Compliance: Getting Those Ducks in a Row

Pharma must coordinate the efforts of medical, legal, HR, global partners and many other players in the regulatory compliance space to keep itself afloat in choppy seas.

Now more than ever, regulatory compliance is becoming strategically significant for Big Pharma. Compliance now requires coordination not only across companies on a global level, but across departments, including regulatory, legal, marketing, information services, human resources, and more. The burden of compliance for industry is underscored in the Office of the Inspector General's 2012 fiscal year projections; OIG's involvement in healthcare fraud and abuse activities led to a recovery of $3.8 billion in fiscal-year 2010, exceeding the target goal of $3.4 billion. It's all hands on deck to create an industry of trust and transparency, all built around a "compliance culture." To help companies plot a new course, Pharm Exec surveys the landscape and highlights current trends that promise to raise the stakes on compliance even further in the year ahead. The key point is to discover what it takes to not only observe the letter of the law, but to stay one step ahead of it—all from a global perspective.

Getty Images / Jason Edwards

"Proactive compliance is more than simple data collection," says the new white paper "Federal and State Sunshine Act Compliance Readiness," by Alliance Life Sciences. "It is about comprehensively protecting and enabling your business to mitigate risk and address regulatory requirements, while increasing efficiencies and reducing cost." Certainly, advice such as this is applicable across the board, concerning compliance around the Sunshine Act, off-label marketing, and other compliance challenges today.

"Inside the pharmaceutical industry, compliance has grown. Compliance needs to assist the business units in operationalizing the legal and regulatory requirements and still have the business be able to do what it has to do," says John Oroho, executive vice president of Porzio Pharmaceutical Services, a subsidiary of the law firm Porzio, Bromberg, and Newman. Porzio Pharmaceutical Services advises companies on how to comply with current regulations in the industry. "Compliance officers have taken a more significant role in companies, and the compliance departments have gotten bigger because it is necessary for companies not only to understand what the requirements are and to operationalize them, but then you've got to show them that you are adhering to those best practices and adhering to the regulatory requirements," he says.

The Sun(shine Act) Will Come Out Tomorrow

By this point, pharma should have all its ducks in a row when it comes to gearing up for the Sunshine Act. However, even though pharma was initially required to begin reporting physician payments as the law stipulates by Jan. 1, there may still be some pitfalls to avoid.

"When the Sunshine Act was proposed, pharma supported it because it was going to give some uniformity to what had been a hodgepodge of different requirements state to state," explains Oroho. This means that as of Jan. 1 pharma would have had to track financial interactions with physicians and teaching hospitals. And on March 31, 2013, the first report of these interactions (anything over $10) will have to be reported by pharma to Health and Human Services (HHS). HHS then has until September 30, 2013, to make that information available to the public in an easy-to-use, searchable website.

Now for the bad news: the specifics on how drug and device makers are supposed to submit info on payments to physicians—specifics that were supposed to be delivered by the Centers for Medicare and Medicaid Services (CMS) on October 1, 2011—were not released until December 15, 2011. The October 2011 deadline would have given pharma companies 90 days to digest the specifics of the regulations before they began tracking spending information on Jan. 1; specifics that, one could argue, are essential to know and understand in order to know exactly what to start keeping track of.

In light of the passing of the October 2011 deadline and the continuing absence of specifics from CMS and HHS, a letter was drafted from BIO, PhRMA, Consumers Union, AdvaMed, Community Catalyst, and Pew Health Group to HHS on October 25, 2011, requesting that the Jan. 1 deadline be extended.

"Delays in establishing procedures for the submission and public reporting of the required information will make it increasingly challenging for manufacturers to know whether they are meeting their statutory obligation as they begin to collect data in 2012. Given that Congress intended that industry have three months to complete implementation based on the government procedures following the October 1, 2011, statutory date to implement the new provisions, we request that a similar time period be permitted following establishment of final procedures for the submission and public reporting of 2012 information for companies to achieve full compliance," the letter reads. "An absence of established procedures could harm both the companies who are trying to comply with the law and the public who stands to benefit from increased transparency of these relationships."

The finally-released guidelines acknowledge the delay in this way: "Due to the timing of the publication of this notice ... a final rule will not be published in time for applicable manufacturers and applicable GPOs to begin collecting the information required ... on Jan. 1, as indicated in the statute. We will not require applicable manufacturers and GPOs to begin collecting the required information until after the publication of the final rule ... We seek comment on the amount of time [needed] following publication of the final rule in order to begin complying with the data collection requirements ... We are considering a preparation period of 90 days, since we believe this was the time period intended by Congress ... and [we] are requesting comments on whether that is a sufficient amount of time." Comments are being accepted through Feb. 17 of this year.

