Code Orange

Pharmaceutical Executive

How will US healthcare reform affect drug pricing, revenue, and compliance?

Media coverage of the new health reform bill has hardened perceptions among political insiders as well as the public that it represents a giveaway to Big Pharma. There is an underlying grain of truth to the assertion that "more care for more people" will likely stimulate additional sales. But overall margins are likely to suffer as a consequence of higher mandated rebates for the expanded government programs, as well as the new "voluntary contributions" companies have agreed to make in order to shrink the Medicare Part D prescription "donut hole."

An effective internal strategy for managing the downsides of reform is equally, if not more, important than being on the right side of voter sentiment. Reform is ultimately not about good public relations, but about preserving profitability in a much more dynamic commercial environment controlled increasingly by a few lead payers with vast purchasing power.

Many Big Pharma companies are now booking charges against revenue in anticipation of the rebates fallout. In contrast to the expansion of insurance coverage—and the arrival of many new customers—these direct "revenue enhancers" aimed at pharma profits will roll out in the next few months. The impact varies among companies.

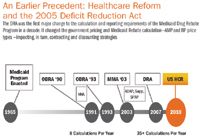

An Earlier Precedent: Healthcare Reform and the 2005 Deficit Reduction Act

Nevertheless, the fundamental truth is that pharma is already in hock to a drug price regime that is highly audited, over legislated, and tied up in yards of red tape. This is because the federal government has a proven model for getting the best price for drugs via rebates, discounts, and other tools across multiple programs. The new law raises the bar yet again in terms of complexity, and showcases government's continuing willingness to change these complex rules mid-game. It overturns well-established aspects of drug pricing and government rebate compliance, while creating new zones of regulatory intervention such as the annual "government programs market share fee," a possibly open-ended contribution that could grow in scale over time, and which launches in 2011.

The signal to industry is clear: Flexibility and scalability of response in processes, data and systems is paramount now and in the future. Given that healthcare reform (HCR), in essence, is more about improving access to healthcare and less about cost containment, it is reasonable to expect even more cost-saving mandates in the future if the spiraling cost of care does not slow down.

HCR requires some 20 different and major programmatic changes in how companies approach different aspects of their sales to the Medicaid, Medicare, PHS, and in some cases even commercial markets.

Key pricing, revenue and compliance provisions of HCR:

» Material increase in Medicaid drug rebate liability for branded, generics, and special categories of drugs resulting from higher required rebate percentage, expansion of rebate eligible programs, and narrowing of sales in the AMP definition

» Expanded 340B discount program with provisions dealing with price integrity, retroactive adjustments, and refunds for overpricing to eligible hospitals or facilities. Penalties for intentional overcharges

» New rule for transparency and public reporting of AMP and FUL "prices" for multiple-source drugs

» Manufacturer discounts of 50 percent on brand name drugs for certain Medicare Part D enrollees in the coverage gap

» An annual flat fee on pharmaceutical manufacturers beginning in 2011, to be allocated across the industry according to market share of utilization under Medicaid, Medicare Parts B and D, VA, and Tricare. The fee does not apply to companies with sales of branded pharmaceuticals of $5 million or less.

Survey Reveals Manufacturer Concerns

Last month, Model N ran the first industry-wide survey to assess how pharma companies are thinking about the strategic and operational implications of the new reform. The 2010 Healthcare Reform Threat Assessment survey launched as an online, invitation-only survey to more than 300 companies with revenues above $100 million a year, and with products in any or all of the traditional categories including branded, generic, specialty, or biological.

One key finding is that the survey companies believe, by a whopping margin of 87 percent, that the HCR bill enacted in March will have a greater or equal impact on future commercial strategies than the last big piece of federal health legislation, the 2005 Deficit Reduction Act (DRA), which introduced a drug benefit to the Medicare population. In fact, the DRA marked a turning point; five years later, industry is still evaluating what ended up being a multi-year package of clarifications, interim regulations, interim final rules, and additional guidelines.

