Ad(Ventures) in Pharmaland

Pharmaceutical Executive

Despite the downside in ad spend, an upside remains in the digital space that's wide open for exploration.

A dvertising spending was depressed across the country in 2008, and pharma was no exception. According to Nielsen, DTC ad spend among pharma companies dropped 18.4 percent in 2008, from $5.3 billion to $4.3 billion. Predictably, the drop was spread unevenly across media. For example, TNS Media Intelligence compared spending on direct-to-consumer advertising in 2008 to 2007. The findings: Magazine DTC spending fell 23 percent, to $1.45 billion, and radio dropped 51 percent, to $25 million, while television fell only 3 percent from $2.95 billion to $2.86 billion. Meanwhile, Internet display ads (not including search) were up by a third in 2008, though they still accounted for just 5 percent of all DTC spending.

Top Impressions

The year's drop in advertising is due, in part, to increased FDA scrutiny and the low number of potential blockbusters reaching market. But a deeper look into the numbers reveals some interesting trends. The recent explosion of digital media is having an impact on the marketing mix, and social media have finally made their debut on the pharma promotional scene. Despite the fall in overall DTC ad expenditure, it's clear that new advertising doors opened in 2008 for an ambitious (yet cautious) pharma to enter.

But if "innovate" is one of the watchwords for pharma marketers today, another is "optimize." And 2008 was a year in which companies looked hard at their marketing mix, analyzing which channels are most responsive and effective. That trend distinguished 2008 from previous years, according to David Baron, senior manager in Ernst and Young's advisory services group. "It's not necessarily 'out with the old and in with the new,'" he says. "It's more 'in with the old and in with the new.'"

TOTAL DTC AD SPENDING

Don't Change That Channel

Television remains an invaluable tool for pharma marketers. The medium's ability to forge connections with an audience is converging more with digital media. Spending on TV may have dropped a bit last year, but much of that drop was attributable to the increased cost of advertising in an Olympic/election year, plus the effect of several big-spending brands reaching patent expiration. "Television advertising is still the leading vehicle when it comes to generating awareness," says Fariba Zamaniyan, senior vice president of Nielsen IAG. "It's not that we expect to see ad spending go away in the DTC category, but what we may see is some share of the mix expanding to incorporate some online [advertising]."

TOP 5 DTC BRAND ADVERTISERS

According to Annie Touliatos, vice president for sales development, Nielsen Monitor-Plus, many pharma brands did up their spending. "When you look at the top 10 brands, you still have many that increased their ad spending in 2008, like Advair, Viagra, and Crestor," says Touliatos. Why the increase? In some cases it was brand strategy; in others, the launch of a competitor; in still others, the company may simply have decided the product was losing traction and needed more exposure.

Take Sepracor's sleeping pill Lunesta. In 2006 and 2007, it was widely ranked as the most heavily advertised drug in industry. But when top-selling Ambien became available as a generic in April 2007, the competitive landscape changed. It became difficult for brands like Lunesta, in the prescription side of the insomnia market, to reach sales goals. Advertising for Sepracor was cut back significantly from $293 million in 2007 to $109 million in 2008. "When you look at rankings on ad spend, it's purely a function of not advertising at the level they have been for business reasons," says Zamaniyan. "There were no adverse effects reported for the brand; it was purely a decision made on a financial basis."

Most of the industry cut back on unbranded advertising in 2008. Not Pfizer. Instead, the company spent 80 percent more on its unbranded "tortoise and hare" campaign for Chantix, the smoking-cessation drug. Other companies should have followed suit, says John Busbice, principal in commercial effectiveness for IMS Consulting. IMS conducted an optimization study that suggested that the top 25 percent of DTC advertisers should have spent more in 2008 than they have historically. In other words, larger brands should have spent more, and smaller brands less. "When people think about cutting to environmental pressures, they are prone to overreact," Busbice says. "One of the things we found is that brands with sales over $750 million per year should have had, optimally, budgets of no less than $100 million. Ideally, the top 15 brands should have spent more."