Clearly, Jan. 1 has come and gone, with the promised CMS guidelines turning up only weeks before the new year—and the show must go on. In the absence of timely guidelines, Oroho advises the Jiminy Cricket mentality: Let your conscience be your guide. "What you're trying to do with compliance is influence behavior so that people do it just because it's the right thing," he says. "If people are acting on a values-based proposition, rather than doing it so they don't get caught or penalized, you will have less improper behavior. I look at compliance as being the conscience of a company."

Silencing Off-Label Marketing: Profit Versus Information

Many times, physicians prescribe drugs for an indication other than the one on the label that has the FDA seal of approval. And patients come to rely on those drugs. The difficulty here lies in the fact that no matter how many physicians and patients swear by a drug's ability to improve health in some way, if it's not on the label, pharma marketing must stay mum. In the past, heavy fines have been imposed on pharma for off-label marketing, but compared to the profit to be made from off-label use, those fines can be just a drop in the bucket.

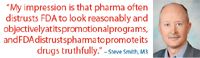

Some believe, however, that current FDA compliance regulations around marketing have all but eliminated the problem of off-label marketing—perhaps with some collateral damage in the form of the loss of other valuable information. Rather than offering up too much information in its marketing campaigns and being willing to accept the risk of subsequent fines, says Steve Smith, chief marketing officer for M3, pharma is often so afraid of saying the wrong thing that it may play it safe by preferring to say almost nothing at all.

"Every word that a pharmaceutical company prints or puts on a website or into a commercial is looked at by a brand manager, a brand team, a compliance team, a lawyer. And it is crafted down to the smallest word to make sure that nothing is said that will appear to be out of focus to the FDA," says Smith. "The regulatory scrutiny is amazing."

The issue, he says, is a lack of trust on both sides. "My impression is that pharma often distrusts FDA to look reasonably and objectively at its promotional programs, and FDA distrusts pharma to promote its drugs truthfully." And so pharma must navigate carefully to avoid sinking its own ship.

Because of the shakiness of this relationship, Smith maintains that any off-label marketing issues he's seen in pharma lately have been—rather than Big Pharma arrogantly going after profit despite potential penalties—unintentional slip-ups that sometimes result in FDA warning letters.

Other gray areas in off-label arise in dialogues between overzealous sales reps and physicians, Smith says. "It's odd to have a dialogue between two professionals where the reps have to say, 'Oops, I can't talk to you about that,' but that's actually what's supposed to happen," he says. "The sales people cannot talk about anything that's off-label, no matter how valuable that information is. So the companies aren't misrepresenting their products by talking about off-label indications, but then who is talking about those? The government is not funding education to tell the doctors about it, so who is? At the end of the day, you do have to ask the question: 'Where's the patient advocacy in this?'"

Admittedly, these regulations are in place for a reason, and pharma has certainly been guilty of pushing the envelope too far and abusing its marketing freedoms in the past. "Pharma gets beat on the head a lot, and we see bad news about them a lot. And they deserve much of it, because they're operating like any other business. They're operating because they have investors, and it's sad to say, but yes, they're operating for the bottom line. And they happen to do that in a place where people's health is more obviously on the line than in other industries." The danger, says Smith, lies in curbing vital information along with curbing promotional language—are we throwing the baby out with the bathwater?

"In the mid '90s, a top 10 pharma ran a nationwide education program in collaboration with the National Heart, Lung, and Blood Institute (NHLBI) that reached hundreds of thousands of physicians and allied healthcare practitioners, improving their knowledge and their treatment of asthma, when it had been clearly shown that doctors were not up on the times with how to treat asthma. And yes, they did it for promotional purposes, but it was a massively successful program from the educational side," says Smith. "So in the past, there have been both benefits and abuses. And with the regulations now, we don't get the benefits. We get a lot less benefits and a lot less abuses. We've trimmed off both ends."

Legislation: The Lay of the Land

There are several other laws and issues pharma must be aware of when it comes to regulatory compliance, including legislation such as the Best Price Rule (BP) and the Foreign Corrupt Practices Act (FCPA).

