Product sites need to offer consumers more than just a hard sell.

Product sites need to offer consumers more than just a hard sell.

Documents from R&D, clinical affairs, regulatory, and sales and marketing can be in the millions. Throw electronic information into the mix, and the number of documents required for litigation increases exponentially.

Doctors like direct mail as long as the message is concise and to the point. The minute you ask the doctor to actually do something with the direct mail, that's when your effectiveness starts to go downhill.

After decades of disparate attempts to secure supply chains, pharma companies may finally be getting on the same page.

Clinical researchers cannot reliably use many of today's electronic health records because of the variability among collection systems.

New partnerships with nanobiotech firms are helping pharma companies overcome solubility problems and extend profitable product lifecycles.

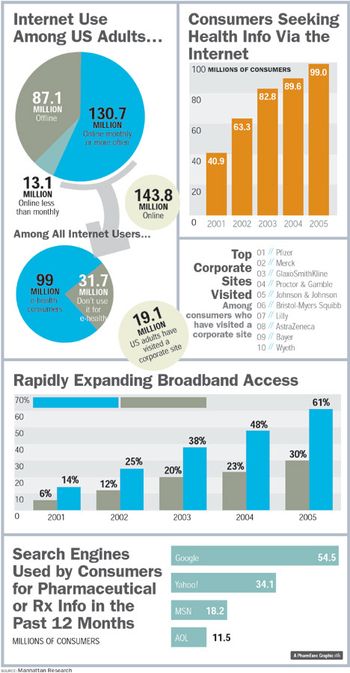

When people ask how health seekers look and act on the Web, there's no one answer: The online universe has become just as diverse as the rest of the world. Nowhere is this more evident than in the latest e-health statistics that, when taken together, paint a picture of customers who are beginning to find their feet-and new finesse-online.

Jeffrey Kindler holds two blue, diamond-shaped pills in the palm of his hand. One is authentic Viagra, manufactured by Pfizer. The other is counterfeit, maybe bought by an undercover Pfizer investigator, or intercepted when smugglers crossed a border, or perhaps seized in a raid on an illegal Chinese factory. Kindler challenges visitors and fellow employees to tell the difference between the two pills. Neither looks in any obvious way "fake," and no one among the journalists, corporate communications employees, or even security specialists gathered in Pfizer's global security operations center cares to hazard a guess.

Adaptive trials aren't just for propeller-heads anymore. They're one of the issues that need to be top-of-mind for the whole executive suite, as a driver of new processes and timelines, as a hot-spot on the budget, and as a battleground where public policy on drug safety and efficacy will be fought out.

I needed to eat. I even wanted to eat. Instead, I sat in front of my hospital lunch tray, unable to face up to a carton of red Jell-O. When you think of it, that's a situation most of us face (minus the Jell-O) every day in business.

Electronic data capture (EDC) is an emerging paradigm for gathering information in clinical trials. Ask anyone who has sorted through stacks of accumulated paper at the end of a study, and they'll say EDC is the wave of the future. But while many companies are on board with the technological benefits, enthusiasm wanes when it comes to actual implementation. Even some of EDC's biggest champions admit to its obstacles: "It's a disruptive technology that doesn't give immediate returns," says James Tiede, vice president of integrated data services, global clinical operations at Johnson & Johnson.

RFID is not ready for prime time anywhere. Certainly not in the US. There is no way RFID gives you end-to-end control of the product.

In a product recall, manufacturers would know which retailers and hospitals got bad bottles. Instead of clearing shelves everywhere, they could call specific customers and say, "Hey, we know you have five of these bottles. We want them back."

Scott Gottlieb called RFID implementation "disappointing." Now, FDA is moderating its view of RFID as a cure-all for the industry.

The Zelnorm study was conducted for $1,000 per patient, a fraction of the price of clinical trials, which can cost $10,000 per patient or more.

Online strategies aren't monolithic; each must meet the particular goals of the brand in question, and serve the knowledge needs of a specific disease state. That said, experts agree on many of the fundamentals-the 5 "I"s of Internet marketing:

At least five of the world's top pharma companies have specified, tested, or deployed large-scale Wi-Fi programs.

The most important result for pharma firms of the changing sales structure is a reduction in the amount of training resources that are available to them.

When you have a workable technology, the question becomes ‘To what do you apply this technology?’ and ‘Where do you spend your time?’ We really believed we would be most successful by spending a lot of time figuring out which drugs to work on and then working assiduously on those few products with huge potential.

Digital forms of image transmission, archiving, and education with the virtual microscope will revolutionize pathology.

The issue of pedigree requirements is emerging at the state level-and figuring out to what extent that will push back to the manufacturers.

Imagine drugs that can detect one particular compound in a patient's body and respond to it by releasing a drug. They're not that far away.

Procter & Gamble Pharmaceuticals discovered that a network resulting from even a modest integration offered benefits that exceeded the sum of its parts.

Garry Barnes says he joined the pharma industry for job security-but don't believe him. During the last 25 years, Barnes has worked for four pharma companies and built five sales forces in therapeutic areas ranging from contraception to organ transplantation.

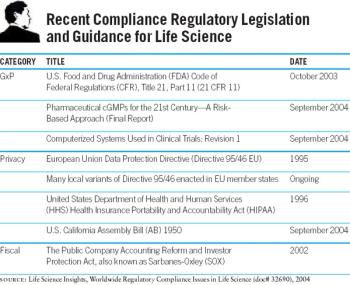

For pharma companies large and small, one of the most pressing challenges of the next few years will be to understand compliance at a much deeper level, to obtain the tools to make it possible.