Direct to Consumer: Hit 'Em Where It Helps

Although in-store promotional programs have the unique capability of reaching a large target audience, they currently make up less than one percent of total direct-to-consumer marketing expenditures.

Many Pharma Brand Managers once believed that direct-to-consumer advertising would pay huge returns by motivating consumers to seek treatment after learning about specific medications. It turned out that TV ads were great for building brand awareness but ill-fitted for another crucial part of the DTC mission—offering consumers detailed information about product benefits, risks, and side effects. Now pharma brand managers are looking for ways to enhance the payback from their DTC marketing investments by filling that information gap. What they've discovered is that they needn't look further than the corner pharmacy for a promotional venue that can offer helpful and credible information about prescription drugs, at the time and place that consumers are most open.

Gary Norman

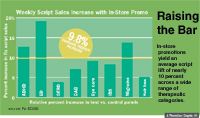

In-store promotional programs have the unique capability of reaching a large targeted audience, yet they currently make up less than one percent of total DTC marketing expenditures. But that trend is changing as savvy pharma marketers have begun to realize that the medium's ability to deliver more balanced and informative content helps maximize return on DTC investments. In fact, independent research shows that in-store promotions yield an average prescription lift of nearly 10 percent across a wide range of therapeutic categories, generating a return of $6.40 for every dollar invested. In comparison, the average return on total DTC advertising expenditures is $2.20 for every dollar spent, according to IMS Health.

How It Works

Education in the aisles isn't new in retail marketing. Companies selling products in grocery stores have used shelf space and packaging appeal for many years to influence buying decisions. On-the-spot coupon dispensers and nutritional information are fixtures in food-store aisles, and the same principles can be applied to reach healthcare consumers.

Dispensers catch customersôattention in the pharmacy aisle, and offer a way to get out detailed product information.

Drugstore customers routinely buy over-the-counter products, from antacids to cold remedies to pain relievers, without consulting their healthcare professionals. Many of us self-treat symptoms with OTC products without ever knowing the exact cause of the problem. Who hasn't seen a co-worker take antacids day after day, without bothering to consult a physician to find out why his stomach is upset all the time? That individual might reconsider a visit to the doctor if he were to run across some detailed information about chronic upset stomach in the pharmacy aisle where his antacids are sold. In another example, an older woman taking calcium supplements might be interested in prescription medications for osteoarthritis. If she were to read information on that very topic while perusing the supplement aisle at her local drugstore, she may decide to visit her doctor to talk about the benefits of prescription medicines.

Pharmacies have a distinct advantage over other promotional outlets: the licensed pharmacists who are on hand to field any questions from customers. Product information available in the aisles may prompt a chat with the pharmacist, followed by a visit to the doctor to discuss a medication's potential benefits. And, as the numbers show, the outcome of that discussion is likely to be a prescription sale.

Bang For Buck For every dollar invested in in-store promotions, companies generate a return of $6.40.

Cholesterol-lowering medications make up one therapeutic category that has seen a significant rise in scripts driven by in-store promotions. The high noise level about these therapies has probably confused many consumers about which product might be right for them, and retailers and manufacturers are finding they can differentiate benefits of certain medications better through in-store promotions than they can with TV ads.

Rx EDGE recently developed an in-store campaign for the seventh major statin on the market, to reinforce the brand's popular advertising campaign and grow prescription volume in a mature and crowded therapeutic category. The program featured dispensers with detailed pull-out product information extending from the store shelves of more than 18,000 pharmacies. A panel on top of each display highlighted the product's key differentiation message about attacking two sources of cholesterol. It also showed an expressive and highly recognizable face from the campaign's TV ads, as the brand team predicted those images would make effective attention-grabbers.

Raising the Bar In-store promotions yield an average script lift of nearly 10 percent across a wide range of therapeutic categories.

The location of in-store displays can be just as important as how they look. For some therapeutic categories, such as prescription pain relievers and allergy medications, it makes perfect sense to set up the display near the product's OTC counterparts. But because there are no such counterparts for cholesterol-lowering medications, the brand team had to choose an area near other products that were likely to be used by those at risk for cardiovascular disease (those people are likely to monitor their cholesterol levels carefully). The team decided on the analgesic aisle—not only because it is the busiest place in the pharmacy, but also because customers concerned about preventing heart attacks are also likely to take low daily doses of aspirin. In-store displays for an earlier statin campaign were placed with the blood-glucose testing supplies for diabetes monitoring, based on the high comorbidity rates between diabetes and high cholesterol.

Proven ROI

How well did the statin's in-store campaign work? After two months on the market, product sales doubled, and follow-up research showed that the in-store displays added six to eight percent of sales growth above that plateau, making the in-store component's return-on-investment ratio a whopping 5:1. In-store displays also generated some 300 million consumer impressions during the monitoring period and an average of two new prescriptions per store, per week.

For another brand in a different therapeutic category, the same company faced the dual challenge of introducing a new product while educating consumers about the benign but bothersome condition it treats—severe dry eye caused by the body's impaired ability to produce tears. The DTC campaign had to overcome a widely held belief that the disease could not be treated successfully, and convince the public to stop self-treating with OTC eye drops. For the product to succeed, consumers had to recognize that they had the disease and should see a doctor about it.

Television and print advertising campaigns, designed to build awareness of severe dry eye and introduce the new prescription product, featured an actress with the disorder talking about how her body's inability to produce sufficient tears hampered her quality of life. The supporting in-store campaign targeted pharmacies in 571 markets—including national drug-store chains, such as CVS and Albertsons, and powerhouse local players, like Duane Reade in New York City and Long's in California.

The in-store displays featured pull-out educational information about the disease, and messages advising consumers to talk with their pharmacist or doctor about the new treatment. The in-store program also brought the TV campaign to the eye-care products aisle to catch the attention of those with severe dry eye and remind them that there is an alternative to using OTC eye drops indefinitely.

By the end of the campaign, in early 2005, the numbers showed that it had achieved its mission: A significant number of consumers had become aware that persistent red eye is a medical problem that needs medication, and the in-store program helped those afflicted with the condition to identify their symptoms and decide to consult with a doctor about treatment.

Follow-up research also showed that the in-store component of the product's DTC promotional effort had boosted overall prescription lifts significantly: At Albertsons, nearly nine percent of the 21-percent total prescription lift could be attributed to in-store displays, and CVS' pharmacy-aisle information accounted for 5.7 percent of the chain's total 17.6 percent raise in prescriptions for the product.

Consumers don't want to be hard-sold when it comes to their health. What they want is objective and credible information to make the right decisions. In-store campaigns are able to extend the reach and value of a pharma ad campaign. They add impressions while communicating more detailed brand messages to target audiences, when and where they are most receptive to them—in the pharmacy.

Gary Norman is executive vice president and business director for Rx EDGE. He can be reached at gary.norman@rx-edge.com

The Misinformation Maze: Navigating Public Health in the Digital Age

March 11th 2025Jennifer Butler, chief commercial officer of Pleio, discusses misinformation's threat to public health, where patients are turning for trustworthy health information, the industry's pivot to peer-to-patient strategies to educate patients, and more.

Navigating Distrust: Pharma in the Age of Social Media

February 18th 2025Ian Baer, Founder and CEO of Sooth, discusses how the growing distrust in social media will impact industry marketing strategies and the relationships between pharmaceutical companies and the patients they aim to serve. He also explains dark social, how to combat misinformation, closing the trust gap, and more.