Blueprint for Excellence

Pharmaceutical Executive

In a time of slow growth, true innovators forge new relationships with core customers

Pharmaceutical brand promotion is undergoing a dramatic shift, with the biggest customers—healthcare practitioners and patients—moving away from mass media to more focused forms of promotion. The fastest growing professional channel is the Web, up 20 percent in 2007. Spending to reach these consumers accounted for 40 percent of the industry's promotion budget last year, according to IMS Consulting.

Yet despite access to growing amounts of information, drugmakers and their field sales forces are struggling to make meaningful connections with their customers. Only one out of three sales calls is rated as "helpful" by physicians, and fewer than 10 percent of US reps have access to robust information about healthcare practitioners, such as patient-level behavior and adherence trends.

Innovation is pharma's first line response to diminishing return on investment (ROI) in sales and marketing. But innovation takes time, and the outcomes are unpredictable. New strategies for improving commercial productivity must harness emerging sources of information to deliver a better understanding of the influences acting on prescribers and deeper insight into prescriber responses. They can also recommend where to implement change within the organization to take best advantage of commercial opportunities.

These strategies revolve around enhancing four key drivers of growth:

» Customer knowledge: a more complete picture of prescribing tendencies and reasons for prescribing

» Promotional resources: optimizing spending, including tailoring promotions to particular customer segments

» Alignment of the sales force with brand strategy

» Technologies that execute and assess customer response to promotion

While these enhancements do not radically transform the pharmaceutical commercial process, they do advance it to the point of higher value through knowledge gained from other industries facing similar fundamental shifts in their business models.

For example, most commercial-excellence initiatives target operating efficiency. Yet when faced with slowed growth, commercial-excellence leaders such as Hewlett-Packard, Proctor & Gamble, Apple, GE, and Charles Schwab implemented commercial changes to drive customer impact, rather than simply addressing operating issues. They used marketing and sales strategies to gain a deeper understanding of specific underserved customer groups, leveraging new sources of information and new technology. This shift in focus toward the customer has resulted in market share gains and restoration of the companies' brand leadership.

The challenge for pharma is to recognize and respond to the opportunity currently available for gaining new efficiencies. Although operating improvements offer value, the most significant value comes from better commercial strategies.

The Process Blueprint

Competitive advantage is increasingly determined by how well a company identifies and leverages the decision-making power of different customer groups. Innovations that deepen understanding of customer interests, preferences for information, and their decision influences are driving value for leading pharma sales organizations, according to IMS's New-to-Brand Rx (NBRx) data, which measures brand performance. New techniques that size, structure, and deploy sales forces for more productive customer relationships can increase the impact of selling efforts without major re-engineering. Improved metrics can now assess the true value of field efforts to increase NBRx, and companies using these metrics are seeing sales force productivity gains between 5 and 15 percent (based on an IMS review of results).

Understanding how a company can implement these drivers of ROI growth may require a systematic diagnostic of current commercial processes, indicating areas where advanced information, technology, and analytics can be leveraged. Untapped value is likely to be revealed in new opportunities for a stronger customer strategy and more effective use of resources, or some combination of the two.

To develop a systematic approach to the type of commercial change necessary to maximize return on portfolios, strategies should incorporate four improvement priorities and an implementation approach for each:

1. Differentiating customers to enable deeper understanding of how to increase market share and product preference

2. Optimizing investment at the customer-segment level to improve brand promotion effectiveness and increase ROI across the portfolio

3. Lockstep execution of channel promotion with brand strategy

4. Opportunity responsiveness to increase agility by monitoring key market-driver metrics

Following is a closer look at each of these four improvement priorities.

1. Differentiating customers

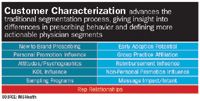

An accurate understanding of prescribers provides the foundation for all other commercial efforts. Differentiation leverages anonymized patient-level data (APLD) and managed care (MC) insights to advance a more robust form of customer characterization. Further leveraging secondary data and primary research (NBRx and market research) also offers new insight into the key influences acting upon prescribers, such as managed care access and control, group practice affiliation, ethnicity of patients, and the expected impact of DTC outreach on patient adherence and prescribing behavior. The goal of differentiation is to identify not only the differences in prescribing behavior but also the factors that contribute to decision making. Once these factors are understood, marketing and sales organizations can develop more effective promotion strategies for their brands.

By aggregating prescribers into distinct customer segments, pharmaceutical companies can focus on the customer with differentiated promotional programs, messages, sales tools, and delivery capabilities customized to optimize ROI at the segment level. For example, a particular customer segment may be most influenced by direct product-attribute comparisons communicated via e-detailing; another segment may want sales reps to deliver the latest information about product features and benefits, so they can engage in two-way dialog.

Strategic implementation approach:

» Understand new sources of customer information, such as APLD, group practice affiliation, patient adherence, and managed care metrics that offer value for the brand

» Adjust current insight processes, such as how marketers and sales operations teams use customer data, setting promotion and sales force strategies to accommodate new information

» As needed, conduct controlled, parallel pilots to help the organization understand the value of new insights (For example, one company compared call plans under its traditional insight approach vs. the new information–based approach, and was able to assess the value.)

» Communicate insight differences to sales and marketing managers in order to share best practices

» Implement a strategy for tracking key performance indicators (KPIs) and customer information over time (For example, one leader in a particular product class has developed a robust dashboard to monitor its share of new-to-therapy patients, assessing its performance among moderate-to-severe patients with the goal of making brand message adjustments as needed.)

2. Optimizing Investment

Professional promotion is usually optimized at the brand level, but shifting from undifferentiated brand messaging to prescriber (and patient) customization is the key to driving higher ROI. Each customer segment responds differently to different promotion; the inclusion of APLD and MC insights in the promotion mix has, according to IMS, a dramatic impact on ROI.

