, novel approaches toward value and ensuring patients access to treatments they need. At first glance, most of them seem reasonable. Unfortunately, many of them are really just populist sound bites and don’t make a lot of sense in terms of actually solving the problem.

Transparency in pricing, cost and comparative value of all pharmaceuticals

Not having a full understanding of the price and underlying cost of a product is a broader healthcare issue. A hospital or physician invoice usually states the official rate and the agreed-upon maximum charge, which the insurance carrier pays. In many cases, the paid maximum rate is only a small fraction of the listed rate. Health insurance companies have many provider network agreements, which give them substantial discounts on the official rate. One of the benefits of healthcare insurance is the ability to benefit from these negotiated rates.

Transparency in pricing and cost of pharmaceutical products seems like a laudable goal, but just like with medical services, it will not change anything. Eliminating confidentiality of deals, whether for drugs or medical services, reduces competition. Drug companies will hesitate to give higher discounts in exchange for a better formulary position if the terms are publically disclosed. Even in Europe, where transparency of information is one of the central principles, the German government is moving toward confidential drug-pricing agreements, as already in place in France, because the government is well aware that it can get a better deal that way.

The inclusion of “transparency in value” is interesting and important. Unfortunately, there is no real mention of value communication in the rest of the paper. Particularly in today’s environment, where PBMs and MCOs are frequently instituting strict prior authorizations and high patient co-payments, physicians and patients need to be well informed of the value of treatments available and the reason for rejection of approval for a prescribed drug. Pharmaceutical companies are so regulated and restricted in their communication to the public, that we only see imagery, such as bathtubs, and an endless list of ever-occurring side effects. In the age of the Internet, where general medical information is overwhelmingly available, this seems very outdated.

Research and development cost

While the cost of R&D is hardly a compelling argument for a patient who needs to pay the co-payment imposed on him or her, it is indeed a part of the complex economics of drug development. The ACP states that other researchers challenge the $2.6 billion Tufts estimate of the cost of drug development. Particularly, it challenges the cost of capital because it was compared to bond interest rates of 1% to 5%. Basing cost of capital only on the basis of bonds, rather than company equity that is at much higher risk and requires a much higher, market-driven return is simply ignorant. Furthermore, there are also estimates of a higher cost of R&D, including an analysis by Forbes that puts actual cost of drug R&D between $4 billion and $11 billion, based on a review of actual R&D investments and drug launches for the top pharmaceutical companies.

Whatever the real cost of drug development is, it does not simply translate to what constitutes a reasonable drug price. Therefore, the discussion is not that helpful. A much more important consideration is the active and competitive investment market for drugs. In today’s environment, there are almost always multiple competing drugs in development with a similar mechanism of action. The interest in investing in these financially risky programs is driven by the estimated return on investment. The expected price, five years or so before launch, drives the viability of a drug development option. Relatively high prices attract more innovation, and competitiveness in the market will ultimately result in net price reductions through negotiations with MCOs and PBMs. Introduction of generics or biosimilars at patent expiration will subsequently make the innovation available for generations to come at only marginal cost. The issue is whether (or how) government intervention will ultimately benefit the patient or will just create another obstacle to innovation and eliminate one of the last remaining competitive U.S. industries. Fostering competition has always been the American way of ensuring consumer choice and fair pricing. The drug industry is still highly fragmented and characterized by intense competition, much more so than the health insurance industry, which large PBMs and MCOs increasingly dominate.

Quality-adjusted life years

The ACP supports the use of quality-adjusted life years (QALYs) in research funded by the Patient-Centered Outcomes Research Institute (PCORI). While quality-of-life considerations are important in assessing the value of a medical or drug treatment, many pitfalls exist in the way they are adopted in some countries for cost-effectiveness calculations

- The QALY metric is considered too theoretical and lacks an intuitive connection with value. Specific clinical outcomes are much more meaningful to physicians, patients and payers. On this basis, most payer systems around the world evaluate drugs on their tangible clinical and humanistic patient benefits, rather than QALY-related criteria.

- The only practical way that coverage considerations use the metric is through a limit on the cost per QALY, as used by the National Institute for Health and Care Excellence (NICE) in England and Wales. NICE uses a per-QALY cutoff between 20,000 pounds (about $29,000) and 30,000 pounds ($43,000) for coverage- and drug-funding recommendations. Many oncology drugs, in particular, don’t qualify under these criteria and have been funded through a separate Cancer Drug Fund because the government faced considerable public upset over the large number of coverage rejections. Over the past four years, a debate in the UK focused on creating more flexible cost-effectiveness criteria through the incorporation of societal value as a parameter. Particularly the elderly took offence to this equivalent of the much debated U.S. death panel discussions, and the proposal was ultimately rejected after a public hearing.

