The Big Sell: Biologics In Emerging Markets

High priced biologics may have a bright future in emerging markets, but winning access in the short term will be a hard sell.

As the mature markets in the United States and Europe continue to wrestle with economic and political uncertainty, drug manufacturers are hunting for new sources of growth. The US medicines market, burdened by a more powerful payer base and a protracted economic slowdown, is projected to grow at only 3 percent to 6 percent between now and 2014, and even that slow pace remains vulnerable to the potential shock of the so-called fiscal cliff. Growth in Europe will be even slower, hovering between one and four percent as the region falls back into economic recession. Policy changes in France, Germany, and the United States, combined with broader economic and budgetary pressures in Italy, the United Kingdom and—most ominously—Spain, will further slow market growth, exacerbating the effects of looming patent expiries.

Getty Images/Adam Gault

All the major pharma companies are revising their growth plans and developing new ways to maintain traditionally high margins through this period of market uncertainty. At the top of the playbook is accelerating the commitment to emerging country markets, where Big Pharma has had varying levels of success—the challenge lies in transforming volume sales into sustainable profits. It is also becoming apparent that additional progress in these diverse and highly complex markets requires large investments in time, resources, and people.

Even if lower than forecast second quarter results from major players like GSK and Pfizer represent a corrective to past optimism, the headline growth rates in many emerging markets present a dramatic contrast to those in the United States, Japan and the "submerging markets" of Europe. According to data from IMS Health, drug sales in emerging markets are still growing at more than twice the global rate. China, expected to be the world's second largest pharmaceutical market by 2015, will expand at an annual rate of 22 percent to 24 percent through 2014. The other components of the BRICs—Russia, India, and Brazil—will grow at between 9 percent and 16 percent. Elsewhere, countries like Argentina, Turkey, Venezuela, Vietnam, and South Africa all exhibit substantial potential, driven by rapid economic expansion, rising incomes, and growing populations.

Many manufacturers have sought to get into these markets quickly, in order to leverage broad portfolios of mature brands and capitalize on the remarkable growth of the middle class. Research from the McKinsey Global Institute projects that by 2025 emerging markets will be home to more middle class households than in the developed economies. In countries like China and India, the size of emerging "middle class" populations may actually be double the population of the entire United States, a number that stirs drug marketers to flights of fantasy.

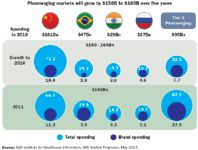

Pharmerging Spending and Growth

Resetting the opportunity button

The reality is more complicated, however. The vast majority of emerging market growth consists of sales of INN generic and branded generic compounds. Manufacturers have made significant efforts to extend the life cycle value of mature brands by introducing them outside their core markets, often with impressive results. Notwithstanding the relative success of this strategy, the growth potential of branded innovators remains limited, and there is a bigger question about the potential for many higher-priced innovator molecules, particularly biologics and targeted cancer compounds. Despite economic growth that has lifted hundreds of millions of Chinese from poverty, the monthly cost of a biologic cancer therapy like Avastin (bevacizumab) still exceeds the median monthly income in China. In other words, without a functioning insurance scheme that allows for reimbursement at low out-of-pocket cost, most of these products will remain beyond the reach of the average consumer.

To better understand the market potential for biologics and other high-priced innovators, we have devised a multivariate econometric model designed to isolate the factors most strongly predictive of growth. We included a variety of economic and demographic measures, health expenditure data from WHO and country governments, and sales data from IMS Health. Some modifications had to be made: for example, data were not available for every time period, and in some cases data from a different source had to be used to fill in gaps in official data sets. Taiwan (the Republic of China) is not a UN member, which means that UN agencies such as the World Health Organization do not capture data on the country. As a result, we relied on data from the Taiwanese government and assumed broad comparability of measures. To adjust for wide variation in population size, we normalized the dependent variable by converting top line sales numbers to per capita figures. Using standard statistical techniques, we modeled growth dynamics across emerging markets in Eastern Europe, Latin America, Asia, the Middle East, and Africa.

Who can pay for biologics?

Our research identifies three factors that explain the majority of the observed variation in per capita biologics sales. First, per capita total expenditure on healthcare highlights the ability to pay for premium-priced innovator molecules. More investment in health correlates with better opportunities for higher-priced innovator products.

