Blockbuster 2.0: Eight Ways to Follow that Leader

Pharmaceutical Executive

What can companies do for an encore when their own blockbuster product is threatened by branded or generic competitors?

Over the past decade, many industry journalists, analysts, and consultants presumed that specialty markets, pricing pressures, and pharmacogenetic testing would kill off billion-dollar products. However-to paraphrase Mark Twain-reports of the death of the blockbuster have been widely exaggerated.

Contrary to popular belief, the blockbuster model is alive and well. Despite a specialty market and intense pricing pressure, Gilead Science’s hepatitis C virus (HCV) anti-viral Sovaldi soared to an historic $10 billion launch last year. Evaluate Pharma projects that sales of Sovaldi and its combination product Harvoni will exceed $15 billion in 2015, surpassing the record annual sales of the cholesterol king Lipitor, the best-selling agent of all time. Even while entering a so-called “niche market” limited to HER+ test expressers with metastatic breast cancer, Roche’s Herceptin has become a $5 billion blockbuster. Currently, there are more than 50 drugs with annual sales exceeding the blockbuster level of $1 billion in global annual sales. According to Thomson Reuters, there are 11 more projected blockbusters launching in 2015, including Bristol-Myers Squibb’s cancer agent Opdivo and Regeneron/Sanofi’s cholesterol agent Praluent.

Ironically, pharmaceutical companies’ bigger challenge has not been finding but following blockbusters. What can these companies do for an encore? How can companies successfully follow their own blockbusters when

threatened by rivals’ brands or generic competitors, either before or after patent expiry? Pfizer’s well-documented struggles to replace its blockbuster Lipitor highlight the immense challenges that many companies face as they pursue “Blockbuster 2.0.” Pfizer tried numerous strategies to replace or extend the patent life of Lipitor, including combining it with the developmental HDL-raising compound atorvastatin, but ultimately failed. GlaxoSmithKline with its respiratory juggernaut Advair/Seretide and Sanofi with its gold standard insulin Lantus are among the many companies currently facing this predicament.

There are many reasons why companies fail to follow a blockbuster with a Blockbuster 2.0. First and foremost, a product has become a blockbuster because it is so well received by market stakeholders, especially providers and patients. It can be very challenging to improve upon the gold standard. Providers and patients trust and rely on the product and often resist switching. For many doctors, prescribing a blockbuster becomes habitual. Payers may have contractual arrangements or financial incentives such as rebates, discounts, or tenders which restrict switching from the blockbuster agent. Branded or generic competitors may offer better or lower-priced alternatives.

Strategies for sequel

A number of pharmaceutical companies however, have demonstrated effective approaches to remedy this situation. Here are eight strategies for following a company’s own blockbuster:

Conversion: The most commonly pursued approach is to convert providers and patients into users of the company’s next generation blockbuster. The classic example of this strategy is AstraZeneca’s switch from its $6 billion blockbuster heartburn agent Prilosec to Nexium, a closely-related stereoisomer. According to a 2002 Wall Street Journal report, AZ initiated the “Shark-Fin Project” seven years before the proton-pump inhibitor Prilosec was scheduled to go off-patent. The internal team identified numerous ways to convert Prilosec users to Nexium believers, including conducting head-to-head studies of the two products demonstrating Nexium’s better results in gastro-esophageal reflux disease (GERD); legal and regulatory activities to protect intellectual property rights; an aggressive advertising campaign to switch “the purple pill” positioning from Prilosec to Nexium; and a massive direct-to-consumer marketing campaign. As a result of this highly controversial approach, AZ overcame branded rivals, prevented generic competition, and successfully established Nexium as a $6 billion successor heartburn drug.

Sanofi is currently borrowing a page from AZ’s Blockbuster 2.0 playbook as it seeks to fend off branded and generic rivals for its market-leading basal insulin Lantus. The company is seeking to switch diabetic patients to Toujeo, its follow-on “next generation of basal insulin.” The company has conducted several head-to-head trials demonstrating the advantages of Toujeo, featuring a more flexible and sustained dosing profile with reduced hypoglycemic episodes and weight gain. The company is also taking legal actions against potential biosimilar competitors and aggressively promoting the product. Despite these steps, analysts expect Toujeo to generate only a small fraction of Lantus’ $8 billion in annual sales. To further offset Lantus’ expected sales losses to competitors, Sanofi has broadened its diabetes franchise with new products, including developing LixiLan, a combination of Lantus with its new GLP-1 agent Lyxumia, and adding MannKind’s inhaled insulin Afrezza.