We also asked companies to tell us why and how these impacts played out so high in their estimation. Respondents broadly oriented their responses along two dimensions: financial and operational/technical. Below are the top concerns cited by area:

Operational

» Need to analyze and completely re-categorize current class-of-trade (COT) definitions and assignments due to defining provisions that affect the calculation of government reported prices

» Major modifications to policy and procedure documents for Average Manufacturer Price (AMP) and other prices

» Calculation methodology definitions including smoothing and revised definition of retail

» Technical implementation of new definitions and implementation of the new Medicaid rebate calculations

» Increased strategic pricing and contracting considerations to mitigate effects on government pricing; increased Medicaid rebate processing activities with additional MCO utilization

Financial/Corporate

» Tax treatment implications and potential for non-operating loss (NOL) resulting from the new tax regime

» Costs and infrastructure for new control programs and accountability management

» New payments mandated via required discounts on branded drugs for Part D donut-hole gap coverage

» Increased Medicaid rebates, up to 50 percent higher in some cases (larger rebate percentage and increased volume due to managed Medicaid inclusion), increased longevity, and more data and related costs to manage

Internal Alignment is Missing

Given this list, there are good reasons to move quickly and decisively. However, the survey showed that much more focus is required: Only 41 percent of the survey group said there was "clear accountability and ownership" of the response to HCR within their own company.

In fact, two-thirds of respondents stated that ownership went no higher than director, with functional ownership most typically lying in the contracting or government pricing arena and a third stating that manager-level representatives are charged with the initial response. Given the potential impacts of HCR on revenue planning and regulatory compliance, CFOs also need to become involved, especially in light of the heavy fines levied in recent years for government pricing violations. The good news is that companies that are responding are doing so quickly in order to address the most relevant issues first.

Next, we asked if companies have looked into the following key areas:

» How the increase in the base rebate formula is going to affect rebates —91 percent said yes.

» Ability to go back and restate/calculate the URAs before Q1 2010 with the old formula—not one company stated an inability to handle this requirement.

One area where companies also seemed to agree was the perceived challenge of a HCR provision that makes Medicaid Managed Care utilization now available for Medicaid Rebates.

The challenge is more than just the increase in dollar outlay. With 62 percent of respondents saying they see a challenge with this new model, and some 14 percent saying they were not sure; to clarify, we examined the write-in responses from survey respondents. The following top areas of concern were identified:

» Data management, including the ability to identify managed Medicaid care claims correctly in commercial submission to prevent rebate double dipping

» Accruals and financial forecasting and adjustment

» Price controls

» Billing origin and increase in reporting and data submission formats

Slow on the Uptake?

Many other changes are on the same order of magnitude, but impact the bottom line differently and require advanced financial modeling. We asked if companies were proactively seeking to model the impacts of the relevant Medicaid rebate percentage increase, AMP definition changes, and relevant provisions on revenue, profitability, and cost projections. Surprisingly, less than half of the companies said they have already done this or are in the process of doing so.

Furthermore, only 43 percent of responding companies have begun work on assessing their current COT structures or potential reorganization strategies to enable the new exclusion and inclusion rules for calculating AMP. Some of this "wait for now" attitude may be a result of the fact that the AMP changes are not effective until October 1, 2010. This also seems to be reflected in the relatively low number of companies (47 percent) that say they have already begun to model the impact of AMP changes on Medicaid rebate payments and accrual policies. As recent headlines show, companies with a more aggressive and proactive accounting philosophy are already undertaking significant activities ahead of time based on their product/market position and perceived increase in rebate liability. In many cases, companies simply don't have enough information, and are waiting for guidance from the Center for Medicare and Medicaid Services (CMS) or the Office of Pharmacy Affairs (OPA).

So how do companies go about getting this information? For example when asked: How do you plan to deal with potential PHS refunds resulting from restatements? The most common answers were a) this is an issue, and CMS has not given guidance at this time; b) we don't know yet and c) undetermined. Equally unclear in the survey group's minds is how a PHS refund might influence their initial best price (BP) calculations—60 percent said they have not yet analyzed the issue, while 15 percent will be more conservative in initial BP (lower BP reported), and 15 percent will make no change in the initial BP calculations.

Few Clear Signals from CMS

Likewise, how helpful is CMS going to be in helping companies navigate the changes? It is still too early to say, with a strong majority of manufacturers stating they haven't contacted CMS for clarification or discussion. One indicator is CMS issued first guidance on the implementation of HCR Medicaid rebate provisions in the form of a letter to state Medicaid directors on April 23.