The great debate in DTC these days is whether consumer-directed advertising will continue to use mass media such as network television and general-readership magazines, or shift to more targeted vehicles such as specialized magazines and cable. Bob Liodice, president of the Association of National Advertisers (ANA), believes predictions of the death of television have always been exaggerated. As a medium for pharma advertisers, he says, "TV is going to be in really good shape."

Optimal Investment

The Power of Print: Marketing to MDs

In 2008, 1,325 products—of all kinds—were promoted to physicians, according to Kantar Media Research. And pharma companies have plenty of options for delivering messages about these products to doctors, from TV and radio spots to newspaper and Internet ads. At any moment, some channels are waning—case in point is journal advertising, which has decreased by 16 percent over the past two years, according to PERQ/HCI More. Meanwhile, others are increasing—such as the use of medical science liaisons to communicate complex data about new products.

The trick is to find the right mix and eliminate media waste. But that's not easy, because promotional activities are synergistic. "When a physician sees an advertisement on television, gets visited by a sales rep, or reads a journal publication and sees an ad, all of those things have a compounding effect and work to make the physician prescribe a product," says Baron.

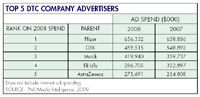

TOP 5 DTC COMPANY ADVERTISERS

The past few decades have seen an astonishing growth in narrowly targeted information sources for doctors. For example, 20 years ago there were seven measured oncology journals. Today, there are 37 publications and demographic editions. That means that the number of oncology publications has doubled—while the number of oncologists remained basically the same. Industry consultant Charlie Hunt explains that new publications are being created to address specialized audiences and gain advertising for new drugs that are increasingly targeted at specialists. "From an advertising standpoint, pharma is moving toward targeting specialty physicians," Hunt says. "For example, if I have a neurology or oncology product, I'm not going into the broad-based publications as much as I'm going to publications specifically designed for oncologists."

Declining DTC

Meanwhile, pharma marketers will be forced (if they haven't already been) to find ways to replicate the value of a sales rep visiting a physician. Ronald Schulman, senior vice president and director of connect marketing for inVentiv Communications, believes that part of the solution is to stop driving physicians to company and brand Web sites, and start engaging them at the locations where they consume healthcare information. This is a process that has already begun on the consumer side, and according to Schulman, "We expect the same dynamic on the professional side, as well. Shrinking reliance on sales forces and journal advertising will continue, but the growth of Sermo and the younger and larger Medscape Physician Connect social network as destinations for healthcare providers will create new avenues for engagement."

Online: The Social Media Scene

From one perspective, digital promotion of drugs is exploding. Companies spent about $1.2 billion online in 2008, and the research firm eMarketer predicts that they'll spend $2.2 billion online by 2011. But that growth must be taken with a grain of salt: US pharma and healthcare companies spent about 5 percent of their ad budgets online in 2006—almost the exact percentage they'll spend in 2011.

So are budgets really shifting toward online? Lee Slovitt, senior media director of Heartbeat Digital, thinks so. "Digital is the one medium to get concrete results and do more with less," Slovitt says. However, in order for this to work, digital media must be approached strategically. "It sort of needs its own campaign," he says. "Advertisers oftentimes overlook the fact that sites like Facebook are user-controlled personal environments. It's more important to recognize, ask to participate, and get permission from users to be a part of their life."

Clients' patterns of spending are changing, says Lisa Flaiz, vice president, group director, and national pharmaceutical practice lead with the Philadelphia office of Razorfish. To her, the trend suggests that clients are still willing to invest in broad DTC campaigns, but that the portable and "beyond the browser" touch points may be more appealing. "Our communications plans look much different now than they did two years ago," says Flaiz. "They include mobile, social, out-of-home, and more digital touch points than ever before. Pharma will continue to be conservative about advertising in the social media space, but will continue to look for ways to surround the discussion in a targeted and relevant way."

