It's important to empower individuals to understand and accept the responsibility for being stewards of their own health.

It's important to empower individuals to understand and accept the responsibility for being stewards of their own health.

Partnerships with geriatric pharmacists will be critical for brand teams that market products specifically to seniors.

If pharmaceutical companies hope to improve their marketing efficiency, they have to change how they approach their customers. For years, manufacturers have been practicing the "more is better" direct-selling approach to physicians. But research now shows what common sense has long suggested: More has become too much. Education has given way to inundation, clamoring for face time with physicians has led to diminishing sales returns, and relationships with major pharma stakeholders have broken down. Physicians, regulators, consumers, and legislators have come to mistrust manufacturers' motives and integrity. As pharma asks how its marketing strategies have missed the mark, it may discover answers in reinventing something it once relied upon: strong relationships with customers.

Gen Xers are attractive to many managers because they typically have a strong work ethic. Although they are self-reliant, they still desire to be taken seriously and want to be valued by their companies.

When rebate strategies are coupled with sales force and DTC spending, it results in "margin-negative" business-that is, sales that bring in less than the marginal cost of selling, promoting, and manufacturing the drug.

If pharmaceutical companies hope to improve their marketing efficiency, they have to change how they approach their customers. For years, manufacturers have been practicing the "more is better" direct-selling approach to physicians. But research now shows what common sense has long suggested: More has become too much. Education has given way to inundation, clamoring for face time with physicians has led to diminishing sales returns, and relationships with major pharma stakeholders have broken down. Physicians, regulators, consumers, and legislators have come to mistrust manufacturers' motives and integrity. As pharma asks how its marketing strategies have missed the mark, it may discover answers in reinventing something it once relied upon: strong relationships with customers.

Instead of leaving the doctor's office well informed, the patient often leaves without enough comprehensible information to comply with the prescribed treatment.

SPCs extend a drug's basic patent protection for up to five years, to take into account the time that may have lapsed between the filing of a patent application and the granting of market authorization.

Manufacturers will have to incorporate Part D–specific messaging into all of their current marketing materials. In addition, they should consider publication plans and CME that specifically address the needs of seniors.

As a result of the rapid innovations in drug technology, and the increasing complexities surrounding drugs' safety, cost, and efficacy, the demand for extensive formulary reviews is growing. To keep pace, Pharmacy & Therapeutics (P&T) committees have been ardently reviewing medications to determine which ones deserve inclusion and preferred placements in health plans and formularies. While there are many factors that influence the committees' decisions, with some carrying more weight than others, pharmaceutical execs complain that there is no accurate way to predict which drugs will make the cut.

Elegant positioning strategies often fail when doctors learn that a prescribed product isn't on a patient's managed care formulary.

The cost of healthcare has become so great that it's important to review the evidence to determine whether the drug is a good value for the money. Yet, pharmacoeconomics is rarely included in the decision process.

Garry Barnes says he joined the pharma industry for job security-but don't believe him. During the last 25 years, Barnes has worked for four pharma companies and built five sales forces in therapeutic areas ranging from contraception to organ transplantation.

After the merger, Wyeth had dozens of incentive plans for several thousand employees.

Pharma companies believe that they can compete in an e-prescribing environment if information systems permit full disclosure and allow doctors to create bookmarks that link easily to information they want.

Traders say parallel distribution of drugs generates savings for patients. Industry says it creates more profits for traders, leaving pharma with less R&D funding.

Accept distortions and untruths. Don't try to undo them. The point is not to win an argument; your critics' views are legitimate, irreversible realities. It's time to give the public something new to think about.

Even though data can single out physicians with high marketing upsides, most pharma companies are doing without such high-value data.

Pharma execs and industry analysts say pharma's reputation has improved during the past year. The general public sees things differently. Research says a few select companies are to blame.

A recently released report claims pharma hides bad clinical trial results and over-promotes drugs. Tougher regs are being called for.

Our goal is competency-based training that has a solid business need, sound instructional design based on adult-learning principles, and metrics that can capture, evaluate, and track what we do. We want a blended-learning approach that can be delivered over the Web, on CD-ROM, or on paper.

Some reps take to tablet PCs like ducks to water, while others wait for them to become the gold standard. Good training can put everyone on the same page.

"You're fired!" It's a simple phrase that everyone is using, and it's put Donald Trump back into the spotlight. However, the most important statement you will ever make as a manager is "you're hired." With all the pressures of the job and the limited time you have for interviewing, it is easy to rush through this process to fill a slot. Stop yourself-hiring a good person is one of the most important decisions you will make as a manager.

The sales aid or detail piece tells the features and benefits about the product. The important marketing points are in bold print.

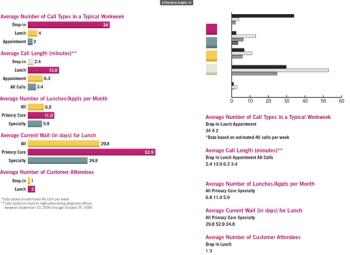

It's twelve o'clock-do you know where your reps are? According to research from Health Strategies Group, lunches provide one of the few opportunities in today's short-call environment for sit-down discussions with doctors. The average length of a lunch is 13 minutes, with an average of three physicians per meeting.