Written mostly as a recital of the provisions, it provided no concrete explanation of the changes while noting that CMS would issue additional guidance to manufacturers and other stakeholders concerning the process that will be used to identify clotting factors, drugs with pediatric indications, and new formulations. Curiously, the letter also left out the changes to the AMP definition—one of the more important elements of the new law in terms of shaping company P&R strategies.

Finally, the survey establishes that there is still considerable uncertainty surrounding even the most basic provisions of the HCR law. Pharma companies clearly see the need to play catch-up. Given the impact on systems and processes, it is not surprising that only half the companies responding to the survey said they are confident about vendor or IT support for the changes that need to be made. Specifically, the survey asked if companies see HCR being an impetus for IT or process improvement investment in the commercial or regulatory compliance areas in 2011 and beyond. Only 18 percent said no, while a full 82 percent said that they anticipate new internal investments in areas tied to pricing, contracting, and revenue management being driven by reform, leading to either complete overhaul of systems or incremental upgrades.

The Bottom Line: Reform is About Profits, not Politics

Building on the survey, how should companies be thinking about HCR as we look toward a decade of implementing steps? Consider the challenge this way: While the 2005 DRA probably multiplied the complexity and financial impact of government program purchasing by five- to tenfold, now comes an entirely new set of regulations—just as manufacturers are wrapping up the last elements to become compliant with the DRA. The new law will change many of the assumptions and rules CMS fixed in place for the DRA, while tossing some new annual taxes into the mix that will basically penalize manufacturers for being on the government formulary.

Couching all this in personal terms, don't be surprised that many of the new law's provisions are open-ended or subject to interpretation. But CFOs and operational managers will still be expected to develop and implement a compliance regime that needs to be effective retroactively —as of January 1, 2010. CMS may not be ready in time, but when it catches up and puts out a few new clarifying regulations, guidance, or final rules—as well as some new catch up calculations for rebates—pharma finance organizations will have to go back and adjust, recalculate, report, and pay what they owe to Uncle Sam. If they don't, the federal Office of Inspector General or a state Attorney General is going to come by for a friendly audit, and probably require them to pay a massive fine, settle, or sign a corporate integrity agreement (CIA). And we apologize in advance if this affects your brand, multiplies your legal bills, and loses you market share in a blisteringly competitive market.

Against this backdrop, what can you do if the questions and responses to this survey are different from yours, or if you feel left behind? In general, there are no magic wands available to manufacturers to ensure regulatory compliance today. Yet, in the coming quarters, shareholders will be evaluating how companies execute on their strategy for dealing with the full range of operational challenges and regulatory risks posed by HCR. Pharm Exec's "c-suite" readers must understand that HCR is the opening salvo in a long process of transforming how healthcare is managed, delivered, and paid for in the US. More cost controls and a re-examination of reimbursement schemes based on European models are likely on the horizon, so operational nimbleness will be essential in minimizing the impact of future P&R mandates.

Even as many respondents to the survey show considerable uncertainty in coping with HCR, a small set of leading companies say they are moving forward. There is hope that CMS and OPA will provide clear direction. While there will still be variations in individual response, don't let this stop you from educating financial and operational management and using a task force mentality to assess, model, and align. Assess data quality, engage different parts of the organization, and think about using HCR to create a long-term road map for compliance for the next round of mandates.

In addition, companies should focus on assessing impact based on exposure to the affected programs, and work with external and internal counsel and IT to identify and address emerging risks. Much like the DRA, HCR gives the industry an opportunity to work through PhRMA and other venues to build common, industry-wide approaches to HCR compliance and to engage in a comprehensive dialogue with the CMS around a shared interest in quality, value and better health outcomes.

Gopkiran Rao is senior director, Life Sciences Industry Marketing, Model N. For more information about Model N, visit www.modeln.com/HCR

The Misinformation Maze: Navigating Public Health in the Digital Age

March 11th 2025Jennifer Butler, chief commercial officer of Pleio, discusses misinformation's threat to public health, where patients are turning for trustworthy health information, the industry's pivot to peer-to-patient strategies to educate patients, and more.

Navigating Distrust: Pharma in the Age of Social Media

February 18th 2025Ian Baer, Founder and CEO of Sooth, discusses how the growing distrust in social media will impact industry marketing strategies and the relationships between pharmaceutical companies and the patients they aim to serve. He also explains dark social, how to combat misinformation, closing the trust gap, and more.