A key question is whether brand advertising will benefit or hinder the brand. For example, will commercial presence on a social media site be met with skepticism? Flaiz expects to see advertising on third party social media sites to increase slightly as more pharma companies develop policies for how to use social media, and get "braver." But she doesn't anticipate significant growth. "Pharma, along with all other industries right now, is rethinking its distribution strategy," she says. "Occupying more of an online presence is how to leverage consumer behavior. The brand of the future has a ubiquitous digital relationship. This is a mostly digital world. It is no longer enough to have a small Web presence; that worked when we lived in a mostly analog world."

Companies trying to place their advertising next to valuable online content used to have two choices: They could advertise on Web sites and online magazines, using technology to bring their ad up when content with certain keywords appeared on the screen, or they could create content of their own—better controlled, but potentially less valuable to readers, if they perceived it as promotional. Today, an increasing number of online content providers are offering another alternative, what Laura Klein, senior vice president of sales and marketing for Everyday Health, calls "custom centers." In this model, a healthcare information provider creates a mini-site devoted to a particular condition, exercising complete editorial control. The drug company sponsors the entire site and runs its advertising on all the pages.

The content, in this model, can take a wide variety of forms: patient stories, tips for living with and managing conditions, Q&A with experts, and a robust array of interactive tools. For example, the What to Expect Foundation developed a successful custom center on its site with support from GlaxoSmithKline. The "What to Expect Guide to Immunizations" includes video clips covering a variety of concerns about childhood immunizations, selected articles, and even a downloadable book, including charts that help parents track immunizations and ask appropriate questions during visits to doctors. The popular health site Everyday Health includes more than a dozen "Everyday Solutions" covering everything from heart health to children's nutrition. These mini-sites include content custom written by the Everyday Health staff (though with full editorial control) and ads by sponsors that include pharma and consumer products manufacturers.

As of October 2008, there are 250 advertisers with Everyday Health in the consumer packaged goods and pharma industries, which include Abbott Labs, Bayer, GSK, and Pfizer. Advertising business for the company more than doubled in 2008 over 2007 and remained on par with growth in Q1 for 2009.

Among the many metrics measured, average click-through rates for marketers' ads in custom centers are two to four times above the industry average. Klein points out that when a custom center is running, Everyday has the ability to market to all users (about 24 million monthly as of January 2009) throughout networked sites, which really exposes them to the advertisers' custom center and ultimately sends them through to be counted as traffic.

Spending Trends: More Declines in 2009?

According to DataMonitor, pharma promotion is moving from traditional brand promotion toward a streamlined, customer-oriented approach. Perhaps that is why Baron believes that maybe it is time for pharma to see the patient as more of a consumer. "There is nothing wrong with raising brand awareness and brand recognition. It doesn't have to drive incremental scripts; brand awareness could be enough to help keep the marketing mix optimized," he pointed out.

Pharma companies are scaling back—not just for budgetary reasons, but because of delayed product launches, regulatory concerns, and the impact of the PhRMA guidelines. Advertising agencies are understandably concerned about what the future holds for them. In the short run, it's probably more of the same. Schulman, for example, expects 2009 to look similar to 2008. "We do not expect the measured media mix to change all that much in 2009," he says. "The total spend will shrink but the allocation will probably hold to form."

All in all, Big Pharma remains at the top of the rankings in terms of most promotional advertising dollars spent. But the future holds a much wider playing field for both large and small companies aiming to optimize the marketing mix.

The Misinformation Maze: Navigating Public Health in the Digital Age

March 11th 2025Jennifer Butler, chief commercial officer of Pleio, discusses misinformation's threat to public health, where patients are turning for trustworthy health information, the industry's pivot to peer-to-patient strategies to educate patients, and more.

Navigating Distrust: Pharma in the Age of Social Media

February 18th 2025Ian Baer, Founder and CEO of Sooth, discusses how the growing distrust in social media will impact industry marketing strategies and the relationships between pharmaceutical companies and the patients they aim to serve. He also explains dark social, how to combat misinformation, closing the trust gap, and more.