Combinations: Gilead is an expert in combining products to ensure follow-on blockbuster success. The company built its HIV/AIDS franchise with its two-fixed dosed combination blockbuster Truvada. It followed that act with the three-dose combination Blockbuster 2.0 Atriplia, which replaced its predecessor as the world’s best-selling HIV therapy. Gilead next launched Stribild, a four-ingredient single-tablet regimen, which has already achieved blockbuster status. The company is applying a similar strategy to its HCV franchise, starting with the mega-blockbuster Sovaldi followed by Harvoni, a combination of Sovaldi and the NS5A inhibitor ledipasvir. Harvoni’s sales have already eclipsed the huge quarterly sales of the original molecule Sovaldi.

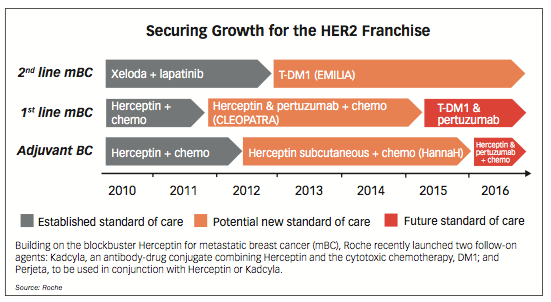

Transition: Building on market entrenchment and physician familiarity of Herceptin for metastatic breast cancer, Roche launched two follow-on agents: Kadcyla (trastuzumab emtansine, or T-DM1), an antibody-drug conjugate that combines the HER2 inhibition of trastuzumab (the active ingredient

found in Herceptin), and the cytotoxic chemotherapy, DM1; and Perjeta, which can be used in conjunction with Herceptin or Kadcyla. These two follow-on agents and a potential bundling of Roche’s HER2 breast cancer drugs represent a critical anti-biosimilar defense strategy for Roche. As shown in the chart, Roche is encouraging oncologists prior to the launch of Herceptin biosimilars to transition to using the two new agents instead of Herceptin.

Prioritization: Some companies sequence next-in-class agents to follow use of the original blockbuster. In analysts’ meetings, Celgene has prioritized use of its original blockbuster Revlimid as a first-line multiple myeloma medicine followed by its other agents Thalomid and/or Pomalyst. Although Pomalyst is a newer, more potent follow-on agent, Celgene wants doctors to prescribe Revlimid first since Pomalyst is unlikely to achieve the blockbuster sales of its predecessor.

Indications: AbbVie’s Humira is the poster child for maintaining the high sales of Blockbuster 1.0 by leveraging eight different indications, including rheumatoid arthritis, psoriasis, and Crohn’s disease. In 2010, Humira US Commercial Leader Jeffrey Stewart was quoted as saying, “We’re the only self-injectable TNF (tumor necrosis factor) inhibitor in the category that works across the bones, skin, and the gut.” More recently, Elaine Sorg, VP, US Immunology at AbbVie, said “Humira is the only biologic with such breadth of indications.” Humira’s U.S. product label literally lists these eight indications as if listing blockbuster versions 1.1, 1.2, 1.3, etc. Humira essentially offers “a pipeline in a product,” to paraphrase AbbVie CEO Rick Gonzalez. Despite being launched 11 years ago, Humira has become the world’s best-selling drug with projected 2015 sales exceeding $13 billion.

Acquisition: Failing to find a TNF blocker to succeed Humira, AbbVie was forced to go outside the rheumatology area. The company recently acquired Pharmacyclics and its oncology product Imbruvica (ibrutinib), the first in a class of medicines called Bruton tyrosine kinase (BTK) inhibitors. AbbVie has publicly committed to its pipeline-in-pill strategy with Imbruvica, which already has four of its own FDA-approved indications.

