From hedge clippers to balancing elephants, the 20th annual Rx Club Awards honored a display of ads featuring the most creative concepts from around the world.

From hedge clippers to balancing elephants, the 20th annual Rx Club Awards honored a display of ads featuring the most creative concepts from around the world.

Long turnaround on ad reviews adds new complications to the process of developing marketing plans.

Noncompliance causes 125,000 deaths and more than $100 billion in increased healthcare expenses.

Marketing effectively to physicians in today's pharmaceutical industry is more important than ever. No longer can companies rely solely on DTC and sales force efforts to increase drug and therapeutics revenue.

Cost-shifting is still one of the favorite tools in almost all employers' cost-cutting toolboxes. But many fear that shifting too many costs to workers will backfire. Low co-pays keep people healthy and on the job: a big return on investment.

A sales rep's sensitivity to the doctor's marketplace, and his understanding of the pressures on physicians-from formularies and HMO rules to the practices of affiliate hospitals-makes him a greater asset in the customer's eyes. Getting to know a doctor involves understanding the responsibilities of personnel in his office. Reps need to know who the doctor relies on most to get things done.

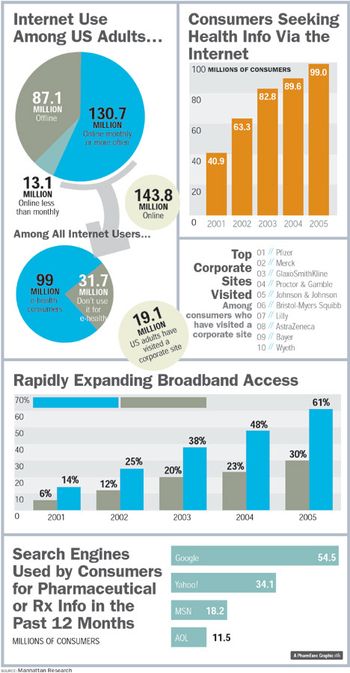

When people ask how health seekers look and act on the Web, there's no one answer: The online universe has become just as diverse as the rest of the world. Nowhere is this more evident than in the latest e-health statistics that, when taken together, paint a picture of customers who are beginning to find their feet-and new finesse-online.

For the fifth year in a row, Pharm Exec invites Professor Bill Trombetta of St. Joseph's University to analyze the pharma industry's financial performance with a battery of business metrics old and new. The highlights: Two top biotechs race neck-and-neck for first place, Forest delivers another strong performance, and AstraZeneca squeezes past Johnson & Johnson and GlaxoSmithKline into the top four for the first time ever. And the winner is . . .

These "guns for hire" bring the science and marketing savvy that clients need, often with in-depth category experience, but without the commitment and cost associated with hiring a full-time employee.

More than high-call frequency will be necessary to succeed in an increasingly competitive sales environment.

Physicians seek point-of-care info and updates in friendly formats. Data should be available when and how they need it, and in exactly the right amounts.

Sanofi-Aventis' campaign for Taxotere elicits an emotional response from oncologists.

Despite heightened scrutiny from industry advocates and the beginnings of self-imposed regulation, pharma companies' violations of DTC regulations have been getting worse, says Tom Abrams, director of FDA's Division of Drug Marketing, Advertising, and Communications (DDMAC). Abrams has been on all sides of drug marketing, from receiving promotions as a pharmacist to creating promotions as a member of industry to regulating promotions as the head of DDMAC. As such, he's in good position to see the big picture.

While the typical brand invests more than $100 million in annual sales force support, it spends on average less than $2 million to determine whether the detail piece is driving prescriptions.

PhRMA Guiding Principle number 10 calls for the banishment of reminder ads. While there are many reasons why drug ads truly advance the public health, there are no good arguments for why reminder ads advance public health in any way.

The most important result for pharma firms of the changing sales structure is a reduction in the amount of training resources that are available to them.

The circumstances of Crawford's departure may complicate the process of securing a permanent FDA leader. Congress and HHS are investigating whether his confirmation process failed to uncover important facts.

Valeant is banking on Viramidine, a pro-drug of its longtime cash cow, ribavirin, to catapult the company to the next level.

Growing by Indication, Genentech Has a New Type of Blockbuster

Think of the role compliance plays in your job. Now imagine that level of concern increased by 25 percent, 50, or even more. That's what pharma has to look forward to in the next few years, as the effects of old regulatory initiatives, such as 21 CFR Part 11 and Sarbanes Oxley, start fully kicking in-and as we experience the as-yet-unknown regulatory fallout of the new concern with drug safety. It's no surprise that a great portion of this volume of Pharm Exec's Successful Product Manager's Handbook series is given over to compliance.

Sales reps should be able to access, in a central location, company-enerated influences that have affected a given physician. This type of closed- loop marketing creates a more customer-centric approach that provides etter influencer-level insight by connecting each resource, providing direction and metrics, and continually re-evaluating key influences and ROI.

Product managers would be less disrupted if compliance activities at pharma companies were more anticipatory than reactionary.

As the industry thinks about new sales force models, it should look beyond ROI numbers, toward a new paradigm that not only works for pharma, but also for its customers.

No brand manufacturers plan to market generic versions of their own product, at least not until the patent expires. And why would they? As long as the branded version enjoys patent protection, marketing a cut-rate product would eat away profit margin during the years when a drug makes the most money.