A look at the performance of the top 15 companies across seven business-key metrics, including the latest standouts in market capitalization and creating shareholder value.

A look at the performance of the top 15 companies across seven business-key metrics, including the latest standouts in market capitalization and creating shareholder value.

Our latest metrics tally across seven business-key measures uncovers some familiar players pacing the field in delivering shareholder value and getting the most from their investments.

Our latest review of biopharma financial performance reveals solid growth rates in enterprise value and rebounding value-to-sales numbers—proving once again the business imperative of regaining and sustaining shareholder value.

Pharm Exec’s latest analysis of financial performance reveals that it’s those drugmakers maximizing the difference between the value and the cost of their capital investments that are delivering the most bang for the buck to shareholders.

Pharm Exec’s latest company leaderboard in delivering shareholder value highlights the most critical measure of management performance-return on invested capital.

With our latest review indicating declines in shareholder value and shareholder value to sales, those companies that score well in critical profit management metrics such as return on invested capital are best positioned to maintain that crucial edge in performance execution.

Our latest review reveals that those companies scoring well on profit management metrics are best positioned to maintain that crucial edge in performance execution.

As market headwinds persist, our latest industry review of shareholder value reveals a sharp performance differential between companies that pursue a strategy of specialized therapeutic focus and those that continue to rely on line diversity, size and scale.

After a sharp spike in revenues, this year’s audit finds our 25 companies doubling down to secure the operational efficiencies that promise to better align with an increasingly tightfisted payer community. Never before has market relevance been so firmly linked to customer reputation.

After a dip into negative territory in 2012, 2013 delivered a resurgence in sales revenues, but the turnaround only spotlights a larger trend: the growing divide between the big Pharmas and the more nimble players.

Shareholder value now depends on finding pockets of "good" growth, in segments with fewer players, and where expenses can be tightly controlled.

Bill Trombetta expands his annual guide to stellar performance with the "Heavenly 27."

Pharm Exec's 7th annual review of the top companies. We slice and dice the numbers to see who's the best a what. (pdf)

Second annual Not Big Pharma audit gives equal time to the little guys. Who's got the Midas touch?

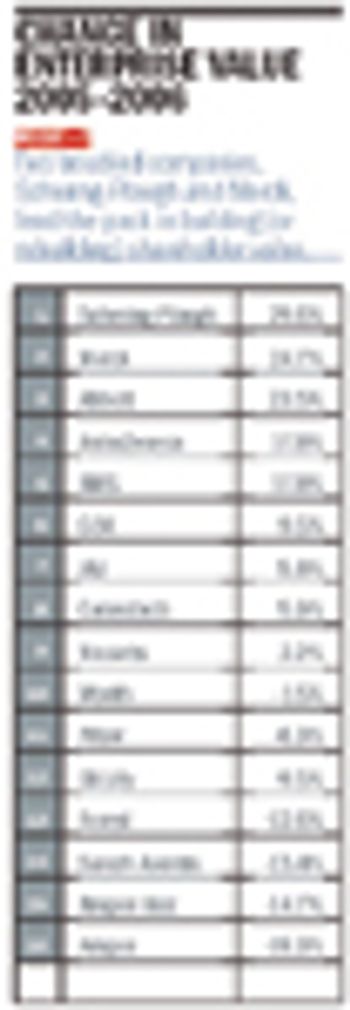

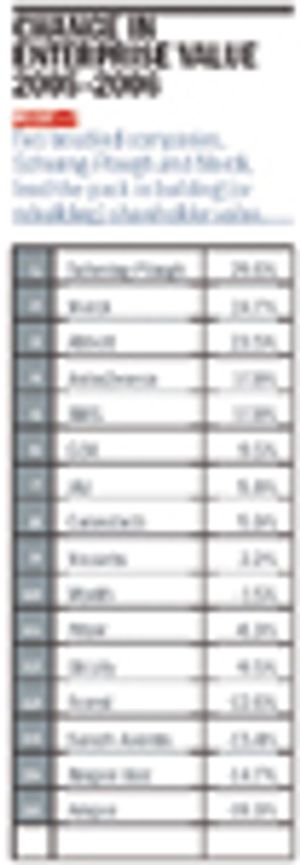

For the sixth year in a row, Pharm Exec invites Professor Bill Trombetta of St. Joseph’s University to analyze the pharma industry's financial performance with a battery of business metrics, old and new. The highlights: Genentech pulls ahead of its longtime rival, Amgen. Forest delivers another strong performance, despite dropping revenue. Schering-Plough is building enterprise value. Biogen Idec racks up a stellar profit margin. And Merck? Well, Merck is back, baby. And the winner is…

Ever wonder how all those biotechs, specialty shops, and generics that make up Not Big Pharma ever manage to stay in business? Pharm Exec asked Bill Trombetta of St. Joseph's University to look at their books, analyzing their financial performance with the same metrics he uses for our annual Industry Audit. His findings may surprise you. In fact, when you check the bottom line, you just might consider changing teams.

For the fifth year in a row, Pharm Exec invites Professor Bill Trombetta of St. Joseph's University to analyze the pharma industry's financial performance with a battery of business metrics old and new. The highlights: Two top biotechs race neck-and-neck for first place, Forest delivers another strong performance, and AstraZeneca squeezes past Johnson & Johnson and GlaxoSmithKline into the top four for the first time ever. And the winner is . . .

Published: August 11th 2020 | Updated: November 5th 2020

Published: September 1st 2012 | Updated: November 15th 2020

Published: September 1st 2009 | Updated: November 15th 2020

Published: September 1st 2007 | Updated: November 15th 2020

Published: September 1st 2008 | Updated: November 15th 2020

Published: June 1st 2008 | Updated: November 15th 2020