- Sustainability

- DE&I

- Pandemic

- Finance

- Legal

- Technology

- Regulatory

- Global

- Pricing

- Strategy

- R&D/Clinical Trials

- Opinion

- Executive Roundtable

- Sales & Marketing

- Executive Profiles

- Leadership

- Market Access

- Patient Engagement

- Supply Chain

- Industry Trends

The IRA Impact: Navigating Its Evolving Complexities

Amid lingering questions and uncertainty, a look at ways pharma companies can prioritize incorporating the Inflation Reduction Act into their strategic planning process—and do it now.

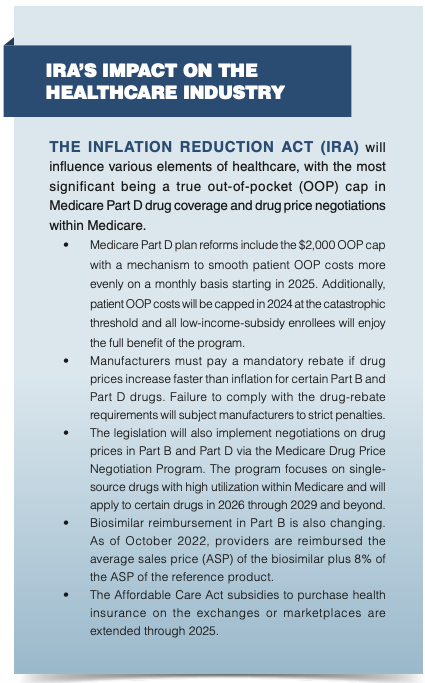

As evidenced by recent headlines, the Inflation Reduction Act (IRA) continues to drive tremendous change across the industry, reshaping healthcare regulations and introducing new challenges and pricing pressures for biopharmaceutical companies.

Given the rapidly evolving landscape, drug manufacturers and their partners should closely monitor the latest regulatory activity —from the ongoing negotiations as part of the Medicare Drug Price Negotiation (MDPN) program to inflation penalties and Medicare Part D benefit redesign provisions. More importantly, biopharma companies need to understand the potential impact of those changes—as well as those on the horizon—and take actions to ensure they are prepared to navigate the new requirements and overcome potential challenges.

As companies develop robust IRA strategies, their plans should reflect and address how they can:

- Leverage existing medical communication pieces (i.e., dossiers) to support submissions to the Centers for Medicare & Medicaid Services (CMS), if selected to participate in the MDPN program.

- Disseminate value messages via a digital platform in an increasingly competitive Part D market.

- Assess their patient assistance program strategy—specifically eligibility criteria and proactively educating patients, healthcare providers, and caregivers.

LEVERAGING MEDICAL COMMUNICATIONS TO PREPARE FOR PRICE NEGOTIATIONS

As the US Department of Health and Human Services announced in early March,1 negotiations remain ongoing with manufacturers participating in the first cycle of the MDPN program. The negotiated prices for the first 10 Part D drugs will be implemented in 2026, before the program expands to include another (yet to be selected) 15 Part D drugs in 2027, and 15 Part B and Part D drugs in 2028.

As companies continue to navigate some of the uncertainty, they can start to prepare for the unknowns—including the next list of affected products—by building an internal IRA team comprised of cross-functional stakeholders. The composition of the team will be unique to each company based, in part, on whether the manufacturer is expected to or has a product on the list versus those that don’t anticipate an immediate business impact but want to have a strategy in place and stakeholders tapped for engagement.

The strategic planning will ensure biopharma companies are prepared for two critical pathways: their drug is selected for the next cycle of negotiations via the MDPN program, or their drug is a direct competitor of a product selected for negotiation. Companies don’t need to recreate the wheel—they should leverage existing processes, including value demonstration assets, to support their planning process for the IRA. For example, companies should leverage existing data sources, such as the Academy of Managed Care Pharmacy dossiers, real-world evidence, and cost-effectiveness analysis, to support their submission to CMS via the information collection request.

Despite lingering questions and uncertainty, companies should prioritize incorporating IRA into their strategic planning process now. Through a proactive and comprehensive approach, companies can pinpoint any existing evidence gaps and develop a more robust value story, including comparative effectiveness—ensuring they are well-positioned to navigate and prepare for IRA negotiations.

ENGAGING PAYERS DIGITALLY TO COMMUNICATE VALUE STORY

While demonstrating a product’s value has always been essential, the pressures brought by the MDPN program and the Medicare Part D plan reforms amplify the need for effectively communicating the value of a product.

