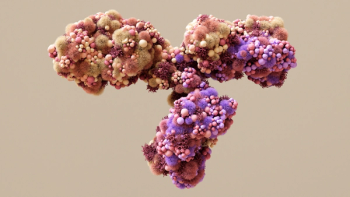

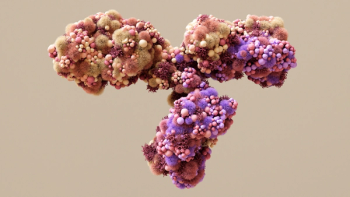

Joint venture aims to implement Invenra’s B-Body bispecific antibody platform to enhance Astellas' research and development efforts.

Joint venture aims to implement Invenra’s B-Body bispecific antibody platform to enhance Astellas' research and development efforts.

Collaboration aims to advance the development of treatments for multiple neurodegenerative conditions, including amyotrophic lateral sclerosis.

The deal, which is worth approximately $13.1 billion, is part of J&J MedTech's goal to expand into high-growth markets.

Agreement comes as Teva aims to strengthen its biosimilar portfolio as part of its "Pivot to Growth" strategy.

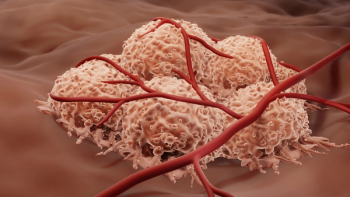

Deal aims to commercialize XTX301 for treating advanced solid tumors by leveraging Xilio’s tumor-activated immuno-oncology therapies.

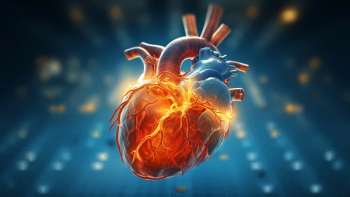

Deal includes the novel treatment CDR132L, which is currently in Phase II clinical trials for heart failure.

A look at pharma and biotech financing, M&A, and stock market performance in 2023—and where developments may head next as company executives continue to navigate stormy but perhaps stabilizing waters in the months ahead.

Sapirstein discusses the current conditions that are impacting investors’ view of the life sciences industry.

The company plans to spend the coming years strengthening its market position and pipeline while also clearing its issues with litigation and debt.

Agreement to focus on research, option, and licensing for discovery of dual tumor-associated antigen-targeting antibodies.

Rebranding aims to align company with its parent company and other subsidiaries.

OSE-230 was developed to activate a unique mechanism for resolving chronic inflammation, focusing on modulation of macrophages and neutrophils.

Collaboration aims to leverage Nhwa’s expertise in the country’s neuro-psychiatric health sector.

Results of a study conducted by the National Institutes of Health indicate that the Paxlovid prevented a substantial number of hospitalizations associated with COVID-19.

Funds expected to advance multiple programs into clinical studies, including FMC-376, which targets KRASG12C cancers.

Researchers find that a thorough evaluation of drug spending and value can lead to a better allocation of healthcare resources.

Roche halts agreement with Repare Therapeutics to develop and commercialize camonsertib just weeks after triggering a $40 million milestone payment when the first patient was dosed with the novel cancer drug.

BioNTech will invest $200 million and get access to Autolus’ manufacturing sites.

The $1.3 billion acquisition—which included two aqua manufacturing plants—expands Merck’s portfolio in the veterinary pharma space.

Novartis rescinds rights to to develop and commercialize multi-tyrosine kinase inhibitor dovitinib due to a material breach by Allarity for lack of financial payment.

The company also announced that it has submitted its new glucose monitoring system to the FDA for approval.

There’s reason to believe that a positive pivot may be in the offing.

Express Scripts has announced plans to offer to a new pharmacy network cost-based pricing option for prescription medications and pharmacy services.

Could the sector please get a little ‘rate’ relief?

Payers won’t let these products break the bank.