It's a new year. Even pharma, with its glacial timelines, has its "Out with the old, in with the new" moment. Welcome to 2011!

It's a new year. Even pharma, with its glacial timelines, has its "Out with the old, in with the new" moment. Welcome to 2011!

A new leader, a big acquisition, and a bold investment in HIV may all be in the works at Gilead. But what will it take to restore the glory days?

Berwick's mission: To successfully translate the new healthcare bill into practice.

The Orphan Drug Act of 1983 has been a roaring success. So why is everybody trying to mess with it?

Several leading pharmas may already have a drug for a retrovirus linked to chronic fatigue disease. Has medicine's "problem child" finally earned the industry's respect?

Novartis CEO Daniel Vasella has built the Swiss firm into the fastest growing pharma in the world, and in the process gained a reputation as an outspoken visionary. But is he really as good as all that?

With the biotech industry reeling from the recession, big drugmakers hold all the cards when it comes to making deals, but picking a winner is still a gamble. Here are 10 to place stakes on.

We know what you're thinking: new president, rotten economy, patent cliff. Do you feel Evel? Well, do you?

Everything you wanted to know about the year's most important deals-and what to watch for in the future

Japan is playing a game of catch-up, dropping big cash on biotechs and risky acquisitions. But with patents expiring and sales falling, can they really pay their way to global success?

A head-to-head comparison of the Drug Vote '08

Young & Partners crunches pharma's filings for, the first half of '08. The results? Ask the Japanese

Could gene silencing be the next great innovation in drug development? Some biotechs are betting on it.

No, it's not as glamorous as its double-helixed offspring. But recent revelations about RNA turn even cold-eyed scientists into lyrical romantics

A plunging currency and other economic turmoil shouldn't phase pharma, right? Yes and no

The contamination of heparin in China cast the drugmaker, its US supplier, and FDA as indifferent and incompetent. Then the story took a very strange turn...

When it comes to developing novel therapies from the animal kingdom, it's mostly a game of pick your poison

Approvable letters delay NDAs, cost pharma plenty, and are at an all-time high. Industry says FDA is gun-shy; the agency says it's business as usual. Who's right?

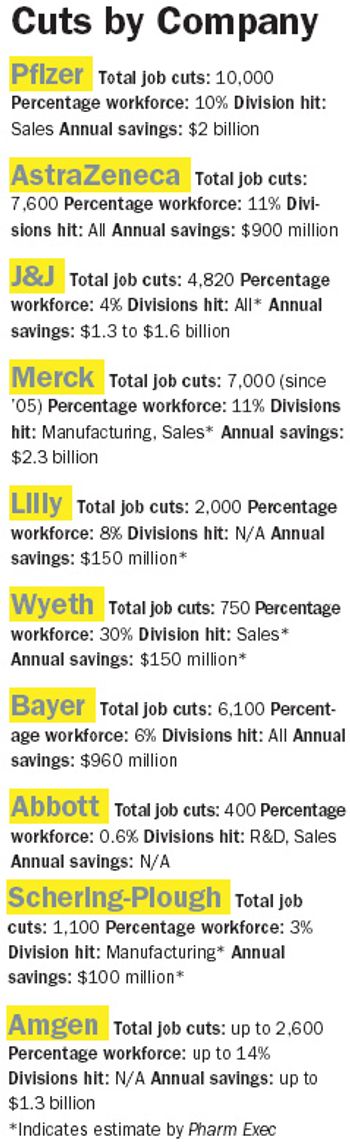

Ever since Jeffrey Kindler rocked our world last December with the news that Pfizer was cutting its sales force by 10,000, we've been waiting for all the other behemoths' shoes to drop. While no precise domino effect has occurred, downsizing, particularly on the sales side, is very much pharma's strategy du jour.

It's testimony to the high anxiety-and hectic activity-in the industry that the merger of German chemicals-to-pharmaceuticals firm Merck KGaA and Swiss biotech Serono elicited only faint fanfare. Both family-owned drugmakers boast an illustrious heritage, but their union garnered none of the pomp and circumstance befitting a marriage of European royalty.

All hell broke loose on May 21 when the New England Journal of Medicine released Cleveland Clinic cardiologist Dr. Steven Nissen's meta-analysis of 42 studies of Avandia, showing a 43 percent increased risk of heart attack.

It's bittersweet being one of the leaders of an industry that is not sustainable," a top pharma CEO recently told Carolyn Buck Luce, Ernst & Young's global pharmaceutical sector leader. Bittersweet is a poignant word for a hard-driving exec to issue.

It was like the end of the arms race last November when Pfizer announced it was slashing its national sales force by 20 percent. Coolly downplayed as cost-cutting by new CEO Jeffrey Kindler, the stunning move was met by industry insiders, Wall Street analysts, and the media with one humongous collective sigh of relief. Big Pharma was seen as having grown dangerously addicted to the detailing game over the past decade, with the top firms plowing more and more of their blockbuster profits into trying to keep up with Pfizer's "flood the zone" strategy and with less and less to show for it.

Everyone agrees that by streamlining and downsizing, Big Pharma is taking a step in the right direction. What no one yet knows is if it's too little, too late. Or what "too little, too late" might look like. Or what else might work.

Big, bold, and brash, Frank Baldino has built Cephalon into one of the nation's most dynamic biotechs. The company, based in suburban Philadelphia, is 20-years-old this year, and is already marking its birthday with a flurry of honors. In January, Cephalon was inducted into the World Economic Forum's Community of Global Growth Companies-a tribute to a 44 percent increase in annual revenue (to $1.67 billion in 2006) and its new footprints in Europe and Asia.

Pharma's next big challenge is simple: Rebuild its broken business model. But between expiring patents and dry pipelines, pricing wars and safety woes, a beleaguered FDA, a bloodthirsty OIG, and Dems on parade, many companies are just trying to steer clear of icebergs.

Published: September 1st 2010 | Updated: November 25th 2020

Published: March 1st 2010 | Updated: November 25th 2020

Published: August 1st 2010 | Updated: November 15th 2020

Published: January 1st 2011 | Updated: November 26th 2020

Published: May 1st 2010 | Updated: November 15th 2020

Published: August 1st 2009 | Updated: November 17th 2020