The Best Price Rule was intended to minimize drug manufacturers from overcharging Medicaid by giving beneficiaries the best discounts that other purchasers negotiated. But as Tony Chen, associate director of government pricing, and David Cesani, senior consultant, revenue contract management at Alliance Life Sciences told Pharm Exec:

The Dialogue Continues

"BP presents a unique challenge to manufacturers as actions to profit-maximize serve to decrease compliance with Centers for Medicare and Medicaid Services (CMS) and the Office of Inspector General (OIG) guidance. Not surprisingly, the OIG has recognized that 'manufacturers have a strong financial incentive to hide de facto pricing concessions to other purchasers to avoid passing on the same discounts to the states' in the form of higher rebates that would have been paid had manufacturers not inflated their BPs.

The details for the offenses typically include fraudulent price reporting based on omitting certain BP-setting transactions or mathematically derived methodologies to artificially inflate BP. In turn, 'whistleblowers' incentivized both morally and financially report these erroneous methodologies to the OIG, triggering increased investigative diligence.

With recent prosecutorial trends that seek to not only punish corporations through fines and corporate integrity agreements, but also to target individual corporate officers, the risks have never been higher for those responsible to correctly certify and report Best Price."

In addition to BP, pharma must carefully consider the implication of the Foreign Corrupt Practices Act. FCPA aims to prevent government officials from exploiting their positions to gain unfair commercial advantage. Essentially, the law states that it is an offense for a U.S. person, entity, and certain applicable foreign entities to make bribes or offer any inducement for the purpose of obtaining or retaining business with a U.S. firm. While FCPA applies to a wide range of industries, the OIG has begun more strongly focusing on its applicability to the pharma industry within the past five years.

"Physicians in Europe and in many companies outside of the U.S. are employees of state-owned hospitals or government facilities, so they could be considered government officials," explains Thomas Sullivan, president of CME company Rockpointe and editor of news website Policymed.com. The problem, says Sullivan, is that practices that pharma has always considered to be on the up-and-up—such as paying to fly physicians to educational meetings—can technically be interpreted as "bribery," even though there may never have been any deceitful intent. "For the most part, pharma is thinking, 'This is how we've always done it.' Now they're going to have to change their practices," he says.

For its part, the OIG has been ramping up efforts and cracking down when it comes to the FCPA and pharma. Why? "There's a lot of cooperation between governments now to settle these cases ... There could potentially be a lot of income generated for these kinds of payments back to the government," says Sullivan. "They've done the fraud and kickback rules in the U.S., but companies have introduced pretty serious compliance regulations, so they're going to run out of violations. They [the OIG] see this as the new frontier."

A New Era

By all accounts, the buzz is that pharma is not trying to push corruption under the rug or find loopholes in compliance laws. On the contrary, it seems the industry is going above and beyond to understand, comply with, and embrace compliance laws that can lead to a more ethically and financially beneficial way of doing business. In fact, it's not that rare today to find pharma using past scandals as springboards for change—not just paying settlements and putting compliance challenges out of sight and out of mind, but rather highlighting them and leveraging them as catalysts for change.

For example, when GlaxoSmithKline recently agreed to pay $3 billion to settle U.S. government civil and criminal investigations into its sales practices, the company used the publicity generated as a platform to announce newly stringent compliance and transparency policies. "This is a significant step toward resolving difficult, long-standing matters which do not reflect the company that we are today," Andrew Witty, chief executive officer of GSK, said in a statement. "In recent years, we have fundamentally changed our procedures for compliance, marketing, and selling in the U.S. to ensure that we operate with high standards of integrity and that we conduct our business openly and transparently."

Deirdre Connelly, president of North American pharmaceuticals at GSK, echoed those sentiments in a bylined column for Pharm Exec last April. "We do not sell chocolate or cars," she wrote. "We bring life-altering and life-saving medicines to patients. Society holds our interactions with our customers ... to a higher standard. We must ... create a framework and a mindset in which compliance with rules and regulations is not the ceiling, but the floor from which our organizations operate."

The Misinformation Maze: Navigating Public Health in the Digital Age

March 11th 2025Jennifer Butler, chief commercial officer of Pleio, discusses misinformation's threat to public health, where patients are turning for trustworthy health information, the industry's pivot to peer-to-patient strategies to educate patients, and more.

Navigating Distrust: Pharma in the Age of Social Media

February 18th 2025Ian Baer, Founder and CEO of Sooth, discusses how the growing distrust in social media will impact industry marketing strategies and the relationships between pharmaceutical companies and the patients they aim to serve. He also explains dark social, how to combat misinformation, closing the trust gap, and more.

Applying Porter’s Five Forces to Portfolio Management in Pharmaceutical R&D: A Strategic Roadmap

March 17th 2025The increasing costs and complexity of R&D in the pharmaceutical industry have necessitated the adoption of strategic portfolio management to optimize resource allocation and enhance competitive advantage.