Are You Trained to Compete and Win?

With the impact of the sales rep in decline, it's time to beef up training for other pharma functions to fill the gap in a competitive marketplace

Imagine that you are on a baseball team where only the leftfielder receives regular training. Each week, the team's coaches teach and train the leftfielder to bat, run the bases, and catch fly balls. The rest of the team practices but receives no such formal training. How do you think this team would fare against a baseball team that trains every member of its team to compete and win?

Stan Bernard

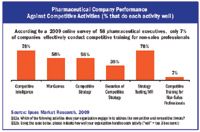

Sound ludicrous? Not in the pharmaceutical industry. Each year, pharmaceutical companies spend enormous amounts of money, time, and resources preparing sales representatives—the "leftfielders"—to compete and win in physicians' offices against sales reps from other highly trained pharma competitors. Yet many of these same companies provide little or no competitive training to the rest of their team, including marketing, medical, and competitive intelligence professionals. In fact, a recent online survey of 58 pharmaceutical executives conducted by the market research firm Ipsos revealed that only 7 percent of pharmaceutical companies do an effective job of training non-sales professionals. Over the past five years, executives report attending, on average, only one training course pertaining to competition in the marketplace; more than one-third report receiving no training at all.

This outdated mindset of training only sales representatives has to change. The pharmaceutical industry in the US, EU, and Japan—the world's biggest markets—has entered the mature, or competitive, stage of its lifecycle. In this stage, there are fewer new products; stagnating markets; tremendous pricing pressures; dramatically increased brand and generic competition; and diverse, powerful stakeholders. These emerging stakeholders, including payers, governments, health technology assessment groups, and guideline developers, have radically reduced the power of physicians and, consequently, the influence of sales representatives. Companies increasingly compete by targeting these potent, diverse stakeholders, which requires leveraging more non-sales approaches and, increasingly, the expertise of their other functional professionals.

Pharmaceutical Company Performance Against Competitive Activities (% that do each activity well)

Pharmaceutical companies must train the rest of their team to compete in order to win in this new, competitive marketplace. There are three basic questions that companies need to address in order to conduct successful competitive training:

1) Who needs to be trained?

2) What competitive training topics are essential for these professionals? and

3) How and when should the training be conducted?

There are three high-priority groups for training. The first rank should be marketing professionals, including franchise and brand team members, market researchers, promotional professionals, new product planners, brand and strategic planners, and senior commercial management. The second priority, surprisingly, should be competitive intelligence professionals. While these individuals are typically well-versed in intelligence gathering, they may not be as knowledgeable in conducting market and stakeholder analyses and developing competitive strategy and tactics. A third priority training group is the extended members of the brand teams, including medical affairs; pricing, access, and reimbursement; health economics; public affairs and external communications; public policy and external affairs; business development; and non-sales field personnel, such as account managers and medical science liaisons.

These three groups should receive both basic and advanced competitive training. Fundamental competitive training focuses on the essentials of the competitive planning process: competitive analysis, simulations, strategy, actions, and results (the CASSAR Framework, see Pharm Exec, October 2010). More advanced training topics focus on new approaches for winning in the competitive stage, such as product counterlaunches; brand versus generic competition; market-shaping and game-changing; and new competitive technologies, such as personalized medicine and pharmacogenomics. Like all effective training, the format should be highly practical, interactive, and engaging, and feature case studies, stakeholder analytics, best practices, and role-playing.

Training can be conducted as a standalone program or as part of existing initiatives. The best competitors in the industry conduct separate, focused, and regular one- to two-day competitive workshops that are tailored specifically for their particular brands, competitors, and markets. Other organizations conduct competitive training during annual brand or marketing planning; existing marketing or professional training programs; "competition conferences;" competitive simulations or war games; or as part of employee "Lunch & Learn" programs. Companies can offer these programs by therapeutic areas or franchises; global, regional, or local markets; or by functional departments.

Companies that have effectively implemented competitive training programs usually have strong executive leadership and buy-in. Senior executives, including the company's CEO, consistently and clearly communicate the importance of enhancing the company's competitiveness through competitive training and execution. These senior executives often participate in the initial competitive training seminars to serve as role models for their employees. Some companies require competitive training as part of employees' annual objectives and performance reviews. It is also wise to include provisions for training in competition in the annual operating plan.

Pharmaceutical companies are increasingly appreciating the popular management philosophy that "a team is only as strong as its weakest link." Pharmaceutical companies need to train not only sales representatives but also the rest of their team to engage and win in this new, increasingly competitive pharmaceutical game.

Stan Bernard is President of Bernard Associates, a global pharmaceutical industry competition consulting firm. He can be reached at SBernardMD@BernardAssociatesLLC.com

The Misinformation Maze: Navigating Public Health in the Digital Age

March 11th 2025Jennifer Butler, chief commercial officer of Pleio, discusses misinformation's threat to public health, where patients are turning for trustworthy health information, the industry's pivot to peer-to-patient strategies to educate patients, and more.

Navigating Distrust: Pharma in the Age of Social Media

February 18th 2025Ian Baer, Founder and CEO of Sooth, discusses how the growing distrust in social media will impact industry marketing strategies and the relationships between pharmaceutical companies and the patients they aim to serve. He also explains dark social, how to combat misinformation, closing the trust gap, and more.