Second, we found that as per capita government expenditure rises, so too do sales of premium-priced products. Higher government expenditure generally signals the presence of at least some formal reimbursement mechanism facilitating access to therapies otherwise out of reach for the majority. The third factor—the percentage of the population living on less than $2 per day—is sensitive not only to incomes but a number of other development indicators. Where the poverty rate is low, not only are incomes higher and more equitably distributed, but populations are more urbanized, making the distribution of biologic products more feasible. We also believe that where the poverty rate remains high, governments will continue to prioritize health sector investment in primary care and the elimination of transmissible diseases.

Applying our model to a basket of emerging markets, we find that the opportunities for high-cost products differ from those for small molecule, generic products, with important implications for manufacturers. Most notably, India essentially disappears from the list, reflecting its low median income ($3,472), low per capita investment in health ($109), and very high poverty rate (75.6 percent living on less than $2 per day). Moreover, given India's predominantly rural population, access issues are significant (as they are in a geographically divided Indonesia). As a consequence, India, despite the presence of an emerging biosimilars industry, appears unlikely to represent an attractive near- or medium-term opportunity for large molecule biologic products. The cash market is untested at the high price points of these products.

China shares some of the same traits, but income and investment levels are more than double those in India, translating into a somewhat better opportunity. As China's government expands coverage to medicines, the market for biologic products will expand. Even today, the market exceeds $1 billion in sales, driven largely by province- and city-level reimbursement programs, often aided or augmented by thoughtful manufacturer access programs.

In contrast, a number of other countries, including many in Latin America, represent near-term opportunities, characterized by comparatively high median incomes and rapidly expanding formal subsidized coverage. These countries include Mexico, Brazil, Colombia, Russia, and Argentina, among others. And although the global economic slowdown has affected growth rates, especially in Mexico, Venezuela, and Russia, stated government objectives include broader coverage for biologics in high-profile conditions like cancer.

Watch the government gap

Our analysis suggests some reasons that emerging markets growth has proven more challenging than many manufacturers had hoped. The role of governments in healthcare financing, for example, appears a critical determinant of market potential. While higher per capita investment in healthcare remains important, where the government finances the majority of healthcare consumption, sales of innovative biologics are higher. Looking at it another way, as patients' out-of-pocket costs rise as a share of total expenditure, total per capita expenditure falls, reinforcing the importance of reimbursement. We can, as a result, conclude that the expansion of the middle class itself does not lead automatically to increased volume sales of Western innovator products. Indeed, even in the West, sales reflect insurance coverage, the majority of which, even in the United States, is financed by governments.

Our finding that the poverty rate represents an effective brake on market potential is also significant. Since government financing is so important to market potential, where there are critical competing priorities—both within the health sector or more broadly, such as poverty alleviation—the allocation of scarce budgetary resources may not be optimized to support Western product sales. Indeed, in low income countries the majority of deaths in children under five result from some combination of measles, malnutrition, malaria, chronic diarrheal disease, and acute respiratory infections—all of which can be alleviated or eliminated with low cost interventions such as vaccination, bed nets, and basic caregiver training. Many organizations providing advice and financing to emerging market governments—from WHO to the Gates Foundation—rightly continue to focus policymakers' attention on these pressing needs.

Medical practice drives access

Against such a backdrop, biologic opportunities in some therapeutic areas may be limited, even in the face of steadily "Westernizing" epidemiologic patterns. For instance, the prevailing Western model of oncology product development may be less relevant in emerging markets. Whereas in the US and Europe, manufacturers have grown accustomed to commercializing—and commanding significant price premiums for—sophisticated new technologies that offer modest incremental benefit, it is not assured that health sector decision-makers in emerging countries will value these products in comparable fashion. In addition, major differences in how health services are paid for can influence the incentives to include biologic drug therapy in treatment. For example, advanced medicines that help keep patients out of hospitals may not be valued as much when hospital charges comprise a smaller portion of total health care spending. Among advanced oncology therapeutics marketed in Brazil, only Glivec (imatinib) enjoys full coverage under the prospective payment system, a testament to that product's strong clinical value proposition.

