12th Annual Pharm Exec 50

Who's taken this year's top spot? Find out in Pharm Exec's annual run-down of the world's Top 50 pharma companies.

Will the recent wave of megamergers and a slow revival of biotech financing be enough to counter a looming storm surge of patent expirations? US health reform is the next big game-changer, as companies seek a balance between earning profits and placatinga restive new breed of payers and the ever-expectant patient

The Pharm Exec 50 ranks the world's largest pharmaceutical companies by global sales of prescription drugs—a key indicator of market change. After last year's storm of activity, the 50 set a more placid pace, as major players worked on integrating blockbuster mergers and licked their wounds after the latest round of Phase III failures. Late-phase problems are nothing new, and drug candidates can come back from them, but there was something particularly heartbreaking about the recent crop of dead ends, given the huge unmet medical need associated with these therapies: Pfizer's Dimebon and Lilly's Semagacestat for Alzheimer's, Merck's vicriviroc for HIV, and Roche's ocrelizumab for rheumatoid arthritis, to name just a few.

Change was most visible on the macro level. The list of the top 10 companies was shaken up a bit, with Novartis passing Sanofi-Aventis to move into second place, and Merck jumping from seventh to fourth. It was also the first year the top company crossed the $50 billion mark in sales of prescription drugs—as Pfizer, fueled by its acquisition of Wyeth, grew from $45.4 billion in Rx sales to $58.5 billion. Meanwhile, consolidation in the ranks continues to place a premium on size and scale: This was the first year that it took $2 billion in Rx revenues to join the 50. As recently as 10 years ago, you could make the list with revenues of only $500 million.

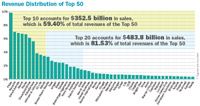

Revenue Distribution of Top 50

Overall, the 50 accounted for $593.4 billion in human prescription drug sales in 2010. That represents an increase of nearly 8 percent from 2009, when the total was $550.5 billion. But among the top 10, there was slightly better growth. This year's group grew its Rx revenues from $319.4 billion in fiscal 2009 to $352.5 last year—an increase of over 10 percent.

A good percentage of that growth was fueled by mergers and acquisitions. In addition to Pfizer and its 29 percent increase, big gainers included Merck (58 percent growth after its merger with Schering Plough) and Abbott (up nearly 28 percent in the wake of its acquisitions of Solvay and Piramal). But the biggest single-year bump came at a much smaller company: The Irish firm Warner Chilcott last year acquired the pharmaceutical business of Procter & Gamble, including the billion-dollar drug Actonel, and raised its Rx revenues a whopping 111 percent to $2.9 billion.

Global Pharma Sales by Region

Looming over the year—and the decade—is the shadow of US healthcare reform. Many in pharma feel they have dodged the bullet of new regulation and stand to gain as a projected 30 million previously uninsured Americans finally obtain insurance coverage for healthcare. But the Patient Protection and Affordable Care Act is not the end of the discussion—it's more like the beginning of an avalanche. The economic forces it sets in motion today will be playing out for payers, patients, providers, and pharma for the foreseeable future, changing the way care is delivered and paid for, creating numerous business threats, but, with luck, ending up with the possibility of getting a better alignment between helping the patient and earning a profit.

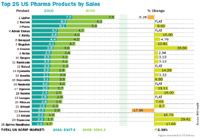

Top 25 US Pharma Products by Sales

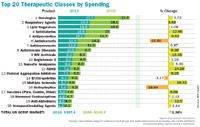

Top 20 Therapeutic Classes by Spending

Top 20 Therapeutic Classes by Prescriptions

Top 25 Corporations by U.S. Sales

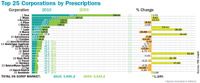

Top 25 Corporations by Prescriptions

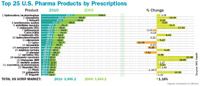

Top 25 U.S. Pharma Products by Prescriptions

Top US Patent Expiries

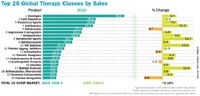

Top 20 Global Therapy Classes by Sales

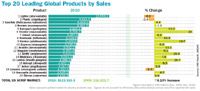

Top 20 Leading Global Products by Sales

The Top 10 Year In Review

1. Pfizer President and CEO Jeff Kindler retired, succeeded by Ian C. Read. George Lorch elected Non-Executive Chairman of the Board. Sutent approved in EU for treatment of pancreatic neuro-endocrine tumors. Launched Prevnar 13, a vaccine against 13 strains of pneumococcal diseases in infants and young children. Also has 118 products in the R&D pipeline and had 1,300 clinical trials in 2010.