Over the last several years, there has been increased exchange of scientific information between payers and biopharma companies through digital channels—a trend accelerated by the COVID-19 pandemic. In fact, Cencora-led market research2 has shown that most payers (80%) surveyed prefer to access product information digitally.

Biopharma companies should leverage digital channels to engage payers and communicate product value information. For example, Cencora’s FormularyDecisions facilitates the bidirectional exchange of information between biopharma companies and healthcare decision-makers representing more than 269 million covered lives in the US.3

With a compelling value proposition and a robust communications strategy, biopharma companies will be better positioned to differentiate their products, navigate the new pressures, and increase brand performance.

ASSESSING PATIENT ASSISTANCE PROGRAM (PAP) CRITERIA

Since the IRA was signed into law more than a year ago, biopharma companies have worked to understand the core components of the IRA and identify how it will affect their portfolios.

One area, in particular, companies need to understand is the Medicare Part D benefit redesign that will offer a $2,000 out-of-pocket (OOP) cap and a new program to smooth OOP costs throughout the plan year. As many PAPs have underinsured criteria for Part D patients, biopharma companies should assess their income eligibility criteria to ensure their program supports the needs of the patient population. This is especially true for patients who are not eligible for a low-income subsidy and can’t afford the 2,000 OOP cap. Manufacturers and their partners can conduct a program impact analysis, which will help inform decisions around what changes they should make to their program.

As 2025 approaches, biopharma organizations should develop a strategic roadmap that outlines the operational changes they plan to make (i.e., CRM system updates, policy adjustments) and the communications strategy they will deploy. For example, companies should build a robust communications plan that enables them to proactively inform providers, patients, and internal team members about the planned changes, so all stakeholders have a clear understanding.

LOOKING AHEAD

Since August 2022, CMS has released guidance on the various IRA provisions—including the MDPN program4 and Part D reforms5—erasing some of the uncertainty. But questions still exist, and we anticipate the implementation of IRA provisions will continue to drive change across the industry.

In order to navigate the lingering uncertainty and changes brought by the IRA provisions, biopharma companies should design and deploy a robust IRA strategy that accounts for the core areas and considerations outlined. By doing so, manufacturers will be better positioned to navigate the complexities of the implications of the IRA while continuing to support the patients they serve.

Corey Ford is Vice President of Reimbursement and Policy Insights at Cencora.

References

1. CMS Issues Additional Guidance on Program to Allow People with Medicare to Pay Out-of-Pocket Prescription Drug Costs in Monthly Payments. HHS. February 15, 2024. https://www.hhs.gov/about/news/2024/02/15/cms-issues-additional-guidance-program-allow-people-medicare-pay-out-of-pocket-prescription-drug-costs-monthly-payments.html

2. Assessing the Evolving Landscape of Digital Engagement Between Healthcare Decision-Makers and Biopharma Companies. Cencora. January 17, 2024. https://www.amerisourcebergen.com/insights/manufacturers/assessing-the-evolving-landscape-of-digital-engagement

3. Access Evidence for Thousands of Products—All From One Site. Cencora. 2024. https://www.amerisourcebergen.com/manufacturer-solutions/formularydecisions/payers

4. Fact Sheet: Medicare Drug Price Negotiation Program Revised Guidance. Centers for Medicare & Medicaid Services. June 2023. https://www.cms.gov/files/document/fact-sheetrevised-drug-price-negotiation-program-guidance-june-2023.pdf

5. CMS Issues Additional Guidance on Program to Allow People with Medicare to Pay Out-of-Pocket Prescription Drug Costs in Monthly Payments. HHS. February 15, 2024. https://www.hhs.gov/about/news/2024/02/15/cms-issues-additional-guidance-program-allow-people-medicare-pay-out-of-pocket-prescription-drug-costs-monthly-payments.html

Pharm Exec Exclusive: Mark Cuban Talks Drug Pricing

June 7th 2024Now more than two years into launching his alternative and transparent drug payment model, the longtime entrepreneur, in an interview with Pharm Exec, discusses the prescription drug cost landscape and shares his recipe for true disruption to the pharma pricing machine.

Pharm Exec Exclusive: Mark Cuban Talks Drug Pricing

June 7th 2024Now more than two years into launching his alternative and transparent drug payment model, the longtime entrepreneur, in an interview with Pharm Exec, discusses the prescription drug cost landscape and shares his recipe for true disruption to the pharma pricing machine.

2 Commerce Drive

Cranbury, NJ 08512

All rights reserved.