How the need for biopharma innovation extends to questions around executive compensation.

How the need for biopharma innovation extends to questions around executive compensation.

Big pharma has become increasingly vulnerable to larger geopolitical and macroeconomic risks-a realization that has slowly creeped into their business planning.

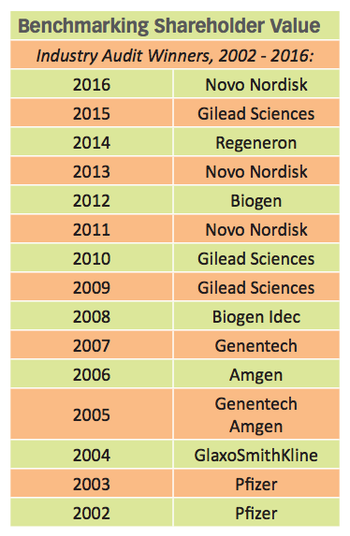

As market headwinds persist, our latest industry review of shareholder value reveals a sharp performance differential between companies that pursue a strategy of specialized therapeutic focus and those that continue to rely on line diversity, size and scale.

With our annual Industry Audit marking its 15th year, we decided to compare 2002 approaches in boosting shareholder value to those of today. The fall in one particular performance metric is telling.

George Sillup and Stephen J. Porth identify the “hot button” issues attracting media attention in 2015.

Pharm Exec adds up some interesting figures from recent industry news.

Biopharma’s diversity commitment remains a work in progress but the benefits-in measurable ROI-are increasingly clear.

Do recent trends in the pharma and biotech M&A and equity markets signal a temporary lull - or a permanent drop? Peter Young reports.

Pharm Exec Editorial Advisory Board member Cliff Kalb poses some of the pertinent questions he expects the pharma industry will be asking this year.

A new discipline-population health-contests disease treatment as an end in itself. It asks: besides advancing the science of medicine, what do biopharmaceuticals actually do to improve health overall?

As tech giants, enter the life sciences industry, healthcare companies should adapt their business model and embark with these new players on a more ambitious, personalized, and preventive healthcare strategy.

In the past few years, we’ve seen the biopharmaceutical industry begin to shift from a one-size-fits-all blockbuster approach toward an individualized, precision science model. This transformation has propelled companion diagnostics (CDx) into playing a more critical role than ever in the commercialization of biopharmaceutical therapeutics.

With hostile takeovers on the rise, Mike Straw argues that pharma boards have a huge role to play in managing the people issues.

Driven by knowledge advances and the importance of a more collaborative commercial model, intellectual property (IP) has morphed from an arcane, specialized function dominated by technicians to a showcase strategic priority of the “c-suite.” This trend is hardly restricted to the life sciences. In fact, some of the most creative work in using IP tools to extract more value from knowledge assets is taking place among businesses that operate across multiple sectors.

After a sharp spike in revenues, this year’s audit finds our 25 companies doubling down to secure the operational efficiencies that promise to better align with an increasingly tightfisted payer community. Never before has market relevance been so firmly linked to customer reputation.

A closer look at our Industry Audit numbers hints to a clear divide between two alternative strategies for long-term growth: scale versus focus.

New cell-culture techniques, biomanufacturing formats, and the expansion of single-use applications are driving rapid change in the biopharma market.

Specialty drug sales, record-breaking M&A paired with tax synergies, and global expansion helped to bring a new face into this year’s Pharma 50 top 10, and substantially boosted the rankings of several others.

Amid the release of our eighth list of Emerging Pharma Leaders, it's fitting to take a look at the trends and values that will determine true leadership in big Pharma in the years ahead.

The pharma industry is making progress and going through a frenzy of activity on the strategic, business, M&A and financial fronts, writes Peter Young.

Casey McDonald reports on yesterday's Healthcare Businesswoman’s AssociationWoman of the Year award ceremony in New York

William Looney reports on last week's Global Educators Network for Health Care Innovation Education meeting, focused on shared learning and best practices to drive reforms in both the public and private sectors.

Peter Young examines the positive drivers affecting the biotech industry and what happened on the M&A, IPO and financial fronts in biotech in 2014 - and what to expect in 2015.

The heart failure health area is set to expand from $2.9 billion in 2013 to $8.9 billion in 2023, writes Josh Baxt.

This year's J.P. Morgan Conference in San Francisco showed that smaller “stealth pharma” players are beginning to show solid organic growth. William Looney reports.