Acquisition of potential Blockbuster 2.0 products or complementary agents in the same therapeutic area is an approach used by many companies. For years, AZ has marketed the $3.5 billion respiratory blockbuster Symbicort, an inhaled corticosteroid/ long-acting beta agonist (ICS/LABA). As competitors broadened their inhaled respiratory portfolios, AZ responded by making acquisitions to fill the gaps in its respiratory portfolio. In 2013, AZ purchased Pearl Therapeutics, whose metered dose inhaler (MDI) development pipeline included a long-acting muscarinic antagonist (LAMA), a LAMA/LABA combination, and a triple combination (ICS/LABA/LAMA) for chronic obstructive pulmonary disease (COPD). Alongside Symbicort, this provided AZ with a full portfolio, with the triple being eyed as a blockbuster on its own. Because the products would not launch for a few years, AZ also picked up the respiratory portfolio of Almirall and its US partner Actavis, giving AZ an instant boost from LAMA aclidinium and LAMA/LABA aclidinium/formoterol in Europe. The Almirall portfolio also contains other products, which, when paired with AZ’s novel agents in R&D, could provide future respiratory blockbusters for AZ.

Litigation: Nearly all companies seek to protect and/or extend the life of their original blockbuster. AbbVie has been defending over 200 patents for Humira prior to its 2016 patent expiry and has sought an injunction to block the European Medicines Agency from releasing detailed clinical trial data. Similarly, Celgene has actively sought to maintain exclusivity for Revlimid beyond its patent expiry in 2019. Given that Revlimid represents the majority of its sales and profits, Celgene has built a patent fort to protect this drug from generic rivals.

Hybridization: Some companies seek to use several of these strategies simultaneously. GSK created a new once-daily ICS/LABA (Breo/Relvar) to convert users from its blockbuster Advair/ Seretide (fluticasone/salmeterol) business, which represents over a quarter of the company’s total pharmaceutical revenues. Recognizing the upcoming fragmentation in the ICS/LABA class and that Breo/Relvar would not be able to replace all of the revenues delivered by Advair, GSK created a Blockbuster 2.0 portfolio-all produced in the Ellipta inhaler, which is an optimized version of its popular but older Diskus inhaler. GSK acquired a large share in Theravance, partnering with the company to pool R&D assets and to ensure rapid development success.

GSK has worked to develop the broadest portfolio in the respiratory field, offered in a common device platform, that includes the first LAMA/LABA to the market in the US; a triple combination that could be first to market; and a novel ICS/LAMA combination targeted for a new indication called asthma COPD overlap syndrome. GSK also used litigation in Europe to challenge Sandoz as it brought its own version of salmeterol/ fluticasone in a purple Diskus-like inhaler to the market. With its landmark studies SUMMIT and SALFORD, GSK is working to evolve the respiratory market, possibly carving out cardiovascular mortality as a new indication, and to establish the healthcare resource utilization benefits of once-daily treatment with the Ellipta inhaler.

Best practices

There are at least three key learnings from companies who have been challenged to find a Blockbuster 2.0:

Accept the challenge: Pharma companies and professionals should not underestimate the difficulty of replacing a billion- dollar agent. As these examples demonstrate, many companies have failed to find a successful solution to the Blockbuster 2.0 predicament.

Start planning early: Branded rivals will target a potential therapeutic class blockbuster as soon as they feel threatened, often as early as developmental Phase II or III, and may conduct counter-launches in the pre-launch period. Similarly, generic companies will seek to acquire a potential blockbuster’s active pharmaceutical ingredient in Phase III and no later than at launch in order to initiate their own counter-strategies. Consequently, companies must initiate a Blockbuster 2.0 multi-disciplinary team or task force as soon as they recognize their first compound’s blockbuster sales potential. This internal team should consist of executive management, marketing, clinical discovery and development, medical affairs, legal, regulatory, manufacturing, competitive intelligence, market research, business development, and other cross-functional professionals as appropriate.

Use multiple strategies: The internal team should evaluate the potential Blockbuster 2.0 strategies listed here and others to find the right mix of options and actions. As Pfizer and other companies can attest, Blockbuster 2.0 failure can be a very painful lesson.

Stan Bernard, MD, MBA, is President of Bernard Associates, LLC, a global pharmaceutical industry competition consulting firm. He can be reached at SBernardMD@BernardAssociatesLLC.com. Janet Wells, MBA, is a Senior Associate at Bernard Associates. She can be reached at Janet.Wells@BernardAssociates LLC.com.