The foreign bias

Our model did not explicitly focus on the competitive dynamics between Western and non-Western manufacturers, but these, too, represent an important consideration for comparatively high cost, innovator products. Data from IMS Health indicate that Western brands generally represent less than 40 percent of volume in emerging markets. While much of this volume comprises low-cost generics, in countries like India and the Republic of Korea, nascent local biosimilar industries have emerged not only as viable local producers but increasingly important global competitors.

Research conducted across multiple industries shows that emerging markets present distinct segments of opportunity. A small, wealthy segment of "global" consumers, generally concentrated in major cities and exhibiting consumption patterns and brand preferences comparable to consumers in developed countries, sits atop the pyramid. At the opposite end of the spectrum lies the much larger "bottom of the pyramid," with limited income and purchasing power. Historically, manufacturers of high-cost therapies have concentrated on the "global" segment, maintaining Western price levels and capturing whatever revenue could be generated. In the middle, however, lies the emerging middle class.

As noted, without some form of health coverage, the middle class cohort will remain limited in commercial value. Nonetheless, it bears watching because this is an important "battleground" segment, one in which local companies will compete directly with Western manufacturers on price, quality, and possibly even indication and product features. Moreover, as in India, local governments may pursue policies designed to support the continued growth and development of local manufacturers, conceivably at the expense of Western innovators. At minimum, steadily rising local regulatory hurdles—ironically designed in part to keep out cheap Chinese imports—will, over time, translate into locally manufactured products that can match Western innovators on quality and safety.

As a consequence, the potential competitive challenge presented by local manufacturers will continue to grow, especially as these companies begin to enter other emerging markets, as Dr. Reddy's has recently done with its version of Rituxan (rituximab) in Peru.

Opportunity: look long term

Although the developers and marketers of innovative biopharmaceuticals increasingly acknowledge the presence of meaningful challenges in emerging markets, they nevertheless present real opportunities. Realizing these opportunities will, however, require a nuanced understanding of the complexities on the ground. While topline growth, buoyed by dynamic macroeconomic expansions across most emerging countries, will remain robust, the majority of this growth will reflect sales of low cost generics, often manufactured locally. As implied in our findings, we see that economic growth, by itself, is not a predictor of the market potential for high-cost innovator products. Rather, the increase in government financing for health care, usually a by-product of economic growth, that signals increased opportunity. As in the United States or Japan, few potential patients can afford a product like Herceptin (trastuzumab) or Neulasta (pegfilgrastim) without insurance. The rapid expansion of an "emerging middle class" will not, in the absence of good reimbursement schemes like those in Taiwan or Venezuela, translate into significant market expansion.

Can Emerging Markets Emerge Fast Enough?

Governments must also seek to manage a broad range of competing priorities and stakeholder demands, which will further influence the pace and scale of market expansion. Governments still struggling to eradicate the most extreme poverty and its associated health consequences will be less likely to devote scarce resources to paying for biologic therapies that offer only incremental improvements in progression-free survival. Similarly, governments hoping to foster the continued growth and development of a job-creating local biopharmaceutical industry may not automatically assume that Western products offer the most meaningful advantages in terms of quality and safety.

Nevertheless, the rapid economic growth across Asia, Latin America, and, increasingly, Africa represents both an unqualified advance in human development and an important commercial opportunity for manufacturers. That capitalizing on this opportunity will be complex and challenging simply reinforces this: Anything as valuable as a growing market representing billions of potential customers will be hotly contested. A realistic, on-the-ground assessment of underlying incentives and the culture of medical practice are a critical first step toward realizing the potential of biologics as a global asset, with market potential across all regions.

Thomas Baker is Senior Principal at IMS Consulting. He can be reached at tbaker@imscg.com.

The Misinformation Maze: Navigating Public Health in the Digital Age

March 11th 2025Jennifer Butler, chief commercial officer of Pleio, discusses misinformation's threat to public health, where patients are turning for trustworthy health information, the industry's pivot to peer-to-patient strategies to educate patients, and more.

Navigating Distrust: Pharma in the Age of Social Media

February 18th 2025Ian Baer, Founder and CEO of Sooth, discusses how the growing distrust in social media will impact industry marketing strategies and the relationships between pharmaceutical companies and the patients they aim to serve. He also explains dark social, how to combat misinformation, closing the trust gap, and more.