2. Novartis Completed purchase of Alcon from Nestlé for $38.5 billion. Jonathan Symonds promoted to CFO. David Epstein replaced CEO Joe Jimenez as Division Head, Pharmaceuticals. Thirteen major pharmaceutical approvals in the US, Europe, and Japan, with 147 products in development. Tasigna was approved in the US, the EU, Japan, and Switzerland for patients with newly diagnosed Philadelphia chromosome-positive chronic myeloid leukemia (Ph+ CML), a form of blood cancer. Menveo (vaccine against meningococcal disease) launched in the US, EU, and parts of Latin America and Asia. Sandoz launched generic enoxaparin, its most successful launch to date, and acquired Oriel Therapeutics.

3. Sanofi-Aventis Initiated acquisition of Genzyme for $16.6 billion (completed in April) and finished acquisition of OTC company Chattem. Began collaboration programs with Harvard and Columbia Universities and a research alliance with Scripps Genomic Medicine. Jevtana approved in US for second-line treatment of metastatic hormone-refractory prostate cancer.

4. Merck Elected Kenneth Frazier CEO. Bought Inspire for $430 million. Rotateq vaccine awarded top honor at Prix Galien USA 2010. Merck BioVentures entered into an alliance with Parexel for biosimilar development. Signed commercialization agreement with Lundbeck for Sycrest and a letter of mutual intent with China's Sinopharm. Pipeline has more than 20 late-stage candidates. Licensed oral mTOR inhibitor for multiple cancers from Ariad. Oral hepatitis C protease inhibitor Boceprevir granted Priority Review status by FDA.

5. Roche Rituxan approved in US as first-line treatment for chronic lymphocytic leukemia (CLL) and relapsed/refractory CLL. Tarceva approved in US and EU for first-line treatment of non-small-cell lung cancer after chemotherapy. FDA rejected use of Avastin as a treatment for metastatic breast cancer; Roche has requested a hearing to appeal this decision. Daniel O'Day appointed COO of the Pharmaceuticals division. Alan Hippe named CFO. Jean-Jacques Garaud appointed Head of Roche Pharma Research and Early Development.

6. GlaxoSmithKline Benlysta (belimumab, the first new lupus treatment in 60 years) approved by FDA in March. Six products in total approved by US and EU; seven more filed with regulators. Malaria vaccine in Phase III trials in Africa, with 30 other late-stage assets. Julian Heslop retired as CFO, succeeded by Simon Dingemans. Patents for active ingredients in Seretide/Advair expired.

7. AstraZeneca Crestor substance patent upheld in US court. Approvals include Vimovo (naproxen/esomeprazole magnesium) in US and EU and Brilique (atherothrombotic event prevention) in EU. Kombiglyze XR, the only once-daily dose of DPP4/metformin, developed with Bristol-Myers Squibb, also approved in US. Nine molecules in Phase III trials or submitted for regulatory approval, with another 92 projects in development. Completed deal with Rigel for development of fostamatinib (rheumatoid arthritis).

8. Johnson & Johnson Completed tender offer for Crucell N.V. in February 2011; acquired 98.93 percent of shares. Products under regulatory review include: Rivaroxoban for stroke prevention in patients with atrial fibrillation (US), Telaprevir for hepatitis C (US and EU), Abiraterone acetate for metastatic advanced prostate (US and EU), and rilpivirine for HIV. Eight more candidates planned for regulatory submission from 2011 to 2013.

9. Eli Lilly Completed acquisition of Alnara and Avid Radiopharmaceuticals. Launched statin Livalo in the US with partner Kowa. Has 68 molecules in development. Several monoclonal antibodies for cancer in late-stage development. Phase III candidates include Necitumumab for non-small-cell lung cancer and Ramucirumab for metastatic breast and gastric cancers. Signed commercialization deal with Acrux for newly approved experimental testosterone solution Axiron.

10. Abbott The year was marked by acquisitions, including the pharmaceutical business of Solvay for $6.1 billion plus milestones, and Piramal Healthcare's Healthcare Solutions business, a leader in the Indian branded generics market, for $2.2 billion in cash, plus $1.6 billion in annual payments through 2014. Additional acquisitions included Advanced Medical Optics, STARLIMS Technologies (informatics), and the remaining shares of Facet Biotech.

About the Authors

Jerry Cacciotti is a Partner in Oliver Wyman's Health and Life Sciences Practice. He can be reached at Jerry.Cacciotti@oliverwyman.com

Patrick Clinton is Marketing Director in the Health & Life Sciences practice of Oliver Wyman. He can be reached at Patrick.Clinton@oliverwyman.com

Cell and Gene Therapy Check-in 2024

January 18th 2024Fran Gregory, VP of Emerging Therapies, Cardinal Health discusses her career, how both CAR-T therapies and personalization have been gaining momentum and what kind of progress we expect to see from them, some of the biggest hurdles facing their section of the industry, the importance of patient advocacy and so much more.