- True value of new drugs is often only established after a number of years of prescribing and the FDA approval of additional indications. In cancer, drugs are frequently launched in later-stage treatments, because it is deemed unethical to use these drugs in an earlier setting, even in trials, without experience-based confidence in their likely performance in an earlier treatment setting, where other good options are available. Also, the FDA-mandated randomized controlled clinical trial setting often does not allow for demonstration of real-life value to patients. Rejecting drugs at time of launch over lack of cost-effectiveness evidence would block many valuable innovations, irrespective of their actual cost-effectiveness. For this reason, even most government-controlled payer systems do not use this methodology for pricing and reimbursement decision making.

- Most U.S. payers are literally shortsighted because they tend to judge the value over no more than a two-to-three-year time horizon. On top of that, PBMs and Medicare Part D plans are managing only drug expenses and will not benefit from any medical cost offsets, thus making cost-per-QALY evaluations of only theoretical interest to them unless they are otherwise motivated or mandated to provide coverage.

Reimportation

Allowing reimportation from other countries is seemingly a solution to bring lower-cost pharmaceuticals to the United States. Besides the considerable safety concerns over counterfeit drugs, there are other reasons reimportation will not help bring lower-cost healthcare to U.S. patients. Allowing reimportation will force pharmaceutical companies to raise prices or discontinue supplying to countries with incomes that are lower than the United States. Average U.S. per capita income is about 50% higher than in Europe. Raising European prices to U.S. levels will lift them above affordability limits and use will naturally go down. As a result of drastically reduced international sales volumes, prices in the United States will actually have to go up. For a more detailed explanation of this phenomenon see “Clinton on Drug-Pricing Warpath: Populism, Real Problem or Both?”

CMS negotiation authority

It remains politically attractive to argue for a strong single-payer system and Center for Medicare & Medicaid Services (CMS) negotiation authority, even though actual experience of management of Medicare Part D programs by private MCOs has proven very effective and competitive. It makes much more sense to build on the success of Medicare Part D by bringing more of the traditional Medicare coverage under private MCO management through stronger incentives of Medicare Advantage programs, which combine inpatient (Medicare Part A), physician outpatient services (Medicare Part B) and self-administered retail prescription drugs (Medicare Part D) into one competitively managed program with multiple patient choices. A strong advantage of doing so is to create better incentives for MCOs to take a more holistic perspective on treatment value without a limited focus only on drug cost, which is one of the drawbacks of the Medicare Part D program.

Value-based decision making

It does make sense to look into ways to allow and encourage innovative agreements that support patient value and overcome many of the existing hurdles in doing so. Many government controls, such as best-pricing laws, have an unintended side effect of choking competition and engaging in agreements that are intended to demonstrate long-term value in treatment practice. Indication-based pricing and outcomes-based contracting or risk-sharing agreements are under much discussion, but generally considered unviable because of government price regulations. Any initiative to resolve this issue will require willing government participation.

Patient co-payments

The ACP position is that patient co-payments and restrictions should not be set at a level that imposes a substantial economic barrier to enrollees obtaining needed medications. Particularly in light of recent trends in tightening restrictions, it would make sense to take this a step further and to ensure full transparency over the reasons for frequent coverage rejections for patients.

Conclusion

The ACP position paper on the escalating cost of prescription drugs has some valuable ideas, but also many flaws that will not help resolve patient access and affordability issues for prescription drugs. There is still a lot of misunderstanding related to the rather complex topic of the drug development process and its economics. We need a more intense dialog between the various parties to resolve this. In an age of sound bites, this is not easy, but it is the only way in which a long-term viable solution can be achieved. If we don’t, patients will be the ultimate victims.

Ed Schoonveld is Managing Principal and leader of the Market Access & Pricing practice at ZS Associates. He can be reached at ed.schoonveld@zsassociates.com.

FDA Outlines Updated Requirement for Placebo-Controlled Trials in Vaccine Research

May 21st 2025In an article recently published by The New England Journal of Medicine, FDA higher-ups Vinay Prasad, MD, MPH; and Martin A. Makary, MD, MPH, wrote that any new COVID-19 vaccine must now be evaluated in placebo-controlled studies.

Addressing Disparities in Psoriasis Trials: Takeda's Strategies for Inclusivity in Clinical Research

April 14th 2025LaShell Robinson, Head of Global Feasibility and Trial Equity at Takeda, speaks about the company's strategies to engage patients in underrepresented populations in its phase III psoriasis trials.

Beyond the Prescription: Pharma's Role in Digital Health Conversations

April 1st 2025Join us for an insightful conversation with Jennifer Harakal, Head of Regulatory Affairs at Canopy Life Sciences, as we unpack the evolving intersection of social media and healthcare decisions. Discover how pharmaceutical companies can navigate regulatory challenges while meaningfully engaging with consumers in digital spaces. Jennifer shares expert strategies for responsible marketing, working with influencers, and creating educational content that bridges the gap between patients and healthcare providers. A must-listen for pharma marketers looking to build trust and compliance in today's social media landscape.