In turn, allocation of promotion investment based on the enhanced segments can yield the effectiveness and efficiencies—top- and bottom-line P&L impacts—that most firms seek. With robust characterization and influential messages, a multi-customer brand strategy can be effectively created and executed, deploying promotion dollars optimally across brands. For example, 12 months after implementation, one mid-sized pharmaceutical company realized 6 percent incremental sales growth in a therapeutic area while reducing its promotion spending by 12 percent.

Physician perception of value drives relationship strength. Traditional sales force–model metrics, such as use of visual aids, frequency of visits, time with physician, clinical knowledge, and script requests, provide diffuse measures of value delivery. They yield inconclusive results and cannot identify specific actions that will increase market share. Novel value metrics at the segment level better explain prescribing behaviors, and identify specific improvement opportunities and field sales behaviors/attributes most likely to increase new-to-brand (NBRx) share.

Strategic implementation approach:

» Set up a promotion-mix model at the customer segment level

» Optimize brand spending and strategy by customer segment (For example, allow for differences in promotion mix and spending levels by customer segment.)

» Use scenario-planning tools to establish a systematic, analytics-based process—one that allows brand teams to project sales from different spending levels and the associated risk of not meeting forecast under each scenario—for allocating promotion spending across the portfolio

» Incorporate an assessment of risk into the portfolio allocation process, so that spending scenarios and sales results can be more accurately predicted and managed

» Develop an internal process to facilitate cross-company strategic planning and execution

3. Lockstep Execution

Coordinated field execution of brand strategy is the next ROI priority. Companies typically deploy field forces without considering the overall promotional strategy, yet sales force performance must be accurately measured against key brand metrics to maximize ROI of field resources. Innovative relationship metrics report the value being received by customers, with critical insights about promotion channel performance; how multichannel marketing efforts contribute to brand ROI; which channels are driving this ROI; and opportunities for new relationship points with customers.

Such metrics enable commercial executives to identify areas of focus for their sales forces to build deeper relationships and achieve greater influence with customers. These metrics are being successfully implemented to change HCP perceptions of reps. Sales force KPIs should derive from customer-focused performance metrics and should ensure that the brand strategy is clearly reflected in every customer interaction, and that every opportunity to build brand equity is fully developed.

Strategic implementation approach:

» Develop brand strategy–based metrics, such as message quality, detail quality, and customer value

» Implement these metrics initially with the sales force, then expand to other promotion channels

» Tie metrics to brand performance, to identify drivers of market share and to quantify the impact of improving the metrics

» Design marketing programs and sales tools focused on these driver metrics to enable brand performance improvement

» Customize all these steps to the differentiated customer segment

4. Opportunity Responsiveness

Using information obtained from sales force and brand KPIs, marketers can identify trends as they emerge, enabling companies to take action in advance of competitors. For example, one firm is using prescriber-level NBRx metrics to identify changes in prescribing tendencies, such as increasing or decreasing usage of a competitive brand for new therapy starts. An alert is triggered to the sales representative when such a change occurs, and selling tools are recommended to the rep to help address the opportunity/challenge. As more companies seek this near–real-time market feedback, the industry is likely to become more responsive—and realize a higher ROI on promotion.

Automated brand dashboards that report the key drivers of product and customer segment performance on a monthly basis are uncovering sources of dissatisfaction with competitor products, practices that improve patient adherence, and e-marketing programs that drive a rise in prescribing. These dashboards take advantage of two new capabilities: increasingly robust strategic data at both patient and prescribing levels, and lower cost technology solutions that enable development, integration, and delivery of KPI information. Pharmaceutical companies that have been early adopters of these new capabilities report productivity gains from their promotion investment and improved efficiencies in their businesses.

Strategic implementation approach:

» Set up monthly brand strategy and execution tracking metrics, linking performance metrics to national target base performance

» Implement a closed-loop marketing system taking advantage of dashboard and information-systems technology to obtain more insightful customer feedback and performance views (Closed loop marketing, as the name implies, is designed to "close the loop" around marketing, sales and physicians, measuring the results of marketing and communications programs by tracking the response rates of specific customer promotions.)

» Capitalize on the value of digitized agencies and the flexibility to customize quickly

» Establish an integrated management approach to channels, such as leveraging patient-relationship marketing

» Measure performance of multichannel programs, and use insights gleaned to innovate

In today's complicated markets, where customer power is rapidly increasing, delivering more value means greater market share. Understanding how to create greater value is the critical capability that drives more effective allocation of resources. Leveraging new technology in new ways enables this to occur.

Accomplishing all of this requires a comprehensive, strategic approach to change, including evaluating potential sales and marketing innovations in light of the company's long term strategy and its future commercial focus with respect to practitioners, patients, and payers. Those companies that can quickly anticipate and capably address the changing needs of select customer groups are likely to achieve leadership position in their core therapy areas.

John Moran leads thought leadership for the Commercial Optimization Center of Excellence for IMS Consulting. He can be reached at jmoran@us.imshealth.comChris Nickum is Global Practice Leader, Commercial Effectiveness, IMS Consulting. He can be reached at cnickum@us.imshealth.com

The Misinformation Maze: Navigating Public Health in the Digital Age

March 11th 2025Jennifer Butler, chief commercial officer of Pleio, discusses misinformation's threat to public health, where patients are turning for trustworthy health information, the industry's pivot to peer-to-patient strategies to educate patients, and more.

Navigating Distrust: Pharma in the Age of Social Media

February 18th 2025Ian Baer, Founder and CEO of Sooth, discusses how the growing distrust in social media will impact industry marketing strategies and the relationships between pharmaceutical companies and the patients they aim to serve. He also explains dark social, how to combat misinformation, closing the trust gap, and more.